- The hyperliquid NFT remained resilient despite the 18% drop in media threw, but adoption was a niche.

- The slow puncture at the EVM limits liquidity, which raises questions about the potential of the NFT market in the long term.

The value of the hyperliquid (media threshing) may have taken a blow of 18% this week, but the NFT market linked to the protocol seems imperturbable – or perhaps simply not interested.

With only 1.5% of users who bridge the ecosystem of the Ethereum virtual machine (EVM), the adoption remains slow.

Despite projects at an early stage like hypers and mechacats showing potential, it is too early to say if they will arise the wave – or flow with it.

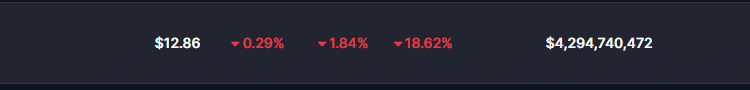

The 18% drop in threshing

The native token of hyperliquid, media threshing, faced a sharp drop, lowering 18% of value.

Source: CoinmarketCap

Despite this slowdown, the NFTs associated with the protocol, including hypers and mecats, seem largely not affected. Unlike the volatility of token prices, these collections continue to negotiate regularly.

The prices of the floor of these NFT remain intact, with hypers at 9.85 and mechacats at 10.50, suggesting a degree of resilience. However, the absence of immediate movement does not necessarily indicate a long -term force.

With only 1.5% of users transforming at the EVM, adoption remains slow, limiting liquidity and potential demand.

Traders looking at these projects must weigh the risks: while early adoption could be lucrative, the lack of deep commitment of the ecosystem presents challenges.

For the moment, hyperliquid NFTs seem to be firm, but if they are prosperous depends on a broader participation of users.

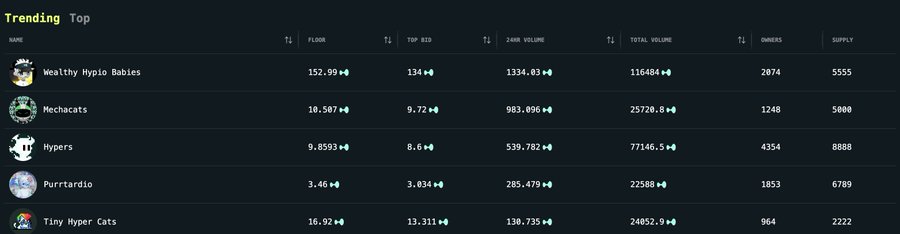

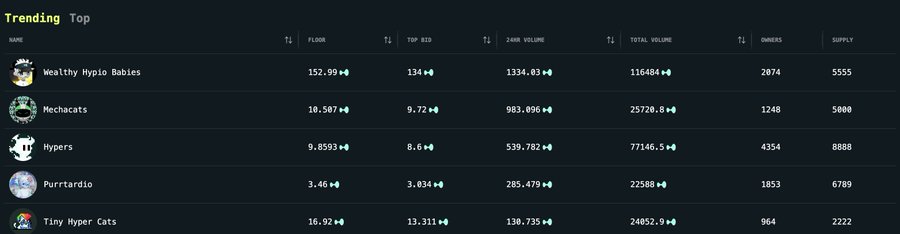

Hypers and mechacats; Why the adoption of the NFT remains niche

Hypers and mechacats are distinguished as two of the main NFT projects linked to hyperliquid, but the adoption remains niche.

Source: X

The hypers, with a total volume of 77,146, and the mecats, at 25,720, are among the most negotiated collections. However, liquidity constraints limit their growth potential.

The small fraction of users going to EVM means that demand is mainly speculative rather than motivated by utility.

In addition, the adoption of NFT on the wider market of cryptography has slowed down, many traders focusing on fungible tokens rather than non -butt.

Without further integration in the hyperliquid ecosystem or additional incentives for users to be filled, these projects risk stagnation. But the problem remains:

If the user base is not growing at a significant rate, NFT demand will find it difficult to take momentum beyond current niche investors.

The upcoming road

For the NFT hyperliquid ecosystem to flourish, a wider adoption is essential.

A key challenge remains to be met more users at EVM – without this, liquidity will remain rare, which limits the appreciation of prices for collections such as hypers and mechacats.

Incitations, whether in line, the benefits of governance or unique integrations in the hyperliquid ecosystem, could stimulate participation.

In addition, partnerships with existing NFT markets could expose these projects to a wider audience.

The global feeling of the market towards NFT will also play a role; If the sector undergoes resurgence, digital hyperliquidal assets could see a renewal of interest.

However, if the ecosystem does not develop, current investors can deal with reduced yields.

For the moment, NFT hyperliquids remain a speculative game with potential – the one that depends on the wider commitment of users and strategic development in the protocol.