Japan huffs and puffs but it doesn’t bring down USD/JPY

In case you missed the Japanese officials’ tirade earlier:

- Japanese Finance Minister Says Basis in Place for Appropriate Currency Action

- Japanese Finance Minister Suzuki says the weak yen has both pros and cons for the economy.

- Ueda, Governor of the Bank of Japan: salary negotiations are not the only determinant of monetary policy

- Bank of Japan Governor Ueda explains what inflation needs to do for a BoJ rate hike

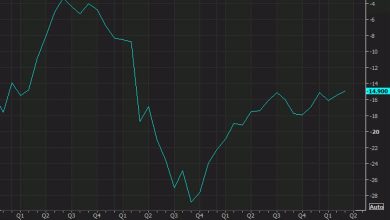

This hasn’t really moved the needle for USD/JPY, with the pair holding around the 154.70 levels for now.

I would say buyers will remain cautious for now. It would take a key trigger to muster the courage to push prices up and test the level of the numbers at this stage. In this regard, it could probably depend on what the economic calendar has in store for us this week.

After the comments above, Japanese bond yields are on the rise with 10-year yields at 0.892%, their highest level since November last year. But this still does not disrupt USD/JPY.

So, attach you belt. This could turn out to be an eventful and volatile week for USD/JPY, if we get the triggers right.

This article was written by Justin Low at www.forexlive.com.

cnbctv18-forexlive