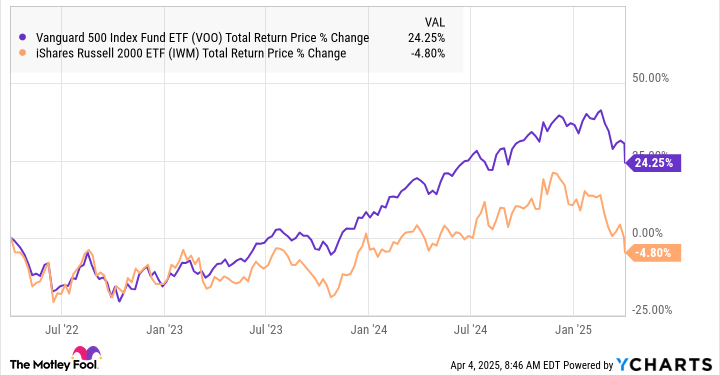

It was not a secret for anyone that the stock market has taken on a massive nose after President Donald Trump revealed his plans for “reciprocal prices”, but there are certain areas of the market that has won the news than others.

In fact, the Russell 2000which is widely considered as the most complete index of small capitalization shares, has now officially fallen into the territory of the bear market. The day after the price announcement, the index fell to a level of 22% below its recent summit, and the term markets indicate that it could be considerably lower when you read this.

Not only did the Russell 2000 considerably underperformed the wider stock market, but small capitalization shares were already a pretty cheap, compared to their high capitalization counterparts, entering 2025. Here is where things are being held with the reference to small capitalization at the moment, and why investment in Russell 2000 feedback could be a great way to create your portfolio for years of return to the market.

VOO Total Return Prix Data by Ycharts

A large evaluation gap in small caps

Small capitalization actions are negotiated with the lower evaluations compared to the S&P 500 In decades, and the gap continues to widen.

At the beginning of 2024, fund analyst Tom Lee rightly stressed that small caps have been negotiating for their lowest prices multiplied compared to large ceilings since 1999. And since that time, the gap has been considerably widened. Last year, the Russell 2000 underperformed the S&P 500 of around 14 percentage points, and it already underperformed of 6 additional percentage points this year.

The gap is a little bewildered. The average S&P 500 component is negotiated for a price / benefit ratio of 26.8, and for a price multiple / book of 4.8. On the other hand, the average component of Russell 2000 is negotiated for 17.5 times the profits and for a P / B ratio of only 1.9.

To be fair, the actions with great capitalization have increased their profits at a slightly faster rate in recent years (mainly due to the success of the actions of Megacap technology). But not enough to justify an assessment of prices in the book which is around 150% higher.

Will small caps turn?

Lee also pointed out that the last time the gap was so wide, small caps outdated large caps in the next 12 years, and a total of 113 percentage points above the S&P 500.

Of course, nothing guarantees that the same thing will happen this time. But there are good reasons to believe that small caps could be set up to surpass. For example, small capitalization shares tend to benefit more interest rate reductions, due to the generally higher dependence on borrowed money, as well as increased appetite for speculation on investors as rates on risk -free investments drop.

The expectations for rate reductions have increased significantly after pricing announcements. In fact, the median wait is now for a total of five rate drops in the federal reserve in the quarter point this year, against three expected a month ago.

To be clear, there is no way to know how long the turbulence of the current market will last, or when small ceilings could start to reduce the evaluation gap. As the last 15 months have shown, it is not because stocks of small capitals are relatively cheap that they cannot become even cheaper in the short term.

That said, Russell 2000 is one of my favorite investment opportunities for patients’ long -term investors. And you don’t need to do anything extraordinary to enjoy it. A simple index fund like the ETF Ishares Russell 2000 (Iwm -4.46%)) It could be a great way to do it.