US CPI data due Wednesday, estimate ranges (and why it’s crucial to know them)

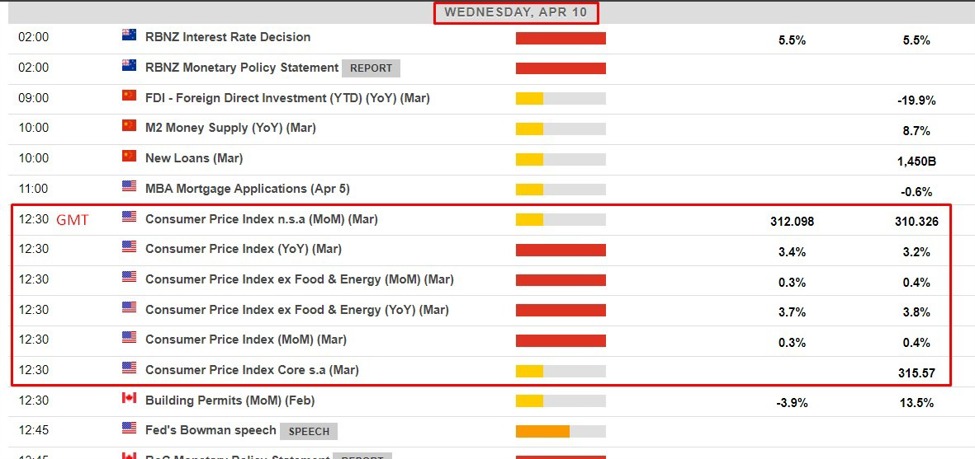

Later today, Wednesday, April 10, 2024, we will receive US consumer inflation data.

- for March 2024

-

due at 12:30 p.m. GMT, or 8:30 a.m. US Eastern Time

This is one of those reports that is essential for future prospects. For example:

- the Federal Reserve will be watching this for the timing of upcoming rate cuts, if it is a positive surprise it will contribute to speculation of a delay in June, and of course if it is not it will will add to the prospect of a reduction in June.

- The Japanese Ministry of Finance (and the Bank of Japan) will review it based on the prospects of intervention on the yen. If CPI surprises to the upside, this will boost USD/JPY buying and delay possible intervention to support the yen (at the margin).

Anyway, enough of my thought bubbles, here’s what to expect. This snapshot is from the ForexLive economic data calendar, access it here.

- The numbers in the rightmost column are the “previous” result (previous month/quarter as applicable). The number in the column next to it, where there is a number, is the expected consensus median.

—

Let’s look at the range of expectations versus the median consensus (the “expected” in the screenshot above) for key data points:

The March CPI annual expectation range shows:

m/m range of CPI title showing:

CPI excluding food and energy (the underlying inflation rate) over an annual period showing:

CPI range excluding power and energy m/m showing:

***

Why is knowledge of these beaches important?

Data results that do not match market low and high expectations tend to move markets more significantly for several reasons:

-

Surprise factor: Markets often incorporate expectations based on previous forecasts and trends. When the data deviates significantly from these expectations, it creates a surprise effect. This can lead to a rapid revaluation of assets as investors and traders reassess their positions based on the new information.

-

Psychological impact: Investors and traders are influenced by psychological factors. Extreme data points can elicit strong emotional reactions, leading to overreactions in the market. This can amplify market movements, especially in the short term.

-

Reassessment of risks: Unexpected data can lead to a reassessment of risks. If the data significantly underperforms or exceeds expectations, it can change the perceived risk of certain investments. For example, better-than-expected economic data can reduce the perceived risk of investing in stocks, leading to a market rally.

-

Triggering Automated Trading: In today’s markets, a significant portion of trading is done by algorithms. These automated systems often have predefined conditions or thresholds that, when triggered by unexpected data, can lead to large-scale buying or selling.

-

Impact on monetary and fiscal policies: data that is far from expectations can influence the policies of central banks and governments. For example, in the case of inflation data due today, weaker-than-expected data will fuel speculation about earlier and deeper rate cuts from the Federal Open Market Committee (FOMC). A stronger (i.e. higher) CPI report would lower these expectations.

-

Market Liquidity and Depth: In some cases, extreme data can affect market liquidity. If the data is unexpected enough, it could cause a temporary imbalance between buyers and sellers, causing larger market movements until a new equilibrium is found.

-

Chain reactions and correlations: financial markets are interconnected. A significant movement in one market or asset class due to unexpected data can lead to correlated movements in other markets, thereby amplifying the overall market impact.

cnbctv18-forexlive