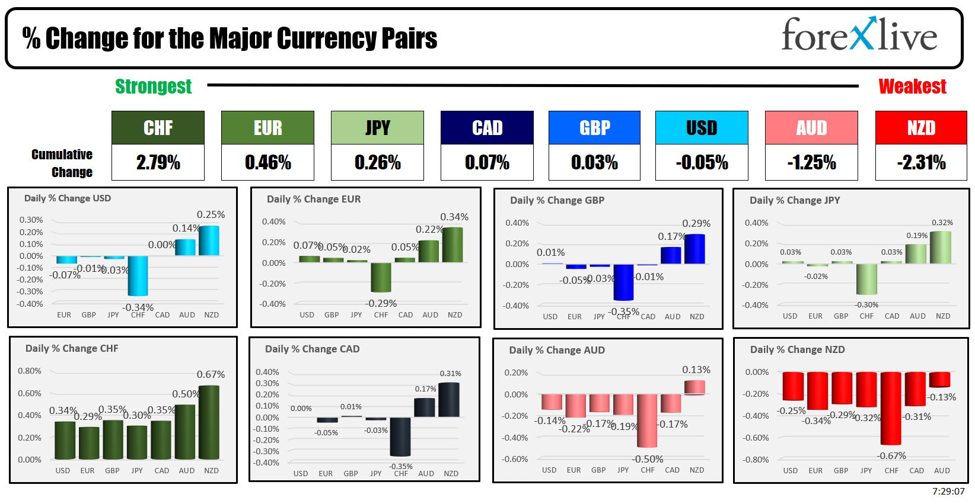

CHF is strongest and NZD is weakest at the start of the NA session.

From strongest to weakest major currency

The CHF is the strongest (flight to safety) and the NZD is the weakest (risk aversion) at the start of the North American session. The USD is mixed, with the greenback losing -0.34% against the CHF and gaining +0.25% against the NZD. Other than that, major currencies are within 0.14% of yesterday’s closing levels to start the trading day, with EUR, GBP, JPY and CAD almost unchanged in the snapshot American in the morning.

The modest steps come despite Israel’s limited retaliation against Iran following a major Iranian drone and missile attack on its territory last weekend. The Israeli response targeted the Isfahan region in central Iran, where there are nuclear facilities and an air base. Despite reports of explosions and the activation of air defense systems in Iranian provinces, Iranian state media downplayed the incident, saying there was no significant damage or disruption on nuclear sites. According to reports, the United States was informed of the attack just before it was launched, but did not participate. This action by Israel appeared aimed at avoiding a wider escalation of the conflict and Iran’s response has so far been limited, leaving investors hopeful that the tension in the conflict is over.

U.S. stocks fell overnight following the Israeli strike, but have rebounded from their lowest levels. Dow futures implied a decline of more than 300 points, but they are now down about -60 points. The S&P is on track for its third weekly decline. The Nasdaq index is on track for its fourth consecutive weekly decline and, given the premarket decline, on track for the worst week since March 2023.

After yesterday’s close, Netflix beat earnings and revenue expectations, and also posted solid new customer numbers, but the stock is still down about -5.5% pre-market , as investors worry about the future. The company announced it would stop reporting its membership numbers starting in the first quarter of 2025 and projected revenue lower than analysts’ expectations for the current quarter – both of which are unsuitable for investors.

Today’s top results don’t impress investors:

American Express Co AXP

- EPS: 3.33 reported vs. 2.95 expected – BEAT

- Income: 15.8 billion reported against 15.79 billion expected – BEAT

- Shares trade down 1.15% in premarket

Procter & Gamble Co PG

- Basic EPS: 1.52 reported vs. 1.41 expected – BEAT

- Income: 20.2 billion reported against 20.41 billion expected – LACK

- Shares trade down -4.14% in pre-market

Schlumberger SLB

- EPS: 0.75 reported versus 0.75 expected – ENCOUNTER

- Income: 8.71 billion reported against 8.69 billion expected – BEAT

- Shares trade down -1.45% premarket

Next week is a key reporting week with Tesla, Visa, Boeing, Meta, IBM, Ford, Chipotle, Intel, Microsoft, Alphabet, Exonn Mobile and Chevron all expected to release their reports.

At this time, no key economic publications are planned in Canada or the United States. Today is the last day before the start of the quiet period for the Fed before its May 1 interest rate decision.

A look at other markets at the start of the North American session currently shows this. :

- Crude oil is trading down -$0.48 or -0.58% at $81.62. At this time yesterday, the price was $81.67. The overnight high price reached $85.64.

- Gold is trading down -$2.50 or -0.10% at $2,376.02. At this time yesterday, the price was higher at $2,382.41. Its high price reached $2,417.89, before turning lower.

- Silver is trading down -$0.13 or -0.49% at $28.07. At this time yesterday, the price was $28.43. Its overnight high price reached $28.93

- Bitcoin is currently trading at $65,051, a far cry from the low of $59,629 and following reports of the Israeli strike. At this time yesterday, the price was trading at $62,800.

In the pre-market, the main American indices are mostly trading lower:

- Dow Industrial Average futures imply a -61 point decline. Yesterday, the index rose 22.07 points or 0.06% to 37775.39

- S&P futures imply a -7.37 point decline. Yesterday, the index fell -11.11 points or -0.22% to 5011.11

- Nasdaq futures imply a decline of -45.23 points. Yesterday, the index fell -81.87 points or -0.52% to 15601.50

European indices are trading lower before the American opening:

- German DAX, -0.65%

- CAC France, -0.17%

- British FTSE 100, -0.83%

- Spanish ibex, -0.55%

- Italian FTSE MIB, -0.15% (delayed by 10 minutes)

Stocks in Asia-Pacific markets were down after Israeli attack on Iran

- Japanese Nikkei 225, -2.66%

- Chinese Shanghai Composite Index, -0.29%

- Hong Kong Hang Seng Index, -0.99%

- Australian S&P/ASX index, -0.98%

In the US debt market, yields are falling:

- 2-year return 4.966%, -2.6 basis points. At this time yesterday, the yield was 4.931%

- 5-year yield 4.639%, -4.7 basis points. Yesterday at this time the yield was 4.615%

- 10-year yield 4.589%, -5.7 basis points. At this time yesterday, the yield was 4.584%

- Yield at 30 years 4.687%, -5.7 basis points. At this time yesterday, the yield was 4.699%

Looking at the Treasury yield curve, the spreads have reversed:

- The 2-10 year gap stands at -37.6 basis points. At this time Friday, the spread was -35.6 basis points.

- The 2-30 year gap stands at -27.9 basis points. At this time Friday, the spread was -24.2 basis points.

The 10-year European benchmark yields are lower:

European benchmark yield at 10 years

cnbctv18-forexlive