CHF is strongest and USD is weakest at the start of the NA session.

As the North American session begins, the CHF is the biggest gainer and the USD is the weakest of the major currencies. The USD is lower ahead of the key US jobs report, which will attract all the attention of markets after a week in which the Federal Reserve kept rates unchanged at 5.5%, but with the Fed reducing the amount of its bond sales and the Fed Chairman not being as hawkish (continuing to ease monetary policy). Even if Fed officials are off the leash after the “quiet period,” no Fed officials are expected, but you never know.

Here’s how Adam summed up the Fed chairman this week:

I might as well start with what Fedwatcher Nick Timiraos wrote:

- There is currently a high bar for the Fed to cut rates, but there is an even higher bar for the Fed to resume rate hikes.

- He still expects inflation to fall, largely because of the disinflation in the housing sector that everyone expects.

In my opinion:

- Powell was repeatedly prompted to say something hawkish or propose rate hikes. He deftly avoided all questions and made it clear that the two paths the Fed was considering were to cut or hold rates here longer.

- He also opposed the idea that a bad jobs report would put the Fed back into action, saying it would take more than “a few” increases in the unemployment rate. Notably, the unemployment rate is currently 3.8% and the SEP projects 4.0% at the end of the year. Keep that in mind in Friday’s nonfarm payrolls report.

- The market clearly feared a more hawkish turn and breathed a sigh of relief, quickly assessing the moves after Monday’s payroll data.

As for today’s jobs report, Adam released yesterday the expectations and what we know so far regarding the jobs stats:

What is expected :

- Consensus Estimate +243K (range +150 to +280K)

- Private estimate +190K versus +232K previously

- March +303K

- Consensus estimate of the unemployment rate: 3.8% versus 3.8% previously (exceeding 4% is the minimum the Fed seems to be thinking about when reacting) boo-boo boo-boo

- Participation rate: 62.7% before

- Previous underemployment U6 7.3%

- Average hourly wage over the year exp +4.0% over the year compared to +4.1% before

- Average hourly salary m/m exp +0.3% vs +0.3% before

- Average weekly hours exp 34.4 vs. 34.4 previously

April Jobs So Far:

- ADP ratio +192K versus +175K expected and +208K previously

- ISM services employment released Friday at 10 a.m. ET

- ISM manufacturing employment 48.6 versus 47.4 previously

- Jobs at Challenger are cut by 64.7K compared to 90.3K previously (four-month low)

- Employment in Philadelphia -10.7 compared to -9.6 previously

- Empire employment -5.7 compared to -7.1 previously

- Initial survey on unemployment claims, week 212K

Justin posted today that ahead of job creation, traders are now looking at rate cuts worth 40 basis points. This is up from the start of the week, when it was around 31 basis points. As for the timing of the first rate cut, a 25 basis point move is now fully priced in for at least November. The odds of a September move are currently around 78% and this will be one to watch.

A look at other markets at the start of the North American session currently shows this. :

- Crude oil is trading up $0.24 or 0.30% at $79.19. At this time yesterday, the price was $79.66. For the week, crude oil prices are down -5.55%

- Gold is trading down -$5.26 or -0.23% at $2,297.47. At this time yesterday, the price was higher at $2,298.17. For the week, gold prices are down -1.73%

- Silver is trading down $0.19 or -0.71% at $26.46. Yesterday at this time the price was $26.24

- Bitcoin is currently trading at $59,149. At this time yesterday, the price was trading at $58,583. For the week, Bitcoin prices were down $4,000, or 6.3%.

In pre-market trading, major US indexes are trading higher ahead of the key US jobs report.

- Dow Industrial Average futures imply a gain of 294.34 points. Yesterday, the index closed up 322.37 points or 0.85% at 38225.67. For the week, the index is unchanged at yesterday’s close

- S&P futures imply a gain of 17.05 points. Yesterday, the index rose 45.79 points or 0.91% to 5064.19. Over the week, the index is down -0.70% at yesterday’s close.

- Nasdaq futures imply a gain of 104.21 points. Yesterday, the index rose 235.48 points or 1.51% to 15840.96. Over the week, the annexes are down -0.55% at yesterday’s close.

European markets are trading higher:

- German DAX, +0.39%. Over the week, the index was down -1.0%.

- CAC France, +0.51%. Over the week, the index is down -1.58%.

- UK FTSE 100, +0.46%. Over the week, the index is up 0.85%.

- Spanish ibex, +0.09%. Over the week, the index is down -2.4%

- Italian FTSE MIB, +0.19% (10 minutes delayed). Over the week, the index was down -1.32%

Stocks in Asia-Pacific markets were mixed

- Japan’s Nikkei 225, on vacation. Over the week, the index increased by 0.79%

- The Chinese Shanghai Composite Index, on vacation. Over the week, the index is up 0.52%.

- Hong Kong Hang Seng Index, +1.48%. Over the week, the index increased by 4.67%.

- Australian S&P/ASX index, +0.55%. Over the week, the index increased by 0.7%.

Looking at the US debt market, yields are lower closer to the US jobs report:

- 2-year return 4.866%, -1.1 basis points. At this time yesterday, the yield was 4.929%

- 5-year yield 4.548%, -1.8 basis points. Yesterday at this time the yield was 4.612%

- 10-year yield 4.556%, -1.4 basis points. Yesterday at this time the yield was 4.605%

- Yield at 30 years 4.705%, -1.2 basis points. At this time yesterday, the yield was 4.741%

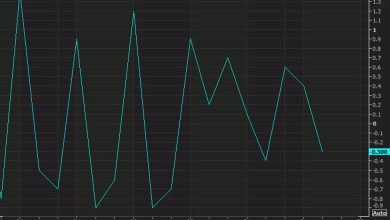

Looking at Treasury yield curve spreads, the yield curve is steeper (but still negative):

- The 2-10 year gap stands at -30.9 basis points. At this time yesterday, the spread was -32.5 basis points.

- The 2-30 age gap is -16.0 basis points. At this time yesterday, the spread was -18.9 basis points.

European benchmark 10-year yields are lower.

10-year European benchmark yields

cnbctv18-forexlive