Retail sales keep Bank of Canada on track to cut rates in June – CIBC

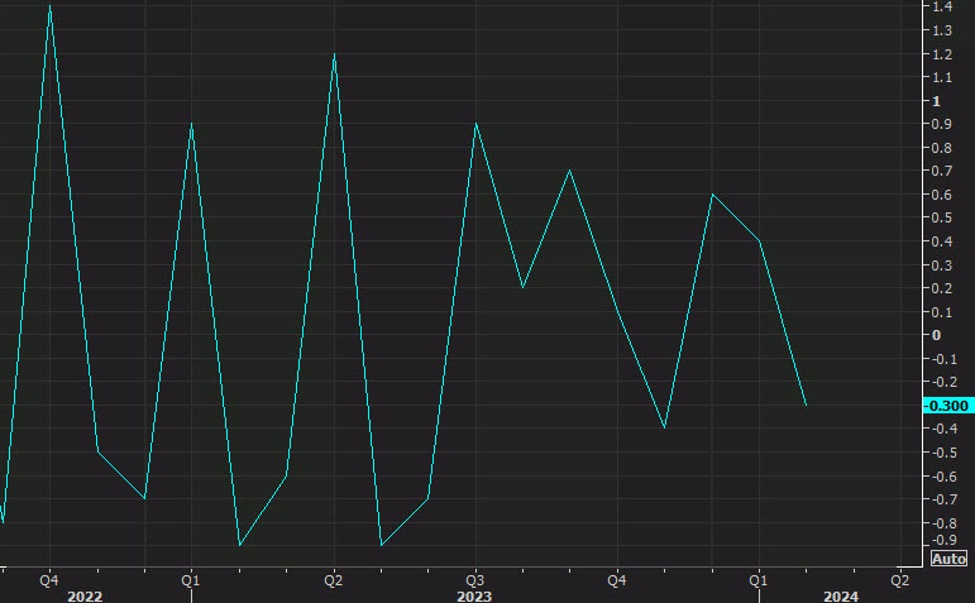

Retail sales in Canada excluding automobiles

CIBC notes that Canadians are becoming more cautious about spending as mortgages come up for renewal at much higher rates.

Retail sales fell by 0.1% against +0.1% expected while sales excluding automobiles fell by 0.3%. Canada’s rapidly growing population also continues to make the numbers look better than reality, with total sales now 2.2% below last year’s levels.

CIBC also notes that warm weather earlier in the year likely distorted the picture.

“Property spending for the full quarter still looks healthy, but this reflects the boost in activity at the start of the year following a mild winter. The momentum has clearly waned since then, and spending will remain under pressure with the unemployment rate rising and mortgages continuing to roll over at higher interest rates. Therefore, the BoC will likely begin cutting interest rates in June.

The market is pricing in a 49% chance of a cut in June, so it’s a close call.

cnbctv18-forexlive