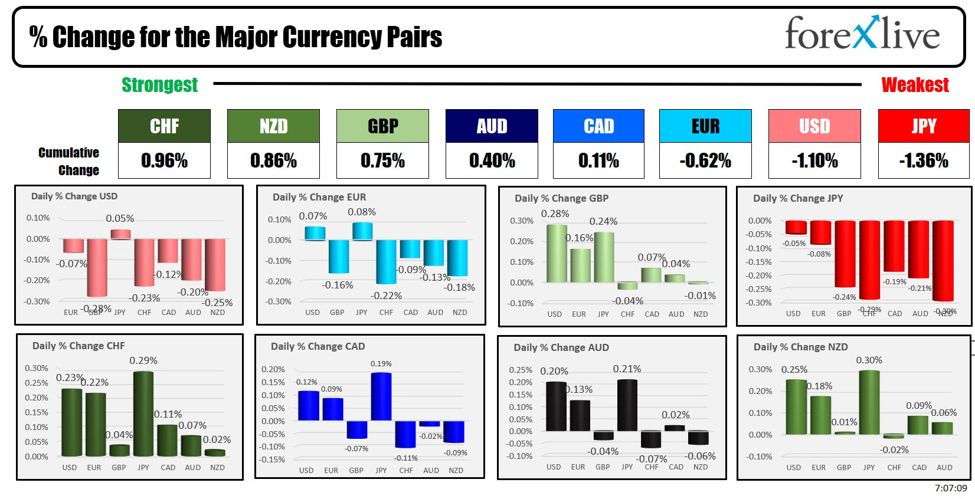

CHF is strongest and JPY is weakest at the start of the NA session

From strongest to weakest major currency

The CHF is the strongest and the JPY is the weakest at the start of the North American session. The USD is generally lower to start the trading day.

Overnight, Australia’s employment change showed -6.6K compared to 7.2K. However, the unemployment rate was lower than expected at 3.8 cents versus 3.9% expected, but was up from 3.7% last month. AUDUSD is slightly higher in trading today, but found willing sellers near the upper swing zone target:

AUDUSD rises towards target resistance.

Last night in Japan, BoJ policy chief Asahi Noguchi highlighted the mixed impacts of a weaker yen, noting that while some large companies have benefited, it poses broader economic challenges. Noguchi said he was increasingly confident that the BoJ’s 2% inflation target would be achieved, but remained cautious about the pace of future interest rate hikes, stressing that they would depend economic data. He also discussed the potential long-term effects of the weak yen on wages and prices, which must be taken into account in monetary policy decisions. Despite the potential for future rate hikes, Noguchi did not commit to any specific actions for the rest of the year, indicating uncertainty over the immediate direction of monetary policy.

USDJPY fell during the Asian session and tested the 38.2% last uptrend move at 153.94 at the session low before rebounding higher. Price is also back above its ascending 100 hour MA (blue line in chart below) at 154.153 after falling below that downtrend MA. If sellers want to “win” against buyers, they must reach and stay below the 38.2% of the last move above the minimum. If they don’t succeed, sellers simply don’t win.

USDJPY rebounds near 38.2% again

On the economic calendar today, weekly jobless claims in the United States (215,000 est. versus 211,000 last week), the Philadelphia Fed business index (2.3 versus 3.2 last month ), existing home sales (4.20 million units versus 4.38 million annualized last month) and the leading index. (which were actually positive the month before after a series of negative readings), will all be released today.

A look at the Fed’s speech before the period of calm which will begin tomorrow after the close:

- Fed Governor Bowman will speak at 9:05 a.m. ET.

- The president of the New York Fed. Williams will speak at 9:15 a.m. ET

- President of the Atlanta Fed. Bostic will speak at 11 a.m. ET

- President of the Atlanta Fed. Bostic will also speak at 5:45 p.m. in case he forgot to remind us that Fed policy will likely be delayed.

Looking at the other speakers today, BCE di Guindos and BCE Schnabel will both be speaking. ECB di Guindos spoke earlier today and said it would be appropriate to ease restrictive policy if inflation conditions are met.

Geopolitical news given that we would have agreed to support an Israeli operation in Rafah, Israel would not carry out a major strike against Iran. The report was a significant movement of Israeli armored vehicles near the outskirts of the town of Rafah. Other reports say Israel is unlikely to carry out a retaliatory attack against Iran before Passover. So the Middle East is warming up a bit today.

TSMC reported better-than-expected earnings, but its stock is still down in pre-market trading (down $2.04 or -1.47% to $137):

Performance:

- Net profit: Increased by 9%, BEAT market expectations.

- Income: Increase of 16.5% per year, influenced by the strong demand for AI.

Factors contributing to performance:

- Increased demand for AI: Helped counter the decline in demand for electronics in the pandemic era.

- Comparative year factor:Last year’s weak chip demand created a weaker basis for comparison, supporting this year’s significant growth.

Summary:TSMC BEAT market expectations with strong first quarter results, driven by growing demand for AI and a favorable year-over-year comparison.

Netflix will release its results after the close. Intuitive Surgical Losses will release their gains later today.

U.S. stocks trade higher in pre-market trading, yields almost unchanged in the face of falling crude oil, gold returns to the upside.

A look at other markets at the start of the North American session currently shows this. :

- Crude oil is trading down a dollar or -1.23% at $81.67. Yesterday at this time the price was $84.80

- Gold is trading up $22.29 or 0.95% at $2,382.41. At this time yesterday, the price was higher at $2,387.80.

- Silver is trading up $0.23 or 0.83% at $28.43. Yesterday at this time the price was $28.46

- Bitcoin is currently trading at $62,800, which is not far from yesterday’s level at this time. At this time yesterday, the price was trading at $62,846.

In pre-market, the main American indices are trading higher:

- Dow Industrial Average futures imply a gain of 89 points. Yesterday, the index fell -45.6 points or -0.12% to 37753.32

- S&P futures imply a gain of 12.54 points. Yesterday, the index fell -29.18 points or -0.58% to 5022.22

- Nasdaq futures imply a gain of 63.88 points. Yesterday, the index fell -181.88 points or -1.15% to 15683.37

European indices are trading higher:

- German DAX, +0.06%

- France CAC, was 0.43%

- British FTSE 100, +0.26

- Spanish ibex, +0.80%

- Italian FTSE MIB, +0.22% (10 minute delay)

Stocks in Asia-Pacific markets were mostly higher:

- Japanese Nikkei 225, +0.31%

- Chinese Shanghai Composite Index, +0.09%

- Hong Kong’s Hang Seng Index, +0.82%

- Australian S&P/ASX index, +0.48%

In the US debt market, yields are almost unchanged.

- 2-year yield 4.931%, +0.7 basis points at this time yesterday, the yield was at 4.964%

- 5-year yield 4.615%, -0.2 basis points. At this time yesterday, the yield was 4.674%

- 10-year yield 4.584%, unchanged. At this time yesterday, the yield was 4.651%

- 30-year yield 4.699%, unchanged. At this time yesterday, the yield was 4.757%

Looking at the Treasury yield curve, the spreads have reversed:

- The 2-10 year gap stands at -35.6 basis points. As of this time Friday, the spread was -31.1 basis points.

- The 2-30 year gap stands at -24.2 basis points. As of this time Friday, the spread was -20.8 basis points.

The 10-year European benchmark yields are lower:

European benchmark 10-year yields are falling

cnbctv18-forexlive