- Cardano follows his escape model of Q3 2024. Holding above his low signal force of February 3.

- If the fractal holds, an escape of $ 2.5 in May is plausible.

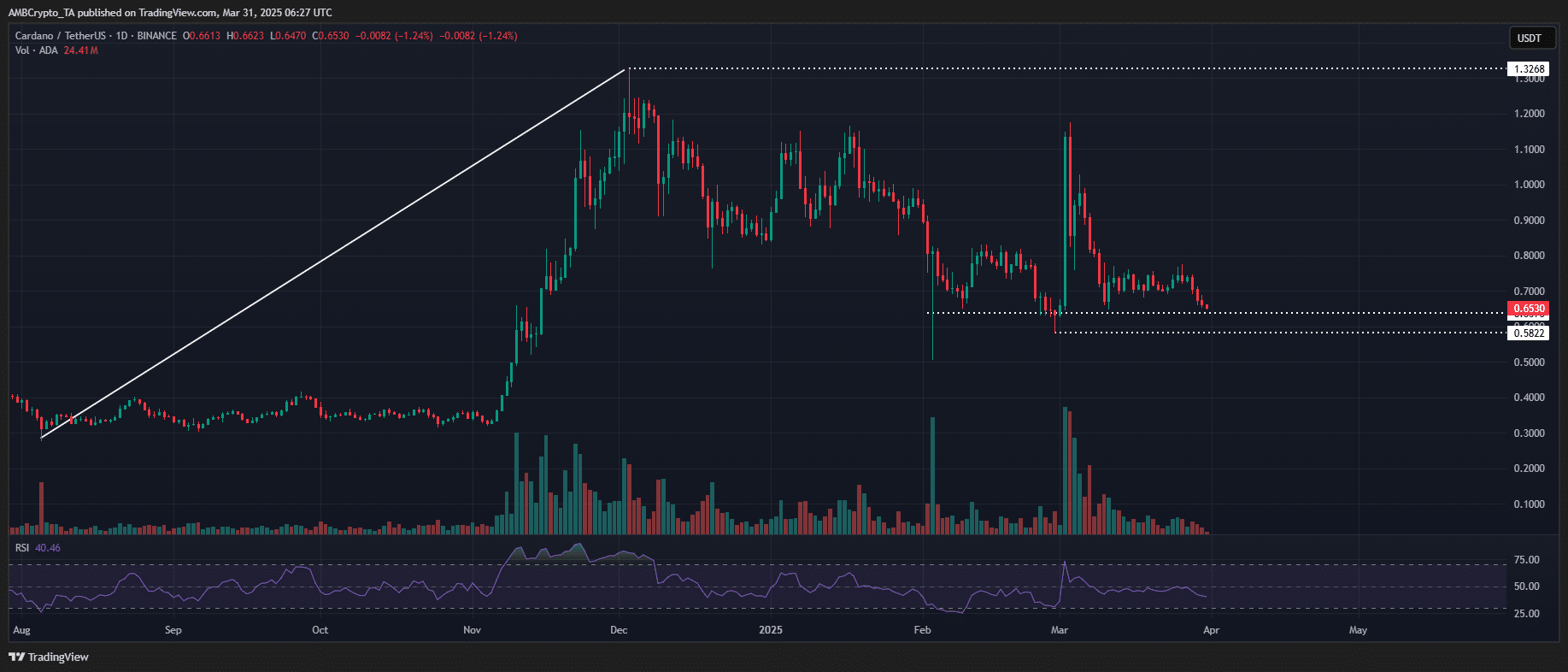

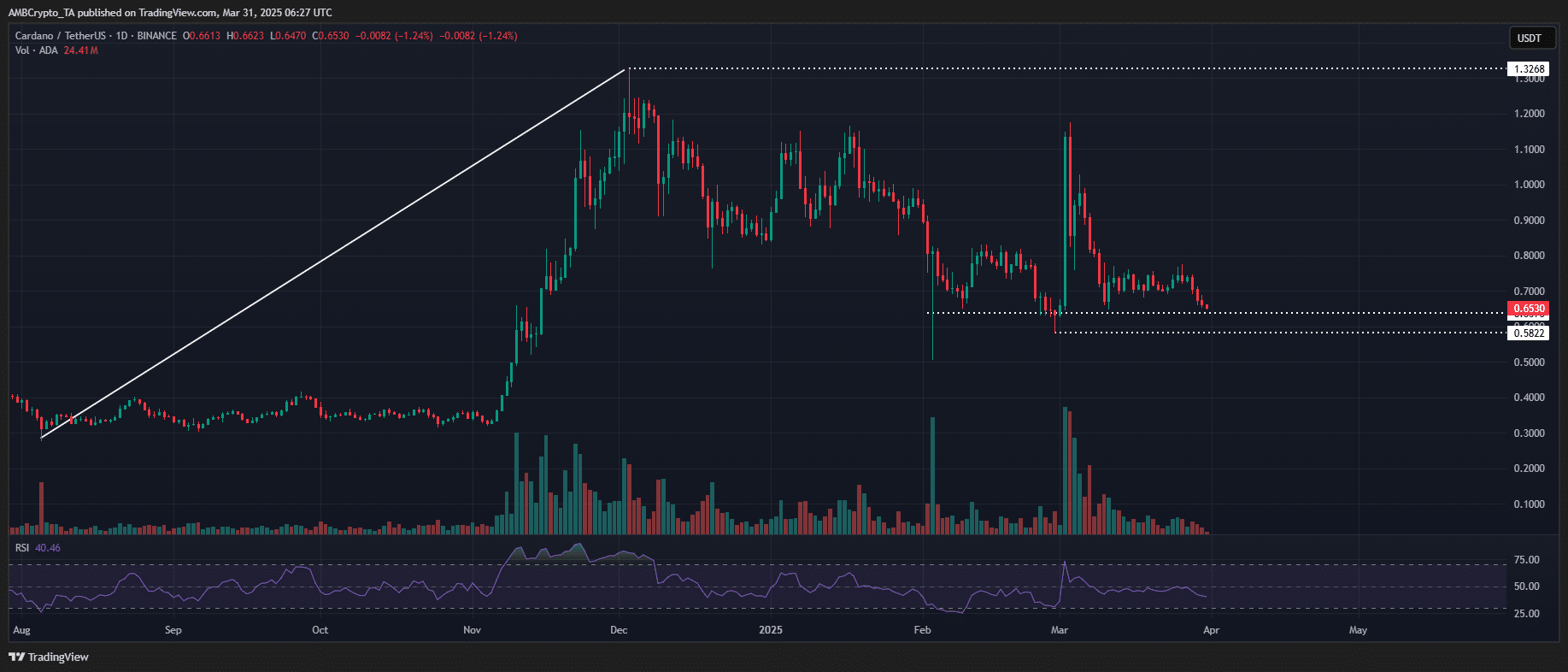

Unlike other high capitalization altcoins, Cardano (ADA) remains 96% above its pre-electoral levels. On the 1D graph, the support zone of $ 0.59 to $ 0.70 was tested three times in the last sixty days, confirming each time a strong purchase absorption.

Interestingly, this price structure closely reflects the Cardano third trimester rupture cycle, where a higher series of stockings after a key box has opened the way to its two years of $ 1.32.

Source: TradingView (ADA / USDT)

However, in the current market environment, ADA is likely to retest the support of less than $ 0.60. At the time of the press, the RSI stretched down without reaching the levels of occurrence.

This suggests discoloring the bullish momentum, which makes it more likely to put up the sale before Reaccumulation gets into play. However, a confirmed escape of Q3 style remains elusive.

Although historical models indicate a strong absorption side to buy in key liquidity areas, a decisive break above the keys resistance levels is necessary to validate the upward continuation.

Analysts speculate that if Cardano follows this trajectory, an escape around $ 2.50 could take place in T2.

Cartano Relat Rally collaborates: key levels and market structure

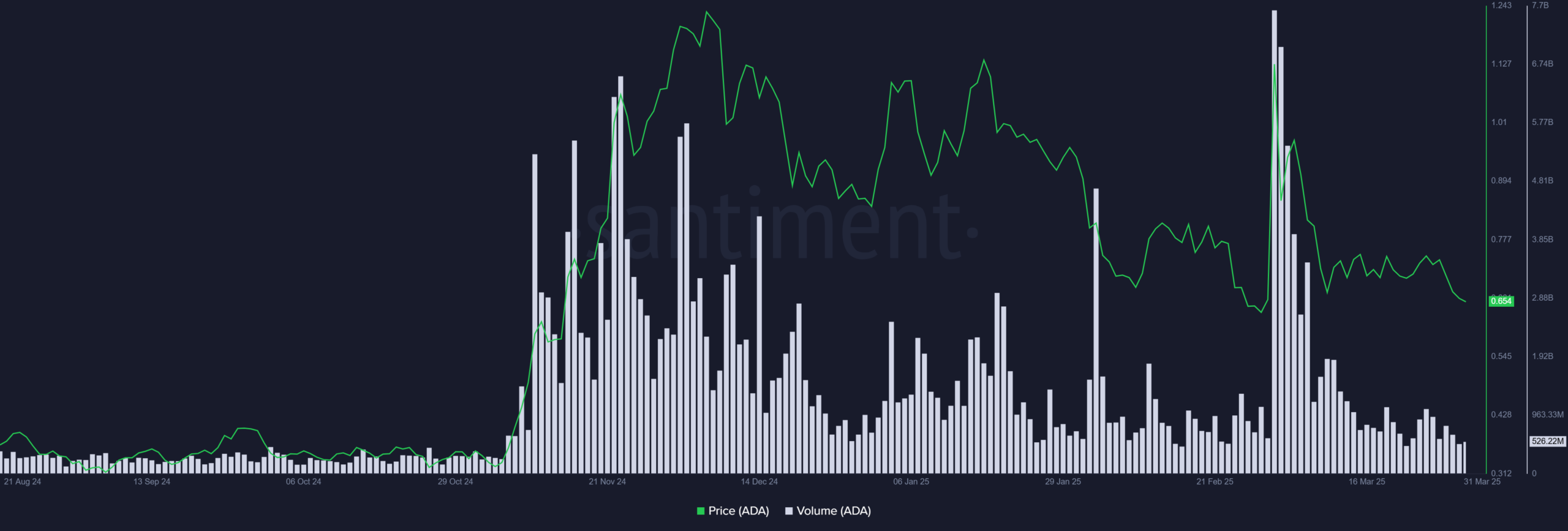

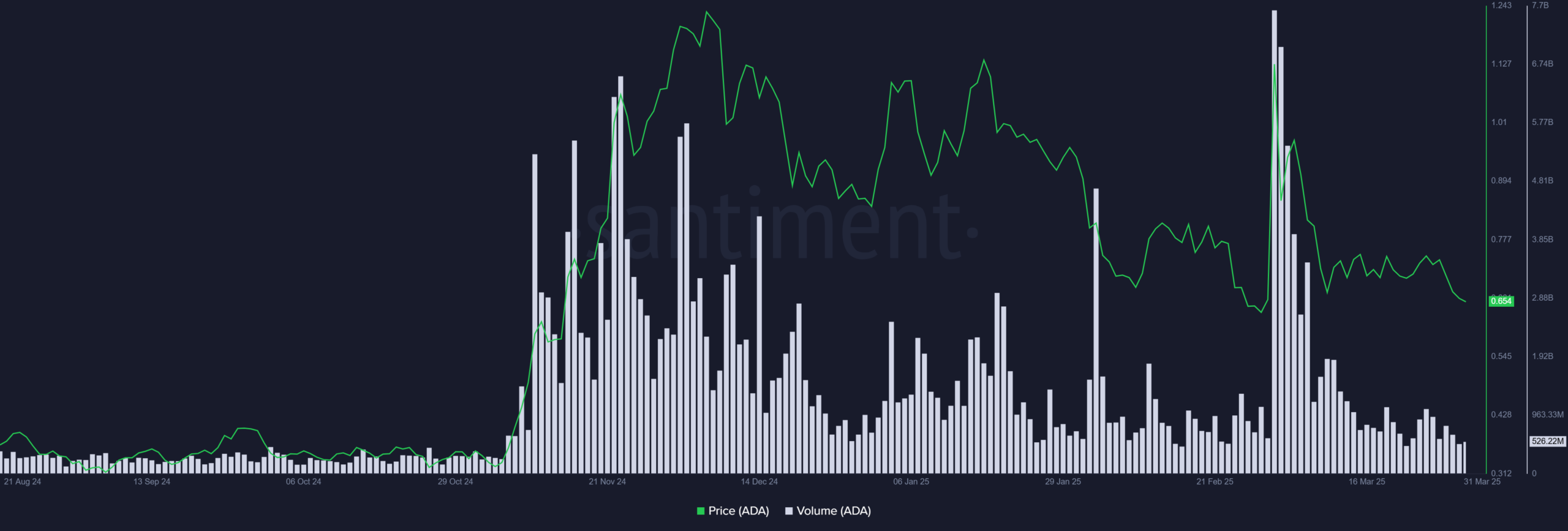

Unlike the drop in cardano on February 28 at $ 0.63, which sparked a volume peak at an annual summit of 7.36 billion, the recent drop to $ 0.65 has no similar purchase interest, with only 500 million people.

This divergence strengthens Ambcrypto’s prospects for more decline while highlighting the feeling of dominant risk.

In other words, despite a historically strong liquidity scanning, absorption side buy remains low, suggesting a lack of conviction among the bulls at current levels.

Source: Santiment

The coming sessions will play a central role in determining whether the structure of the Cardano historic market remains intact. A rebound in the application area of $ 0.60 could open the way for a short -term holding of the resistance level of $ 0.73.

Simultaneously, the ADA / BTC pair is approaching a crucial inflection point, potentially signaling an escape from its prolonged monthly decrease trend.

As Bitcoin claims that the volatility of Q2, a change in capital rotation to altcoins could strengthen ADA’s relative performance against BTC, further improving its prospects for escape.

Given the historical models, robust support levels and technical confluence, a new test of key resistance levels seems more and more plausible.

However, for Cardano to reach a Q3 style break, he must solidify his domination against Bitcoin (BTC), allowing a potential rally of 100% + to $ 2.50 in Q2 – a critical trend to observe in the coming weeks.