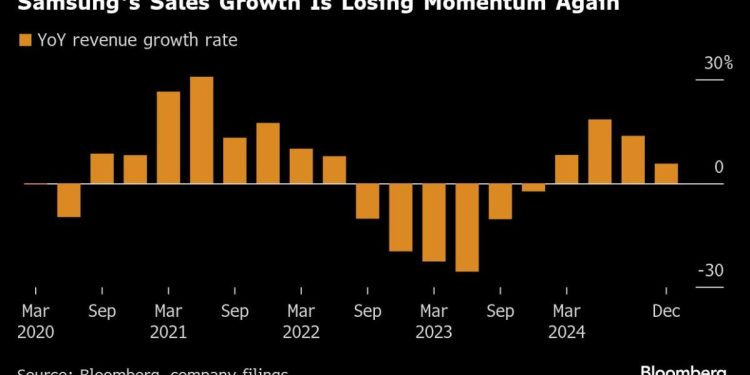

(Bloomberg) – The pivotal chip division of Samsung Electronics Co. reported a smaller profit than expected while the largest memory manufacturer in the world is fighting to restrict the main rival SK Hynix Inc. in the intelligence arena artificial.

Most of Bloomberg

Samsung increases its research and exploitation costs, managers saying that memory spending would remain high as last year. Total capital expenses reached 53.6 Won billions ($ 37 billion) in 2024.

This thrust has resulted in a long, late approval on its 8 -layer HBM3E – a less advanced variety of wide -band memory than SK Hynix provides – from Nvidia Corp. For use with AI processors adapted to the Chinese market.

But the effort, as well as the exposure to Legacy Dram, weigh on the largest company in South Korea. The semiconductor unit of Samsung declared an operating profit of 2.9 Billions of Wons for the December quarter, the average projections of missing analysts. His net income has reached a larger number of 7.58 billions of dollars, thanks to an increase in its network activity.

The share price of the largest company in South Korea fell by around 2.5% on Friday morning, the first day of negotiation in Seoul after the Lunar New Year holidays. SK Hynix’s shares fell up to 12%, in part reflecting that the low cost of Deepseek would upset the entire premise of major expenses for data centers and powerful chips.

Samsung reduces its exposure to the conventional dram and NAND for PCs and mobile devices while pursuing arenas with the upper margin of Dram and HBM server, where the “remains strong” demand, said managers. It has increased expenses in research and development and expansion of frontal capacity in its efforts to make up for SK Hynix and Micron Technology Inc., but the foundry activity will remain low, while mobile and PC demand will remain soft, have- They declared.

Its smartphones, televisions and other devices are faced with growing competition, said the company, managers citing uncertainties and current delays in economic recovery.

Investors remain concerned about Samsung’s ability to accumulate on the large bandwidth memory flea market, designed to work with NVIDIA IA accelerators. The company had trouble obtaining its latest products certified by Nvidia – offering an unusually long window for SK Hynix and Micron to carve out commanding tracks on the booming HBM market.