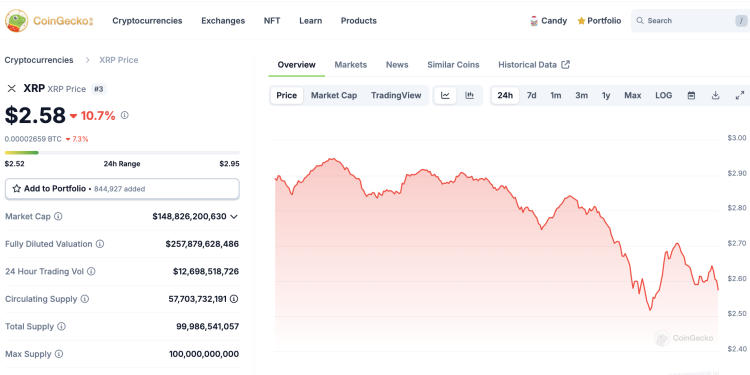

The Ripple price (XRP) fell as low as $ 2.60 on Sunday, February 2, down 17% in 3 days of consecutive losers, chain data suggests an accumulation of whale and a long -term approach to merchants of merchants detail. Is the Prix du XRP an early rebound while American Canada’s trade escapes.

The XRP price stabilizes above $ 2.60 while the Trump pricing war triggers the feeling of risk

Ripple (XRP) has been downwards for three days, with multiple lowering catalysts, including climbing trade tensions between the United States and Canada. On February 2, XRP dropped as low as $ 2.60, marking a decrease of 17% compared to its opening price of $ 3.10 on January 29.

The recent market turmoil has been launched by the announcement of new prices, while former President Donald Trump accused Canada of unfair commercial practices and has imposed new key export restrictions. In response, Canadian Prime Minister Justin Trudeau announced reprisal measures, triggering fears of prolonged economic confrontation.

Geopolitical uncertainty has sent shock waves through the world markets. The main American stock indices have dropped, while the cryptography market has followed suit, Bitcoin (BTC) plunging $ 96,000. Meanwhile, gold has gained ground while investors fled to safety assets, highlighting the classic feeling of risk observed during periods of geopolitical instability.

Despite losses, the Ripple prices action has shown relative resilience compared to other mega-capital altcoins. While XRP posted a daily decrease of 10%, some of the best winners last week like Suit and Polkadot suffered even higher drops, exceeding 15% in the same period. This performance suggests that XRP could attract strategic buyers who seek to enter the market to a discount in uncertainty.

490 million XRP transferred from Binance, referring to resilient long -term perspectives on FNB

While the price of XRP was under pressure, the data on the chain indicate a potentially optimistic underlying trend. An important metric to assess the feeling of investors is the total of XRP reserves on the Binance. Cryptoist data reveals that XRP deposits on the Binance fell to a 40 -day hollow, going from 3.04 billion XRP on January 16 to 2.55 billion XRP from February 2. This means that 490 million XRP parts left Binance in just over two weeks.

This drop in exchange reserves suggests that long -term investors and whales accumulate XRP and move their assets in storage of cold. Binance deals with more than 40% of the global retail cryptography market, which makes this metric particularly relevant to assess the feeling of investors.

Another interpretation of this trend is that institutional actors can proactively accumulate XRP in anticipation of the regulatory clarity surrounding negotiated funds on the stock market (ETF). Bloomberg analysts recently suggested that an ETF Litecoin could be approved first, which raises expectations that other altcoins, such as XRP, could follow. Institutional investors often acquire assets before major regulatory developments, which suggests that recent outings could be linked to potential assets related to FNB.

Assessed at the current price, the 490 million XRP deleted from Binance result in approximately $ 1.3 billion. This reduction in the offer could act as a stamp compared to an additional drop-down action, potentially stabilizing the XRP at $ 2.60 while other cryptocurrencies suffer more extreme losses.

In conclusion, despite the recent drop in XRP, the asset seems to be better than some of its peers. The accumulation of whales, the drop in exchange reserves and the ETF story could provide solid tail winds for the action of XRP prices once wider market conditions.

XRP price forecasts: $ 3 rebound hopes are based on $ 2.60 support

XRP price forecast graphics show that the part to support the undulation stabilized above the level of critical support of $ 2.60, and despite the recent sale, the wider technical structure suggests a potential rebound to $ 3.00 If key indicators line up.

The structure of the Elliott waves on the daily graph notes that XRP has recently completed its fifth wave, followed by a net corrective movement, typical market cycle behavior. Fibonacci retrace levels highlight a key support area around $ 2,5990, coinciding with the level of retracement of 0.618, which historically acts as a strong reversal point for bullish recovery.

If XRP maintains this level, buyers could regain confidence, feeding a potential movement towards the resistance of 0.382 ($ 2,8439), or even $ 3.0562.

The MacD indicator, however, presents a more cautious perspective, the signal line crossing the MACD line, confirming weakening the bullish momentum. If the sales pressure persists and XRP loses the support of $ 2.60, a deeper retirement to $ 2.50 remains likely. However, if buyers absorb current food and the MacD histogram begins to show reduced red bars, this could confirm the bottom, positioning XRP for a relief rally

Frequently asked questions (FAQ)

Yes, a drop in exchange reserves suggest that investors hold XRP in the long term, reducing sales pressure and potentially supporting price stability.

XRP has dropped due to a broader slowdown in the market, triggered by the United States Trade War, the feeling of risk and profit after its recent gathering.

Yes, a drop in exchange reserves suggest that investors hold XRP in the long term, reducing sales pressure and potentially supporting price stability.

Warning: The content presented may include the author’s personal opinion and is subject to the market state. Do your market studies before investing in cryptocurrencies. The author or publication does not hold any responsibility for your personal financial loss.