S&P 500 Technical Analysis – Technology Weakness Weighs on the Market

Fundamental Overview

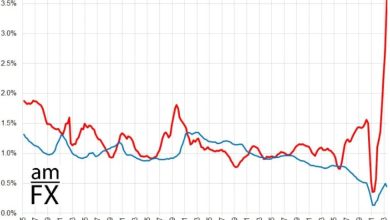

We have experienced a slight decline in the S&P 500 in recent days. If we were to find a catalyst, this could be the second consecutive failure in US jobless claims last Thursday, but the data was still pretty good and not a cause for concern overall. In fact, last Friday’s US PMIs showed a fairly good recovery in growth without inflationary pressures. This should be good news for the market and for risk sentiment in general.

The index was pulled lower mainly due to tech weakness, with Nvidia extending the correction to 16% from the all-time high (it is currently positive in pre-market trading). If we look at other markets, the Russell 2000 and Dow Jones rose and growth sensitive sectors like industrials and financials were positive. Also keep in mind that it’s the end of the quarter that could distort price action. Overall, this feels like a healthy step back.

S&P 500 Technical Analysis – Daily Timeline

S&P 500 daily

On the daily chart, we can see that the S&P 500 has fallen slightly in recent days. From a risk management perspective, buyers will have better risk to reward a setup around the trendline where they will also find the confluence of the 50% Fibonacci retracement level. However, at the moment it is difficult to envisage such a significant decline unless we have some really ugly US data.

S&P 500 Technical Analysis – 4 hour time frame

S&P 500 4 hours

On the 4-hour chart, we can see that price is testing the minor trendline around the 5510 level. This is where we can expect buyers to step in with a defined risk below the trendline to position itself for a rally towards a new all-time high. Sellers, on the other hand, will want to see the price fall to increase bearish momentum and position themselves for a decline into the major trendline around the 5360 level.

S&P 500 Technical Analysis – 1 Hour Time Frame

S&P 500 1 hour

On the hourly chart we can see that we have good support around the 5510 level, adding an additional confluence to the trendline, which should technically strengthen the support zone. Buyers will then need to break through the resistance at 5555 to gain conviction and increase their bullish bets to new highs. The red lines define the average daily range for today.

Upcoming catalysts

Today we have the US Consumer Confidence report in which the market will focus on the details of the labor market. On Thursday we will receive the latest US jobless claims figures, while on Friday we conclude the week with the US PCE.

cnbctv18-forexlive