Kevin O’Leary forecasts no Fed rate cut this year: ‘That’s just the reality’

Investors should quash any hopes of interest rate cuts this year because the Federal Reserve won’t be able to meet its inflation mandate anytime soon, Kevin O’Leary said.

The “Shark Tank” star told Fox Business Network that monetary policy will remain unchanged and that anyone still betting on a dovish pivot is wrong.

On Wednesday, the Fed itself backed it up, announcing after its latest policy meeting that it would keep the federal funds rate at its current target range of 525 to 550 basis points.

“They continue to show their optimism month after month. But there will be no rate cut this year,” O’Leary said Tuesday. “I’m investing under the assumption that we’re going to live with this rate cycle staying the same for the rest of the year. I’m sorry, that’s just reality.”

His view adds to a growing chorus of commentators who have become convinced of a zero-reduction scenario, as a raft of hot economic data continues to spoil market forecasts: where once cuts were expected as early as March, solid figures on employment, the economy and inflation. gradually postponed this prospect until the end of the year.

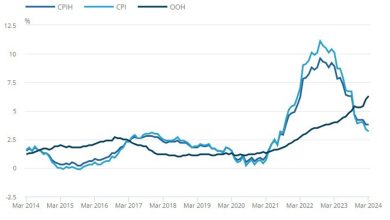

And in late April, the Fed’s ability to cut interest rates was called into question by more analysts as first-quarter GDP slowed significantly from previous numbers. With inflation still rising, this has given rise to fears of stagflation, a scenario quenched only by rate hikes.

“The Fed’s mandate is 2% inflation – not two, not three, not 3.2 – it’s two, and so inflation won’t come down near two for a bunch of reasons, and, therefore , they will not reduce rates,” he added. Leary said.

For its part, the Fed plans three rate cuts in 2024, although officials have repeatedly said that would depend on future inflation and economic data.

At the same time, some on Wall Street have also pointed out that the Fed may feel reluctant to pursue rate cuts, as the impact of rising borrowing costs has yet to really have much impact. impact on the economy.

Still, forecast changes weighed heavily on stocks, with April becoming the first loss month of 2024 for the market.

businessinsider