Business

ING believes chances of June decline are canceled out by yesterday’s CPI

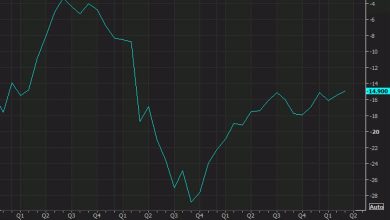

- Core inflation, at 0.4% month-on-month, exceeded the expected 0.3%, reducing the likelihood of a Fed rate cut in June.

- Market expectations for a June rate cut fell sharply from 15 basis points to just 5.5 basis points following the release of the inflation report.

- A reduction in June would likely require payroll growth near 100,000 and a core CPI of 0.2% in future reports.

- The core CPI’s slight beating of expectations is still twice the pace needed for a 2% annual inflation target.

- Given current inflation trends, a Fed rate cut before September is unlikely, capping potential cuts at three for the year.

- Basic services led the rise in inflation, with notable increases in medical care and transportation services, while some categories like vehicles and airfares saw price declines.

This article was written by Arno V Venter on www.forexlive.com.

cnbctv18-forexlive