Forexlive Americas FX news ends on April 8. Yields are rising but the USD is falling slightly.

The economic calendar and speaker schedule during the US session was light. Inflation expectations from the New York Fed saw the 1-year measure unchanged at 3.0%, but 3-year expectations rose to 2.7% from 2.9%. The news didn’t really impact Forex, but US rates remained high all day.

Specifically, out-of-the-curve yields all rose, with the biggest gains coming in the short term, with the 2-year yield approaching session highs. The 30-year yield is closer to the lows of the session. The 10-year is trading towards a new high in 2024 (highest dating back to November 2023).

A market overview currently shows:

- 2-year yield 4.792%, +6.1 basis points

- 5-year yield 4.432%, +6.4 basis points

- 10-year yield 4.421%, +4.4 basis points

- Yield at 30 years 4.551%, +2.0 basis points

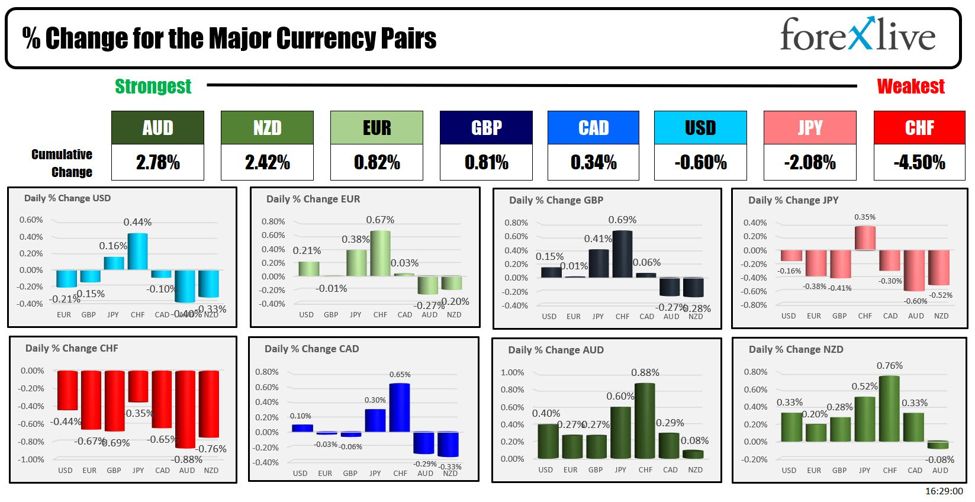

In Forex, as the New York session draws to a close, the AUD is the strongest and the CHF the weakest. The USD ends slightly lower for the day. At the start of the session it was slightly higher. The US greenback closes lower against the EUR, GBP, CAD, AUD and NZD. It fell -0.40% against the AUD – the biggest drop for the USD. The dollar rose today against the JPY and CHF, with the largest gain of 0.44% against the Swiss franc.

Technically,

- For USDJPY, the highest price hit a high of 151.938, less than 3 pips from the 2024 high and a new 30-year high. Although sellers leaned in, the downside was limited to the high level, keeping the pair within earshot of that level. The price is currently trading at 151.847 before the close.

- GBPUSD trended higher and in doing so tested its 100-day MA at 1.2663. Sellers leaned against the MA. There is additional resistance at the 200-bar moving average on the 4-hour chart at 1.2683 if the price breaks higher during the new trading day.

- EURUSD advanced during the US session, reaching a high of 1.0861. In this upward move, the pair extended above the 50% of the March trading range at 1.0852. With the breakout, buyers will look for further upward momentum at the 100-day MA which looms at 1.8717.

- AUDUSD traded up and down during the Asian and European session, but made new highs during the US session. This rise took the price above the 100-day MA at 0.65698. Staying above this MA would be the best-case scenario for the pair on the new trading day.

- USDCHF rose in the Asian and European sessions, and traded up and down in the US session. However, the price remained above the 200 and 100 hourly MAs between 0.9041 and 0.9046. The best case scenario for USDCHF is to stay above these MAs into the new day and leave more space between these MAs and the pair’s price.

Crude oil fell today on hopes for a ceasefire and release of hostages in Israel. A proposal was made to Hamas, but according to sources, they rejected the Israeli plan. Crude oil trades lower -$0.30 at $86.50

Bitcoin has been rising and is currently trading at $71,695.

Gold was trading up $9.03 or 0.39% at 2,338.60. Today, the precious metal has reached a new all-time high.

cnbctv18-forexlive