This is a story in development and will be updated throughout the day.

Google was found guilty of antitrust violations in two of the three alleged markets, following a long -awaited decision in its antitrust advertising technology battle with the Ministry of Justice.

Judge Léonie Brinkema left in part with the lawyers of the MJ ruling on Google guilty of having violated the American anti -rust laws by monopolizing the markets for the advertising servers of publishers and the exchanges of announcements, and by illegally linking his advertising server to his exchange of announcements. However, Google was not found guilty of monopolizing the advertising network market for advertisers.

Thus, with the responsibility established, the case now enters the appeal phase, with the MJ lawyers which push for the sale of its case of advertising technology.

“The court concludes that applicants have not proven that there is a relevant market for the advertising networks of the Open Web display advertiser, but has proven that Google violated section 2 of the Sherman act by acquiring and maintaining the advertising server market of the publisher’s open presentation publisher.

He continues to indicate: “(Google) illustrated his editor advertising server (DFP) and AD Exchange (ADX) in violation of sections 1 and 2 of the Sherman law.”

The trial, which heard arguments of prosecution and defense in September of last year, before a recess of one month for the closing of the remarks, then the current judgment, revealed the measures that Google was ready to take at the top of the online display advertising, including the erosion of the evidence.

For example, several internal communications from former Google employees have referred to an internal knowledge that publishers were trapped by the feedback loop created by political decisions following approval by the Federal Trade of the purchase of $ 3.1 billion in DoubleClick in 2008.

DOJ lawyers want a compulsory rupture of advertising technology from the online advertising giant, alias Google AD Manager. However, the sources consulted by Digiday compare the perspective of such a seismic movement at the opening of the Pandora box.

So what now?

The court has not yet imposed a specific appeal, but it has made an order forcing the parties to jointly propose a calendar to submit memories and have audiences on what remedies should be imposed to combat the antitrust violations of Google.

Some believe that drastic measures such as the rupture of the Google advertising technology empire remain unlikely and that more realistic results include stricter transparency requirements or partial divests.

The remedies could involve the separation of the Google announcement server from its exchange of ads to prevent the closed loop domination, although the implementation of these modifications takes years due to the deeply integrated ecosystem of Google.

Meanwhile, experts like Megan Gray from Gray Matter and Richard Kramer from Arte Research suggest turning assets of Google’s advertising technology, such as “Google Network”, in a transparent and capped entity. The defenders of this approach say that he would reduce regulatory concerns while minimizing the disturbances of publishers who depend on Google.

Google can even welcome this decision, given the weak margins of “Google Network” and high regulatory liabilities. Such resolution could appease investors of Wall Street, allowing Alphabet to focus on AI progress.

They must stop buying directly in gam and become a tenderer for auction

Anon. investigate

However, success depends on the in -depth understanding of Google systems regulators to ensure significant transparency and equity.

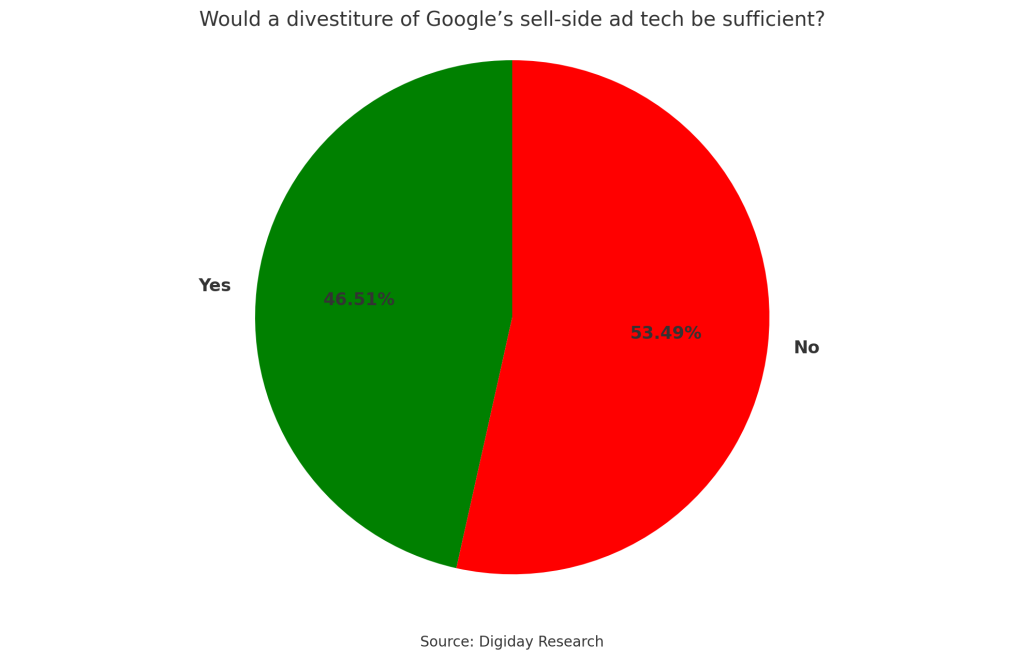

For example, in a study carried out at the start of the test in September of this year, respondents in the survey indicated a wide range of preferences as to the ideal result of the Digiday research team, with about half affirming that additional measures in addition to divestment would be necessary to remedy some of the rich in the sector.

Indeed, the potential fragmentation of such a fundamental cornerstone could affect the programmatic income of publishers; This is the extent of their dependence on the request of the advertiser facilitated by the closely woven relationship between the Google advertising server and its exchange of announcements.

“Google does not need to stop Google Ad Manager (GAM), but they should stop buying from publishers within GAM,” noted an anonymous respondent at the survey in September, adding that he should also be forced to participate in header auctions like other companies such as Magite, OpenX, Appnexus, etc.

The respondent continued to announce: “Currently, Google seems to take advantage of its dominant position to buy a priority inventory without really participating in the auctions in mind. They say they are, but it’s not reality. If they really wanted to participate, they could create their own prebid adapter for header auctions.

“However, they prefer to buy more precious impressions within Gam without participating in the auction of header tenders with others. Why would you do it?