Zions Bancorporation (ZION) reported third-quarter financial results that beat Wall Street estimates, easing concerns about the health of the U.S. regional lender.

Elevate your investment strategy:

- Enjoy TipRanks Premium at 50% off! Benefit from powerful investing tools, advanced data, and insights from expert analysts to help you invest with confidence.

Zions reported earnings per share of $1.48, beating analysts’ estimates of $1.46. The bank’s profit increased by 8.3% compared to the previous year. Zions reported $672 million in net interest income for the third quarter, which is the banks’ largest source of revenue. Net sales before provisions increased by 14% compared to the previous year.

The bank’s net interest margin increased by 25 basis points compared to the same quarter last year, while customer-related non-interest income increased by 8%. Tangible book value per share increased 17% from a year ago. “We are pleased with the company’s core results, which include 14% growth in pre-provision net sales compared to the prior year period,” said Harris H. Simmons, CEO of Zions Bank.

Zions income statement. Source: Main Street Data

Loan contract

Zions also reported that its deposits grew at an annualized rate of 7% in the third quarter. However, despite top and bottom results, Zions’ loans contracted at an annualized rate of 3% in the third quarter of the year. As previously reported, third-quarter results were impacted by a $60 million write-off due to bad debt.

Last week, Zions announced it would take a hefty provision for credit losses when it reports its third-quarter financial results, sending its shares down 11% in a single trading day. Provisions for credit losses represent the money that banks set aside to cover bad debts. Zions operates in 11 states in the Western United States and had total assets of $89 billion at the end of 2024.

Is ZION Stock a Buy?

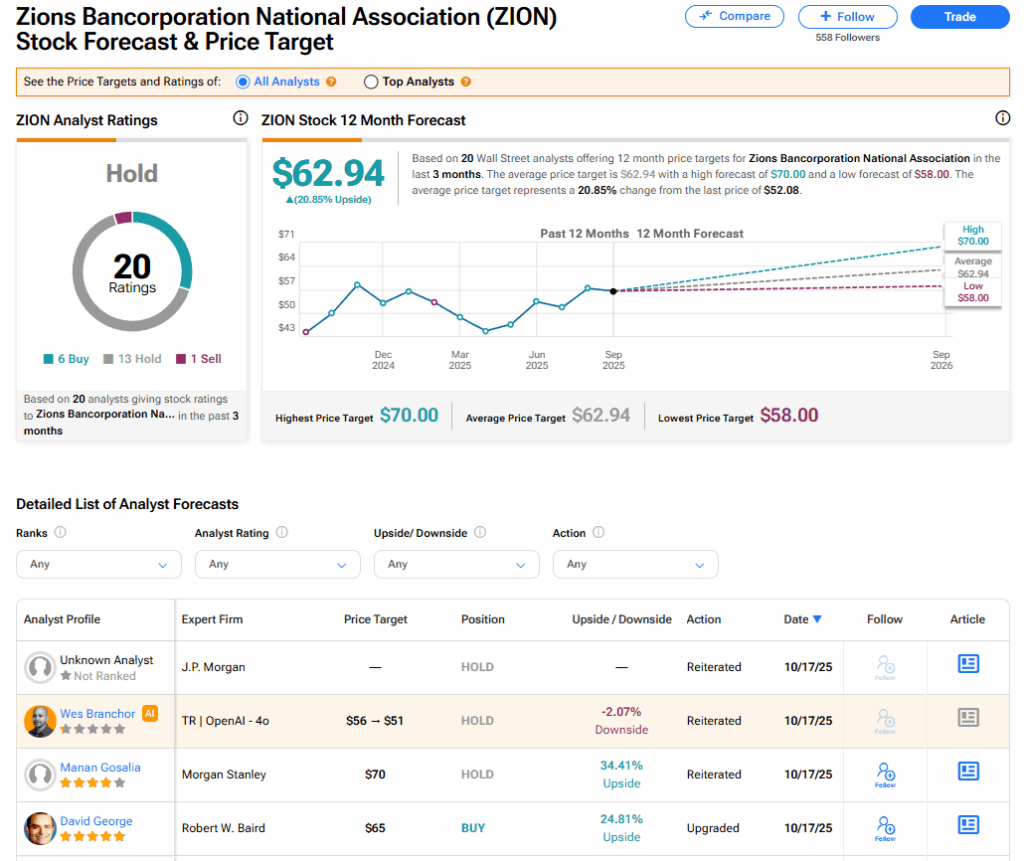

Zions stock has a Hold consensus rating among 20 Wall Street analysts. This rating is based on six buy, 13 hold and one sell recommendations issued over the past three months. ZION’s average price target of $62.94 implies an upside of 20.85% from current levels. These ratings could change after the company’s financial results.

Read more analyst notes on ZION stock

Disclaimer & DisclosureReport a Problem