This is the salary you need to earn to receive the maximum Social Security benefit

A number of factors affect your Social Security benefits, and your salary is just one of them. It’s important to note that your benefit amount is not based on your last year or two of work, but on your lifetime earnings. So even if you earned a lot of money in your final years before retirement, you might not get the most. amount of the service.

Read more: 8 States to Move to if You Don’t Want to Pay Social Security Taxes

Check out: 4 Awesome Things All Rich People Do With Their Money

Here’s how to get the most Social Security benefits.

Sponsored: Protect your wealth with a Gold IRA. Enjoy the timeless appeal of gold in a Gold IRA recommended by Sean Hannity.

How Social Security benefits are calculated

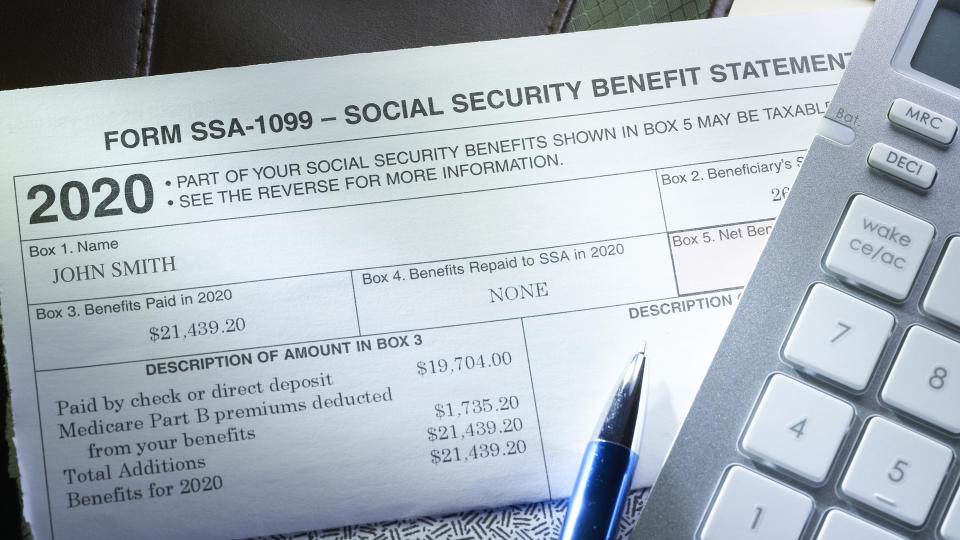

The Social Security Administration calculates your benefit amount by taking into account your lifetime earnings and then adjusting your actual earnings to account for changes in average earnings since the year the earnings were received. Your benefit is based on adjusted average monthly earnings over the 35 years in which you earned the most.

This average is fed into a formula to find the “primary insurance amount” – the amount of benefits you would receive at your full retirement age.

Check out: Suze Orman offers 5 facts about Social Security every future retiree needs to know

What salary do you need to receive the maximum benefit?

In 2024, $168,600 is the salary needed to receive the maximum benefit. The Social Security Administration takes your 35 highest-earning years and averages them (adjusted for inflation) to determine your benefit. If, using this calculation, you have paid the taxable maximum over this period, you may be entitled to the maximum benefit.

What is the maximum social security benefit?

The maximum benefit depends on your retirement age. If you retire at full retirement age in 2024 (ages 66-67, depending on the year you were born), your maximum benefit would be $3,822. However, if you retire at age 62, your maximum benefit would be $2,710. If you retire at age 70, your maximum benefit would be $4,873.

Martin Dasko contributed reporting to this article.

More from GOBankingRates

This article originally appeared on GOBankingRates.com: Here’s how much you need to earn to get the maximum Social Security benefit.

yahoo