XRP Price Drops Below $0.5 – A Sign of Further Downsides to Come?

- XRP maintained the $0.4 price range despite the decline.

- Interest has declined over the past 24 hours.

In recent days, Ripple (XRP) has seen a decline in its price, clouding the outlook for the expected rebound.

This decline not only affected XRP’s immediate financial outlook, it also led to a notable decrease in interest among investors and traders.

Ripple goes through a bend

AMBCrypto’s analysis of Ripple (XRP) has revealed a concerning trend as the cryptocurrency has seen a series of declines in recent days.

According to the daily chart, the downturn began around July 3, when the price of XRP fell 3.79% to around $0.46.

The next day, on July 4, the decline deepened, with a further drop of over 7%, bringing the price back to around $0.43. According to the latest data, XRP is trading with an additional drop of over 3%, keeping its price at around $0.43.

Source: TradingView

The analysis also highlighted a sustained downtrend in XRP’s Relative Strength Index (RSI), which currently sits at around 35.

An RSI reading below 40 typically indicates that an asset is in a bearish phase, suggesting that selling pressure is dominating. This persistent downtrend in the RSI further confirms the negative momentum and could indicate continued downward pressure.

Interest in XRP is waning

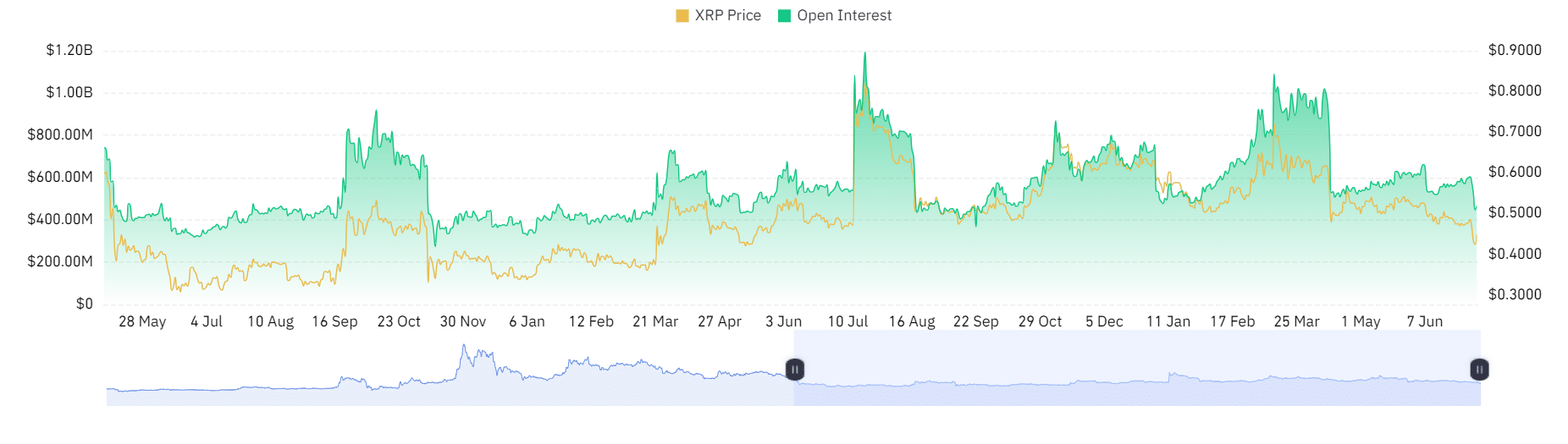

Analysis of XRP’s open interest on Coinglass has indicated a significant decline in market participation. Over the past 24 hours, its open interest has fallen below the $500 million mark, currently sitting at around $467 million.

Open interest represents the total number of outstanding derivative contracts that have not been settled. This decline in open interest suggests a decrease in funds committed to XRP derivatives.

This reflects a decline in trading activity and a decrease in investor confidence or interest in holding positions in XRP at this time.

Source: Coinglass

Despite the decline in open interest, analysis of the weighted funding rate reveals that buyers have remained dominant. This could mean that even though overall market participation has declined, those who remain active still tend to buy rather than sell.

Read Ripple (XRP) Price Prediction 2024-25

Despite the reduction in open interest, buyers’ dominance over the funding rate could indicate that there is still some underlying support for XRP.

The support is due to remaining investors expecting a rebound or finding current price levels attractive enough to maintain or open new positions.

News Source : ambcrypto.com

Gn bussni