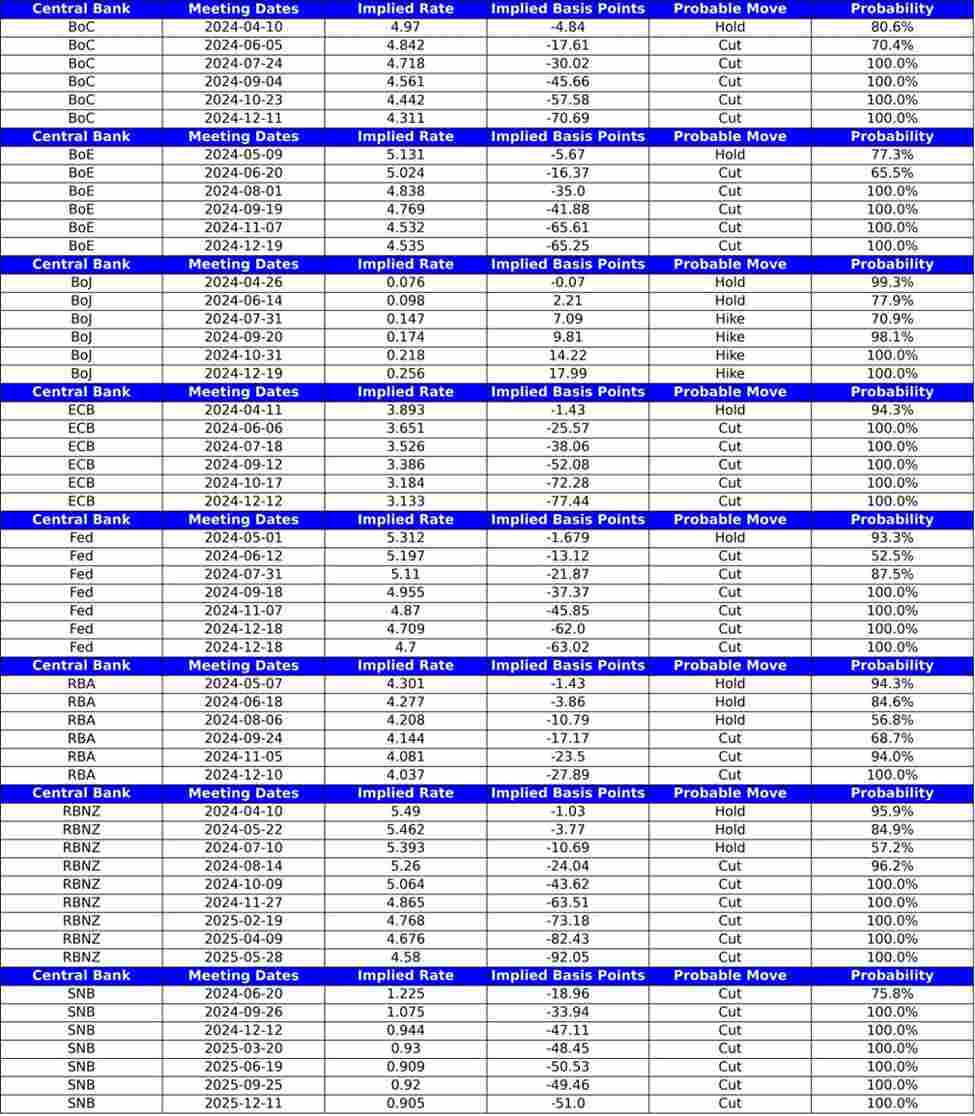

What prices are set for major central banks ahead of this week’s major events?

There haven’t been many major changes since last week, but it’s important to see what the markets are expecting heading into this week’s major events.

RBNZ: Markets are pricing in a roughly 96% chance of a first cut from the bank at their August meeting. After their recent conciliatory trend, I don’t think there’s much that requires them to change much at this week’s meeting. So this could be a placeholder.

Fed: The odds of a cut or hold in June are about 50/50 as we head into US CPI this week. The chances of a drop in July, however, are still at 87%, so we will not have to wait very long to see the markets fully factor in a drop in July again. When it comes to things like positioning, I think a simpler trade this week would be missing from the data (in reference to the dollar).

BoC: Only 70% chance of a rate cut in June seems too low. A decent deceleration in CPI data, a decent absence in jobs data, and businesses saw a decent reduction in those expecting a CPI rise in the outlook survey companies. I think the Bank of Canada no longer has any reason not to adopt a more dovish policy this week.

ECB: Some participants seem overly enthusiastic about the ECB’s confirmation of a June cut this week, and others are actively positioning themselves in favor of further decline in the euro as a result. With a June cut already 100% priced in, I don’t really see the appeal of short EUR positions unless the bank makes the case for much deeper cuts than is already priced in.

Central bank rate expectations (April 8, 2024)

cnbctv18-forexlive