What Bitcoin and Ethereum Exchange Flows Say About the Future of the Crypto Market

- A measure of exchange flow showed that the local bottom could be reached for BTC, ETH.

- Market sentiment was not bullish and the behavior of holders at crucial support levels would be critical for the next price movement.

Bitcoin (BTC) and Ethereum (ETH) bulls have struggled to shift market momentum in their favor. The significant losses over the past ten days mean that the price has returned to a support zone where buyers are expected to stop sellers.

Ethereum’s MVRV and NVT ratios showed that the asset could be undervalued. The liquidity pocket at $3,500 could see a short squeeze, but momentum was bearish otherwise.

Meanwhile, another BTC survey showed that mining activity had declined and miners were selling Bitcoin. However, the selling pressure had started to decrease in intensity over the past two days.

AMBCrypto decided to look at how both assets have performed since the exchanges to gauge market sentiment. This revealed that the bulls may not have much to cheer about yet.

What does the net exchange flow metric indicate?

Measuring net trade flows provides valuable insights into the market. When flows are positive, it indicates that inflows are greater.

This in turn is a sign of potential selling pressure on the asset, as it involves participants sending the crypto to exchanges to sell.

Values below zero mean that outflows are larger, which is a good sign for buyers.

This indicates that market participants are withdrawing their assets from exchanges, probably to store them in safer locations, and indicates accumulation.

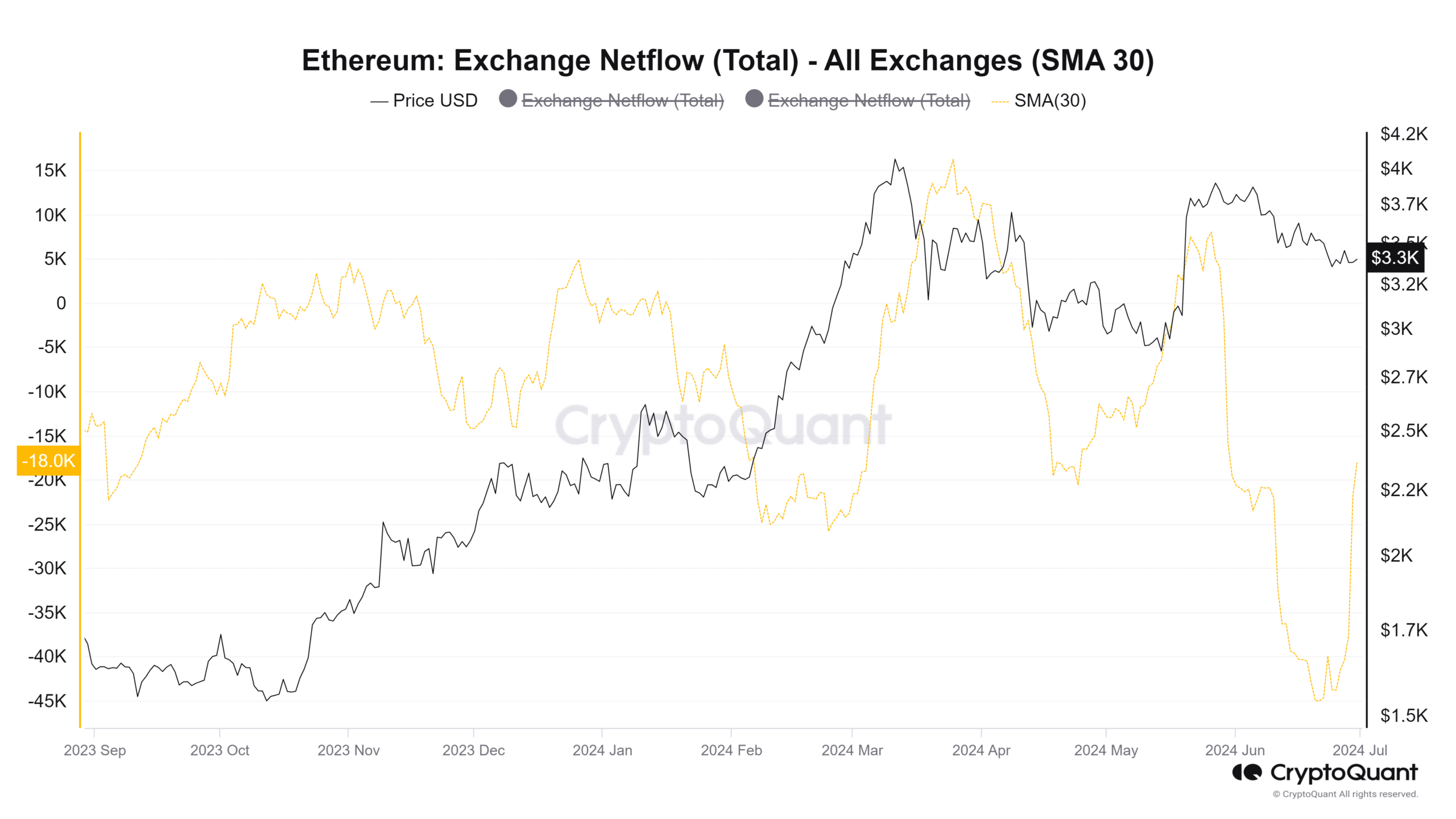

Source: CryptoQuant

30-day simple moving averages were used to better understand exchange flow trends. ETH inflows were significant in mid-March and late May.

Both events marked a local high for the price.

Over the past month, net flow has been sharply negative, showing accumulation. Over the past eight days, outflows have slowed, but the 30DMA net flow has remained in negative territory.

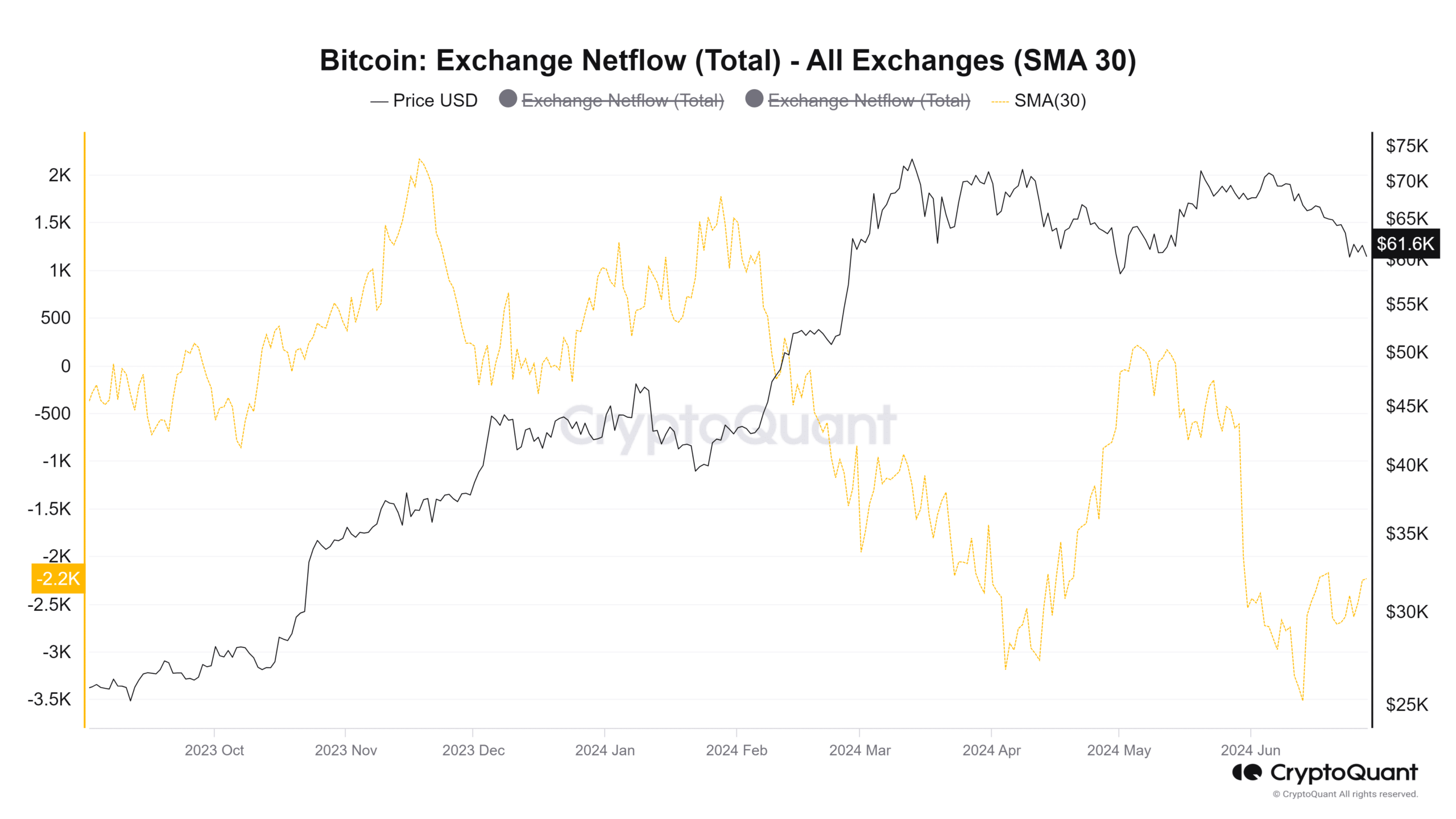

Source: CryptoQuant

Meanwhile, Bitcoin saw steady accumulation throughout February and March. The 30DMA showed that BTC outflow from exchanges continued to dominate.

In late April and May 21, there were spikes in BTC inflows, but these were exceptions to the trend.

Are Bitcoin and Ethereum heading towards consolidation?

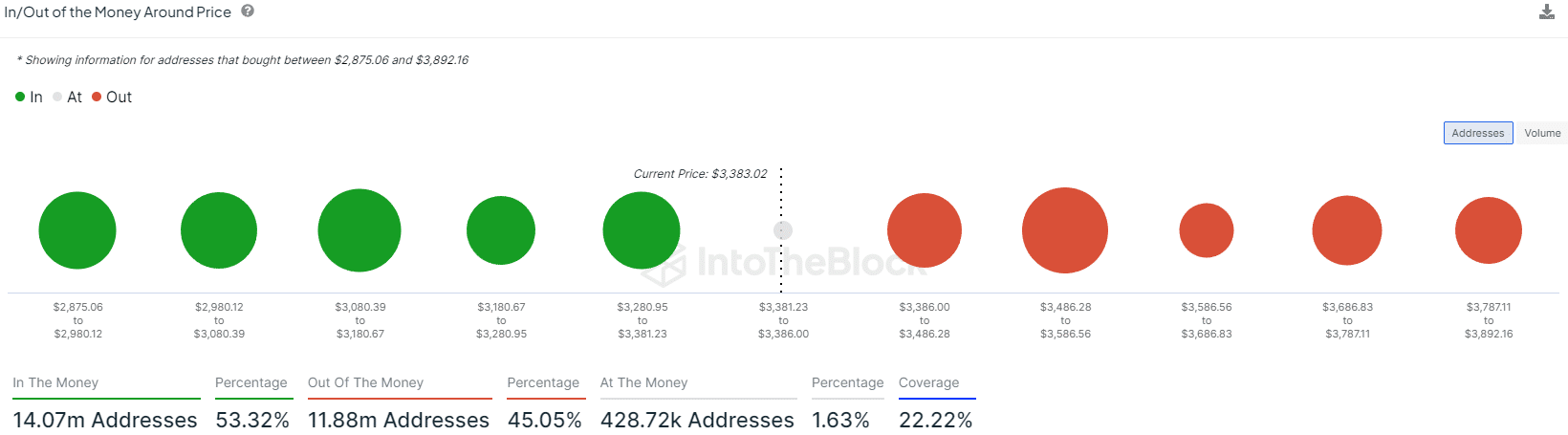

Source: IntoTheBlock

AMBCrypto’s review of IntoTheBlock’s money inflow/outflow data has highlighted key support regions.

Currency fluctuations around the price have shown that Ethereum has a strong bastion of support between $3,080 and $3,180 and between $3,280 and $3,381. Likewise, the $3,486-$3,586 area also acts as strong resistance.

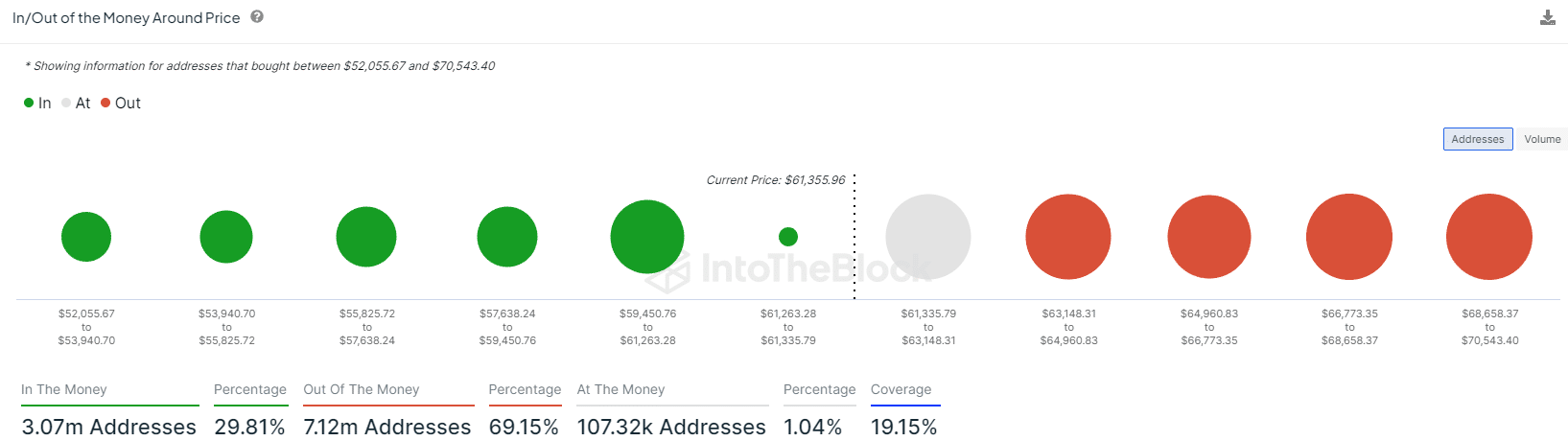

Source: In the block

Read Bitcoin (BTC) Price Prediction 2024-25

For Bitcoin, the range of $59,450 to $61,263 is support and resistance is $63,148 to $64,960.

This means that the current price consolidation of these two crypto market leaders could be limited to these levels and lead to the formation of a range.

News Source : ambcrypto.com

Gn bussni