Conclusion of Forexlive Americas FX news on April 17. USD falls after 5-day bullish streak

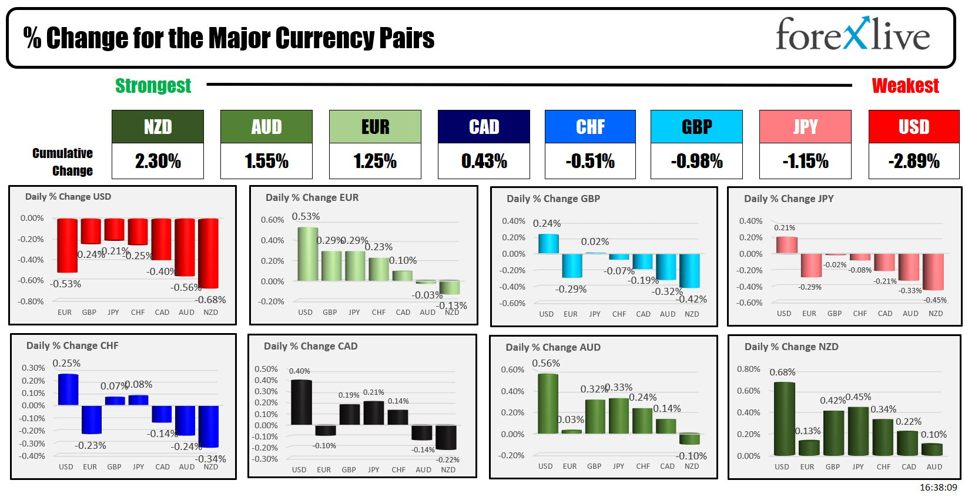

The USD was lower today and the weakest of the major currencies. The NZD is the strongest.

There was little economic data (well, nothing). Weekly oil inventory data showed a larger-than-expected build in oil stocks, although gasoline and distillates posted declines. Oil prices fell today, helped by calm geopolitical news from Israel and Iran. The warmongering calmed down for the day.

Some ECB officials (Centeno and Nagel) have spoken of a rate cut in June. However, this had little impact on the euro. However, later in the day, the ECB’s Lagarde said she was monitoring exchange rates and that it could be inflationary (textbook stuff). It may have been a quiet day, but it gave buyers a reason to push the pair up into the swing zone up to 1.0675 where sellers stalled the pair. However, this was enough to take the price to a new high for the week (the high hit 1.0679 before turning slightly lower). The price is currently trading at 1.0671a. Watch 1.0655 for potential support on the new trading day.

For USDJPY, it fell during the US session as yields fell and the pair found willing sellers during the Asian and US session ahead of yesterday’s high at 154.78. The high price reached 154.72 today. The decline, however, fell short of the rising 100-hour MA at 153.98. On the new day, a move below and then the 38.2% of the latest uptrend from Friday’s low at 153.94 is the minimum needed to show that sellers can resume a some control. In the absence of this, buyers are still in control. Japan’s Kanda and Suzuki fired a few shots when commenting on the exchange rate, but this was largely ignored by markets. Nonetheless, as the USDJPY price approaches 155.00, traders are becoming increasingly wary of intervention. So be aware.

The biggest mover today was NZDUSD, which gained 0.68% today. This increase ended a 3 day decline and a 4 out of 5 day decline in risk-free flows. The upward move took the pair higher to test the lower 100 hour MA at 0.59259. The high price reached 0.59244 today.

US stocks fell today. The S&P and Nasdaq are now down for 4 consecutive days. The final figures showed:

- Dow industrial average down -0.12%

- S&P Index, -0.58%

- Nasdaq Index, -1.15%

The small-cap Russell 2000 index fell -0.99% despite falling yields today.

In the USD debt market, yields have indeed found a bid. The 20-year bond auction resulted in solid purchases (-2.5 basis points).

- 2 years 4.938%, -2.5 basis points

- 5 years 4.616%, -6.5 basis points

- 10 years 4.589%, -6.8 basis points

- 30 years 4.704%, -5.3 basis points

In other markets;

- Crude oil fell sharply as tensions eased in the Middle East. Price is down -$2.54 or -2.93% to $82.82

- Gold sells off late in the day and is now trading down -$22.10 or -0.93% at $2,360.60.

- Bitcoin fell below $60,000 to a low of $59,672, but rallied to $61,053. Bitcoin’s all-time high was reached at $73,794 on March 11. Since then, the price has fallen by 19.14% from the high to today’s low.

cnbctv18-forexlive