Ben RoiEconomic journalist

Getty Images

Getty ImagesStocks are rallying after a fraud warning from two U.S. banks sparked a worldwide sell-off.

Two regional U.S. lenders, Western Alliance Bank and Zions Bank, said Thursday they had been hit by questionable or fraudulent loans, raising fears of problems in the banking sector.

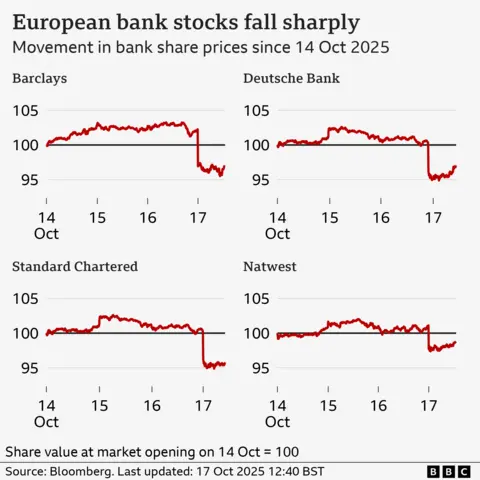

Some of Britain’s biggest banks, including Barclays and Standard Chartered, saw their share prices fall by more than 5% on Friday morning, before recovering.

The FTSE 100 index of leading shares had fallen around 1.5% at one point before regaining ground.

The US benchmark S&P 500 was up slightly in early trading after Donald Trump appeared to indicate that high tariffs (export taxes) imposed on China may not be “sustainable”.

On Thursday, Zions Bank announced it would write off a $50 million loss on two loans, while Western Alliance revealed it had filed a fraud lawsuit.

“Pockets of the US banking sector, including regional banks, have caused market concern,” said Russ Mould, chief investment officer at AJ Bell.

“Investors are starting to wonder why there have been a plethora of problems in a short period of time and whether this indicates poor risk management and lax lending standards.”

“Investors have been spooked,” he added, saying that while there was no evidence of problems with UK-listed banks, “investors often have a knee-jerk reaction when problems emerge in the sector.”

Banking stocks in Europe were also hit, with Germany’s Deutsche Bank down more than 5% and France’s Société Générale down 4%, before regaining some ground.

Asian markets fell earlier on Friday. Japan’s Nikkei index closed down 1.4% and in Hong Kong, the Hang Seng index ended the day down 2.5%.

But shares of some of the hardest-hit U.S. banks on Thursday appeared poised to regain some ground.

As of Friday morning, Zions Bank shares were up about 5%, after falling 13% on Thursday. Shares of Western Alliance Bancorp, which had fallen nearly 11%, also rose about 3%.

In an interview on Fox Business Network, the White House director of the National Economic Council called the problems a “mess” left by the Biden administration, while saying U.S. banks were well-positioned to handle the stress.

“Right now, the banking sector has sufficient reserves,” said Kevin Hassett. “We are very optimistic about our ability to stay ahead of the curve in this area.”

Investors have been nervous following the bankruptcy of two high-profile U.S. companies, auto loan company Tricolor and auto parts maker First Brands.

These failures have raised questions about the quality of transactions in the so-called private credit market, where companies take out loans from non-bank lenders.

This week, Jamie Dimon, the head of America’s largest bank JPMorgan Chase, warned that these two failures could be a sign of more to come.

“My antenna goes up when things like this happen,” he told analysts. “I probably shouldn’t say this, but when you see one cockroach, there are probably more. Everyone should be warned about this.”

There have also been warnings – including from Mr Dimon – that the boom in investment in artificial intelligence has produced a bubble in the US stock market, raising fears of overvaluation of stocks.

Market turmoil on Friday saw the price of gold hit a new record high of $4,380 an ounce, as investors sought safe havens for their money.

Another closely watched measure of market nervousness, the VIX volatility index, sometimes called the “fear index,” rose to its highest level since April.