WFC Results: Wells Fargo Falls After Net Interest Income Drops

Wells Fargo Stocks (New York Stock Exchange: WFC) fell in premarket trading after the bank’s net interest income fell short of estimates. WFC’s net interest income (NII), a key measure of the revenue the bank generates from lending, fell 9% year over year to $11.9 billion in the second quarter, below the consensus estimate of $12.12 billion. The bank attributed the decline to the impact of rising interest rates on funding costs.

WFC Second Quarter Results

The bank reported diluted earnings per share of $1.33 in the second quarter, compared with $1.25 per share in the same period last year. That was above analysts’ consensus estimate of $1.29 per share.

Wells Fargo’s revenue rose 0.7% year over year to $20.7 billion, beating analysts’ expectations of $20.3 billion.

WFC Dividends and Share Buybacks

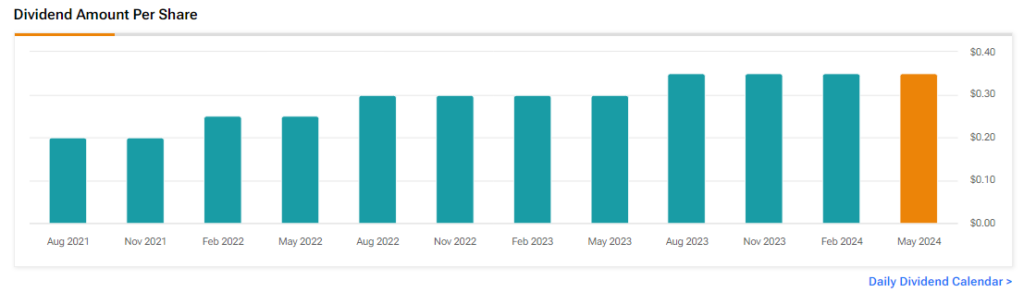

Wells Fargo repurchased $12 billion worth of stock in the first half of the year and plans to increase its third-quarter dividend by 14%. Currently, WFC offers a dividend yield of 2.3%, with a quarterly dividend of $0.35 per share, as shown in the chart below.

Is WFC Stock a Good Buy Now?

Analysts remain cautiously optimistic on WFC stock, with a Moderate Buy consensus rating based on nine Buys and nine Holds each. Over the past year, WFC has surged more than 40%, and WFC’s average price target of $63.96 implies 6.3% upside potential from current levels. These analyst ratings are subject to change following WFC’s second-quarter results today.

News Source : www.tipranks.com

Gn bussni

/cdn.vox-cdn.com/uploads/chorus_asset/file/24814379/STK450_European_Union_01.jpg?w=390&resize=390,220&ssl=1)