There is an old joke in economics that the stock markets have predicted nine of the last five recessions. The point being that the prediction of a recession only based on the stock market is difficult. “They can turn on a penny. They can turn around in the blink of an eye, “said James Angel, a finance professor at Georgetown University. The main stock markets fell on April 3 and 4 after the announcement by President Donald Trump from a reference rate of 10% for imports from all foreign countries and even more for others. The markets have experienced the largest decrees of a day since the stock market crash and the recession that occurred at the start of the COVVI-19 pandemic in 2020. The markets continued to swing the following week with a few days down before Trump’s announcement. The market, in general, is known, what is in the answer, according to experts, say and are not a perfect forecast. Recession, we have to wait and see, “said Dina El Mahdy, professor of accounting at the Morgan State University, saying key indicators should be assessed over six months. However, go hand in hand. An example of this is the stock market after September 11, said El Mahdy. It was a major event that had a negative market response worldwide. “All the news, the world news, the local news can be found with a punctual shock on the market, but if it is persistent, if it has a short -term effect, it can in fact become a recession,” said El Mahdy. Other indicators have indicated the possibility of a recession. For example, JPMorgan Chase increased its chances of recession calculated by 40% to 60% after the prices are announced. For a recession, the decline is extended from about six months to two years, according to El Mahdy, but depression can last several years. References are officially defined by the National Bureau of Economic Research, a non -profit organization that focuses on research and analysis of the main economic issues. They have a committee called the economic cycle dating committee, which holds a file of commercial cycles. They define a recession as a “significant drop in economic activity that spreads in the economy and which lasts more than a few months”. Calculations take into account a certain number of indicators, in particular: the number of non -agricultural employees in industrial industrial production dates, according to data from the NBER economic cycle. More recently, this includes the recession from February to April 2020 and before that, the great recession from December 2007 to June 2009. The office identifies economic peaks and hollows. A peak is the last month of expansion, while a hollow is the low peak of the recession. The determinations of recession in the past have taken between four and 21 months, so that the Committee can award precise cutting -edge dates. Recents are cyclical events, but they actually start at the top of the economic cycle when economic activity begins to refuse. “You only really see when you see waves, when you see the rhythm of the UN.” You don’t have to wait for the official government statistics to go out and inform you that things are not as good as they were. ” These government statistics include these key data indicators for a recession. Course of a recession. does not apply is during the recession from March to November 2001; There were not two consecutive quarters of the drop in real GDP. Another major indicator is the unemployment rate. This calculation measures the number of unemployed percentage of the workforce for the 16 years and over. The workforce is all those eligible for employment, whether employed or unemployed. “But when you see the unemployment rate increasing, it is a pretty good sign that we can be in a recession,” said Angel. Other key indicators include the consumer price index and consumer confidence. Consumer confidence plays a role in the watch if there is a drop, people could reduce their economy Activity.phnjcmlwdcb0exblpsj0zxH0l2phdmfzy3jpchqipfmdw5jdglvbigpeyj1c2ugc3ryawn0ijt3Aw5kb3cuywrkrxzlbnrmaxn0zw5lcigwc2 FNZSISKGZ1BMN0AW9UKGUPE2LMKHZVAWQGMCE9PWUUZGF0YVSIZGF0YXDYXBWZXITAGPZ2H0PE3ZHCIB0PWRVRVY3VTZW50LNF1ZXJ5U2VSZWN0B3JBBGWISI MLMCMFTZSIPO2ZVCIHYXIGYXBPBIBLLMRHDGFBIMRHDGF3CMFWCGVYLWHLAWDODCJDKWZVCIHYXIGCJ0WO3I8DC5SZW5NDGGGG7CIXTPZIH0W3JDLMNRL BNRXAW5KB3C9PT1LLNVDXJJZSL0W3JDLN0EWXLLMHLAWDODD1LLMRHDGFBIMDGF3CMFWCGVYLWHLAWDCJDW2FDKKECK9FX0PKX0OTS8L3NJCMLWWD4 =

There is an old joke in economics that the stock markets have predicted nine of the last five recessions.

The point being that the prediction of a recession only based on the stock market is difficult.

“They can turn on a penny. They can turn around in the blink of an eye, “said James Angel, a finance professor at Georgetown University.

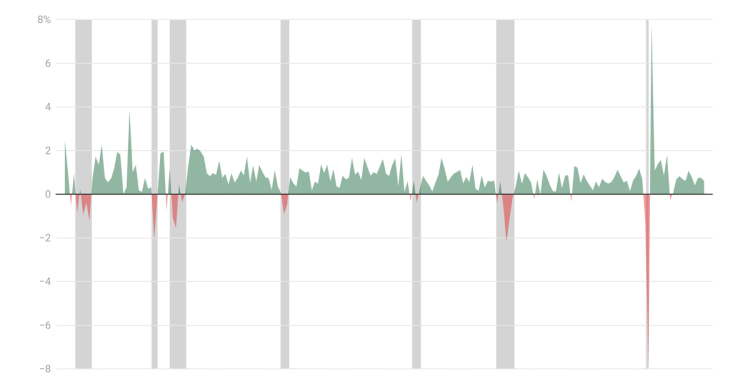

The main stock markets fell on April 3 and 4 after the announcement by President Donald Trump from a reference rate of 10% for imports from all foreign countries and even more for others. The markets have experienced the largest decrees of a day since the stock market crash and the recession that occurred at the start of the COVID-19 pandemic in 2020.

The markets continued to swing the following week with a few days down before Trump’s announcement that he stopped prices in most countries for 90 days, which raised the clues.

The market, in general, is volatile, say the experts and are not a perfect forecastist.

“We do not know if this answer will turn into recession; we will have to wait and see,” said Dina El Mahdy, professor of accounting at the Morgan State University, saying that key indicators will have to be assessed over six months.

Day by day, it is a popularity competition motivated by expectations for the benefit of the company.

“”And when the stock prices drop, it is a strong enough signal that people expect companies to earn less money. Why would they do less money? Because of a recession,“” Said Angel.

But recession and stock market accidents are not always peer, however. An example of this is the stock market after September 11, said El Mahdy. It was a major event that had a negative market response worldwide.

“All news, world news, local news can be found with a punctual shock on the market, but if they are persistent, if it has a short -term effect, it can in fact become a recession,” said El Mahdy.

Other indicators have indicated the possibility of a recession. For example, Jpmorgan Chase has increased its The calculated chances of a recession of 40% to 60% After the announcement of the prices.

References and depressions are both a decrease in economic activity. For a recession, the drop is prolonged from about six months to two years, according to El Mahdy, but depression can last several years.

References are officially defined by the National Bureau of Economic Research, a non -profit organization that focuses on research and analysis of the main economic issues. They have a committee called the economic cycle dating committee, which holds a file of commercial cycles.

They define a recession as a “significant drop in economic activity that spreads in the economy and which lasts more than a few months”. Calculations take into account a certain number of indicators, in particular:

- Number of non -agricultural employees

- Job

- Industrial production

- Real manufacturing industries and

- Real personal income

- Real personal consumption expenses

- Real gross domestic product

- Real gross interior income

- Real average of GDP and GDI

The NBER says that there is no rule defined on how the indicators are weighted, but two with the most weight are income and the number of non -agricultural employees.

There have been 34 recession to date, according to data from the NBER economic cycle. More recently, this includes the recession from February to April 2020 and before that, the great recession from December 2007 to June 2009.

The office identifies economic peaks and hollows. A peak is the last month of expansion, while a hollow is the low peak of the recession. The determinations of recession in the past have taken between four and 21 months, so that the Committee can award precise cutting -edge dates.

References are cyclical events, but they actually start at the top of the economic cycle when economic activity begins to decrease.

“You really know that it is really a recession after it has already started and has already started to get bad. When you see waves of layoffs, when you see the unemployment rate increased,” said Angel. “You don’t have to wait for official government statistics to go out and inform yourself that things are not as good as them.”

These government statistics include these key data indicators for a recession. Although there are many, economists say that two of the largest are the gross domestic product and the unemployment rate.

The gross domestic product, or GDP, is the total value of goods and services produced by the United States. Many GDP drops occur during a recession period.

A metric often mentioned is that a period of recession occurs when there is a period of two quarters where the gross domestic product, or GDP, decreases. But it is not always true.

The NBER calculations do not use this rule, explaining that most recessions have two or more quarters where GDP descends, but not all. In addition, they take into account other indicators.

An example of the rule that does not apply is during the recession from March to November 2001; There were not two consecutive districts of the drop in real GDP.

Another major indicator is the unemployment rate. This calculation measures the number of unemployed percentage of the workforce for the 16 years and over. The workforce is all those eligible for employment, whether employed or unemployed.

Unemployment rates are often the lowest just before the start of a recession.

“But when you see the unemployment rate increasing, it is a fairly good sign that we could be in recession,” said Angel.

Other key indicators include the consumer price index and consumer confidence. Consumer confidence plays a role in the watch if there is a drop, people could reduce their economic activity.