Focus on Monday’s US data: GDP growth in the first quarter – the range of expectations to watch (and why)

On Thursday at 12:30 GMT, or 8:30 a.m. US Eastern Time, we get advanced US economic growth figures for the November-March quarter:

The Federal Reserve will be careful to assess the strength of the American economy. A stronger-than-expected rate will strengthen the case for delaying rate cuts, and vice versa if it is weaker than expected. This will also have implications for the Japanese Ministry of Finance (and the Bank of Japan). If growth surprises on the upside, this will spur USD/JPY buying and delay potential intervention to support the yen (at the margin).

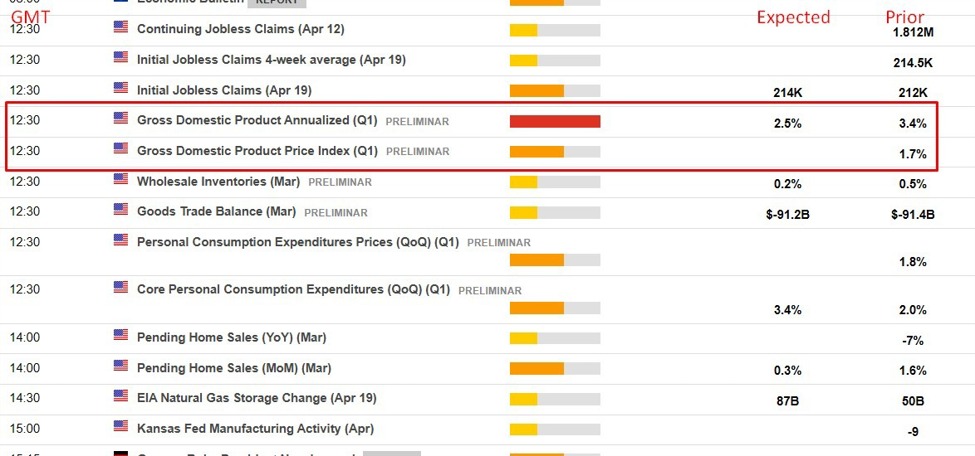

Consensus expectations are shown in the table below. This snapshot is from the ForexLive economic data calendar, access it here.

The range of expectations is 1.0% to 3.1% year-on-year, compared to a consensus of 2.5%.

Goldman Sachs is at 3.1%:

***

Why is knowledge of these beaches important?

Data results that do not match market low and high expectations tend to move markets more significantly for several reasons:

-

Surprise factor: Markets often incorporate expectations based on previous forecasts and trends. When the data deviates significantly from these expectations, it creates a surprise effect. This can lead to a rapid revaluation of assets as investors and traders reevaluate their positions based on the new information.

-

Psychological impact: Investors and traders are influenced by psychological factors. Extreme data points can elicit strong emotional reactions, leading to overreactions in the market. This can amplify market movements, especially in the short term.

-

Reassessment of risks: Unexpected data can lead to a reassessment of risks. If data significantly underperforms or exceeds expectations, it can change the perception of risk of certain investments. For example, better-than-expected economic data can reduce the perceived risk of investing in stocks, leading to a market rally.

-

Triggering Automated Trading: In today’s markets, a significant portion of trading is done by algorithms. These automated systems often have predefined conditions or thresholds that, when triggered by unexpected data, can lead to large-scale purchases or sales.

-

Impact on monetary and fiscal policies: data that is far from expectations can influence the policies of central banks and governments. For example, in the case of today’s expected data, weaker than expected data will fuel speculation about closer and larger rate cuts from the Federal Open Market Committee (FOMC). A stronger (i.e. higher) sales report will lower these expectations.

-

Market Liquidity and Depth: In some cases, extreme data can affect market liquidity. If the data is unexpected enough, it could cause a temporary imbalance between buyers and sellers, causing larger market movements until a new equilibrium is found.

-

Chain reactions and correlations: financial markets are interconnected. A significant movement in one market or asset class due to unexpected data can lead to correlated movements in other markets, thereby amplifying the overall market impact.

cnbctv18-forexlive