April 30 Deadline Approaches for Student Loan Cancellation

Californians who obtained federally backed student loans from private banks may have some or all of their remaining debt canceled by the Biden administration, but they need to act quickly: The deadline to qualify is Tuesday.

Relief is available to students enrolled in income-driven repayment plans or the Public Service Loan Forgiveness Program. It is also available to some parents who borrowed through the Federal Family Education Loan program.

This is not a new initiative, however – rather, it is the last chance to participate in one of the administration’s first and most successful efforts to reduce the mountain of student debt.

The Department of Education launched the One-Time Income-Based Repayment Adjustment Initiative in 2022 to address complaints about loan servicing companies losing track of their payments, failing to extend borrowers credit appropriate for their public service work and push distressed borrowers into costly forbearance or deferment. programs instead of payment plans based on their income.

After completing its review of payment records last year, the department automatically provided full or partial forgiveness to eligible borrowers – no application was required. The Department of Education estimated that 3.6 million borrowers would receive credit for at least three more years of repayment, putting them that much closer to wiping out their remaining debt.

Under income-driven repayment plans, borrowers pay a monthly amount that is a percentage of their income, regardless of the amount of debt they have. Those who remain current on their payments have all remaining debt forgiven after 10 years if they participate in the Public Service Loan Forgiveness program; otherwise, those on income-driven plans would have their debt forgiven after 20 to 25 years of payments.

The new calculation, however, only applies to loans issued directly by the federal government. This left out borrowers with federally guaranteed and bank-issued loans under the Perkins Loan, Federal Family Education Loan and Health Education Assistance Loan programs.

These borrowers have one last chance to qualify. for a unique fit. If they combine their federally guaranteed loans into a Federal Direct Consolidation Loan before Wednesday, their prior payments on those loans will automatically be eligible for review.

Borrowers can apply online to consolidate their loans at the studentaid.gov website. To meet the deadline, the application simply must be submitted by the end of the day Tuesday — approval may come later, said Celina Damian, student loan servicer at the California Department of Financial Protection and Protection. ‘innovation.

As part of this one-time adjustment, the Department of Education is providing borrowers with credit for the entire period that payments were suspended due to the pandemic. This represents a little over three years of credits.

Additionally, the department provides credits for payments made under any other type of repayment plan in which the borrower was participating before switching to an income-driven plan. And it credits borrowers for months they spent in deferment or extended periods of forbearance.

Borrowers whose adjusted payment numbers push them past the 20-year (for most undergraduate loans) or 25-year (for graduate loans) thresholds will automatically have their remaining debt forgiven.

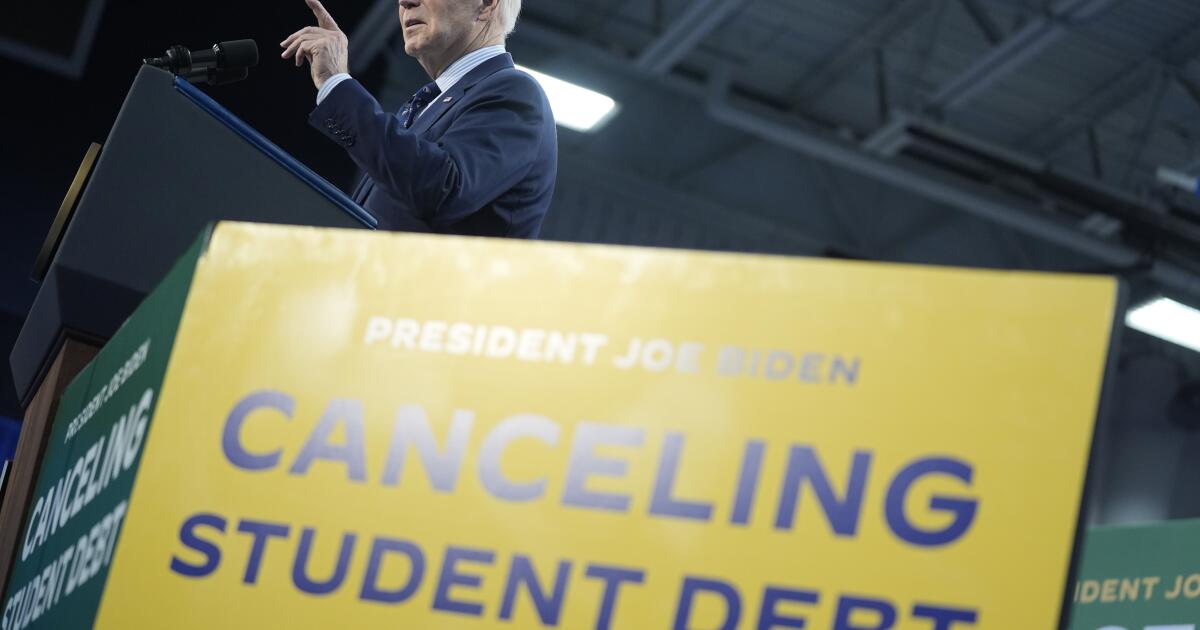

Although the Supreme Court rejected President Biden’s proposal to provide debt relief for about 40 million borrowers in 2023, the administration has two other major efforts or is in the works. He proposed a set of rules that would reduce the debt of about 30 million borrowers, and implemented a new income-driven repayment plan that has lower monthly payments and pays less interest.

California Daily Newspapers