Eva-Kataline | E+ | Getty Images

It is a common occurrence, a fairy tale of sorts, that middle-class Americans received perpetual relief under the 2017 Tax Cuts and Jobs Act.

First, property taxes generate 32% of state and local revenue, and median property taxes on single-family homes in the United States have increased by more than 25% since 2019. There are also discrete excise taxes imposed on the sale products such as fuel. , airline tickets, tires, tobacco and other goods and services that can mitigate some of the savings from many federal tax cuts that are temporary and could disappear after 2025.

The devil is usually in the details, and clearly he’s been busy.

The provision that reduces corporate tax rates to 21% is permanent, but the qualified business income deduction enjoyed by many small businesses, as well as the increased standard deduction and favorable tax brackets, will expire at unless Congress extends these results.

Capitol Hill could very well benefit from these tax cuts, although it should be noted that it would cost $288 billion in 2026 alone, according to the Institute on Taxation and Economic Policy and $2.7 trillion in 2024 to 2033, according to the Peter G. Peterson Foundation. .

Meanwhile, Uncle Sam already has his own money problems, and 31% of the debt is expected to be held by the public, or $7.6 trillion, maturing in 2024 at much higher rates. To add context, the United States will spend more on interest than on the military this year.

Congress will be motivated to set all tax cuts in stone, but that would only add fuel to the debt fire.

What tax changes could be on the horizon

If a divided Congress fails to make amendments, old tax brackets will return after years of wage growth — meaning more of your income could hit the highest tax brackets sooner. old and the most expensive.

There’s also the once-unlimited state and local tax deduction that legislation capped at $10,000, the personal exemption that was eliminated, the deduction for unreimbursed business expenses, a moving deduction, interest on a home equity loan home deduction, a uniform deduction and a deduction for theft and catastrophic damage resulting from an environmental event which are no longer available. It is not yet known whether these provisions will be returned to taxpayers.

There is also the qualified business income deduction which provides a 20% tax break to small businesses provided they are below certain income thresholds. That deduction is about to expire, a concern that has motivated the Chamber of Commerce to lobby on behalf of its constituents. All of this adds up to crippling cost-of-living challenges from excessive government spending, a pit our Treasury should revisit to make these tax cuts permanent.

I hope Congress solves the problem or seeks a solution

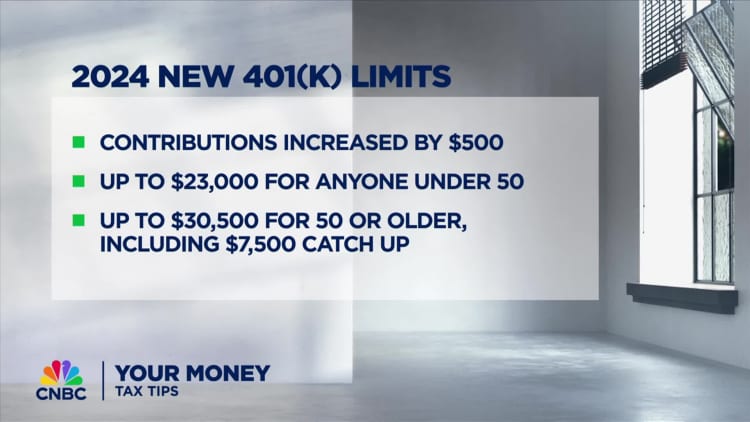

The simplest solution for ordinary Americans is to increase contributions to their pre-tax retirement plans, such as 401(k), which will reduce exposure to federal and state taxes dollar for dollar. However, once distributions are made, they will be subject to regular income tax at a time when welfare spending has accelerated, and the Treasury will have fewer workers paying more retirees.

A Roth 401(k) plan can protect against future taxes, but does little for current exposure and is subject to legislative risk from federal and state governments saddled with unfunded liabilities and pension obligations. Although political hurdles make this outcome unlikely, the math could force officials to draft legislation that would tax distributions on a means-tested basis or some other measure tailored to their tax needs.

Real estate offers some relief because you may be able to depreciate the property over its lifespan. For example, the IRS allows homeowners to deduct 3.64% of the original purchase price for 27 years. A property purchased for $500,000 therefore offers an estimated annual deduction of $18,200 to offset any income received.

Interest rates have made real estate much less attractive. But it’s worth noting that upon the owner’s death, whatever the property was worth at the time of death becomes the new cost basis – the value used to determine how much the owner can depreciate – and beneficiaries can start depreciating again at a higher rate. value for another 27 years.

Another option is permanent life insurance. Media and financial literacy experts have spent years highlighting the high commissions and fees associated with whole and universal life insurance policies.

However, upon closer inspection, these vehicles offer more than a death benefit with no income tax exposure and have a savings component that can grow tax deferred with the market.

Additionally, the policy owner can borrow money against the savings component of the policy, known as the cash value, pay no taxes, and repay the loan with the death benefit when he or she dies. Think of it as a Roth individual retirement account with no income or contribution limits that pays a death benefit when you die.

Suffice it to say, these solutions are viable for some people, but each household needs a strategy tailored to their own situation. As attractive as it may seem to reduce your tax exposure, the first call should be to your tax advisor, because if you remember, it is the nuances of this legislation that many of us have overlooked, namely the fact that the benefits for some were permanent and for others, temporary – that’s what got us into this predicament in the first place.

— By Ivory Johnson, certified financial planner and founder of Delancey Wealth Management in Washington, DC. He is also a member of the CNBC Financial Advisor Council.

cnbc