Why the Bitcoin price correction can last for months

- The Delta gradient revealed that Bitcoin’s potential decline could last one to two months.

- The decline in active addresses raises concerns about BTC demand.

If Bitcoin (BTC) price action is anything to go by, then it is about to drop lower than it has in recent days. In short, this projected decline could last a month or two.

However, AMBCrypto did not draw this conclusion without the necessary data. In this article, we will analyze it. One of the main metrics that fits this prediction is the Delta gradient.

The South is the way

For those unfamiliar, the Delta Gradient measures the relative change in momentum compared to the true organic capital of a cryptocurrency.

When the gradient is positive, an upward trend appears. Most of the time, this uptrend lasts 28 to 60 days.

At press time, Bitcoin’s downtrend was -2.34. This negative reading implies that the price could continue to follow a downtrend. Furthermore, this predicted downtrend could last for a similar duration.

Source: Glassnode

At the time of writing, the Bitcoin price was trading at $61,062. This is a decrease of 4.96% over the last seven days. If the Delta gradient continues to decline, Bitcoin price could fall below $60,000 like it did a few days ago.

This also matched Bitcoin’s reaction to the period when the realized price exceeded the spot value. Additionally, we looked at the profit/loss made by the network.

Mixed signals appear on the charts

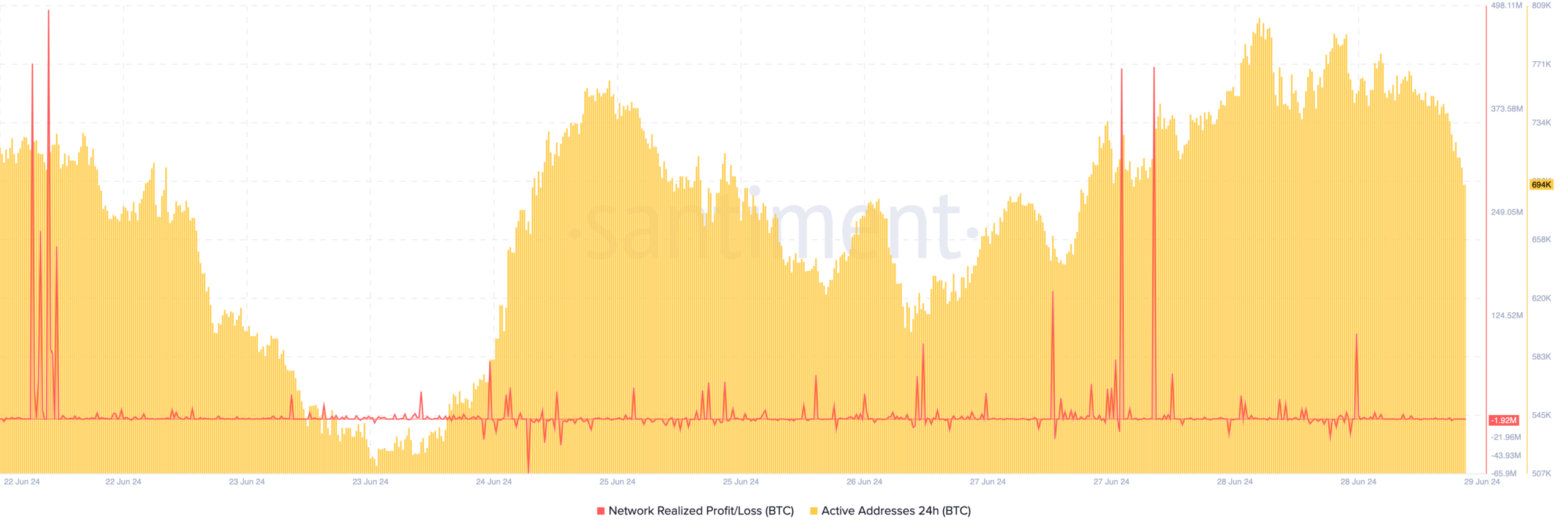

This metric shows the value of trades that have made a profit or loss in the recent period. A positive reading of the metric implies that profit taking is high. As such, this could lead to a decline in prices.

However, if the metric is negative, it implies that there has been an increase in realized losses. If it is intense, the price may start to climb. According to Santiment, the realized profit/loss on the Bitcoin network was -1.92 million.

This implied that a large portion of on-chain transactions ended in losses.

In general, this drop portends an increase in prices. But this may not be the case due to the decrease in activity on the Bitcoin network.

At press time, the number of 24-hour active addresses had fallen to 694,000. A few days ago, it was almost a million. Active addresses are a measure of user activity.

Source: Santiment

So, when it decreases as it has been lately, it means that market participants are not interacting with BTC at a high level. Therefore, this could lead to a notable drop in demand for the coin.

Realistic or not, here is the market capitalization of BTC in terms of ETH

If demand continues to fall, prices will also fall. However, analyst Michael van de Poppe opined that BTC’s correction may be over soon.

According to him, the week that has just ended has been good for the currency. He said:

“A pretty decent weekly candle for Bitcoin approach here. I would expect the correction to be relatively complete. We also haven’t seen the most obvious deep corrections in previous cycles.”

News Source : ambcrypto.com

Gn bussni