A Tesla car drives past a store of the electric vehicle (EV) maker in Beijing, China, January 4, 2024.

Florence Lo | Reuters

It was a brutal first quarter for You’re here investors.

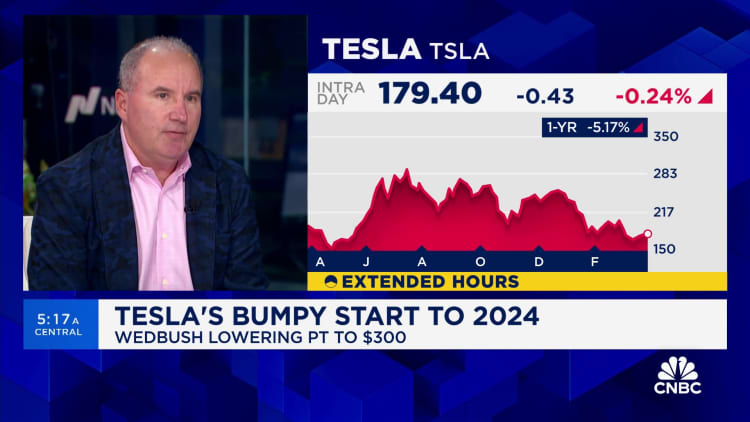

Shares of the electric vehicle maker plunged 29% in the first three months of the year, the worst quarter for the stock since late 2022 and the third worst since Tesla’s IPO in 2010. It s It is also the biggest loser in the S&P 500.

Wall Street’s main concern is Tesla’s core business. The company is set to announce first-quarter vehicle production and deliveries in the coming days, and even the most optimistic expect mediocre results, despite price cuts and incentives for buyers who were suspended throughout the quarter.

As of Thursday, the last trading day of the quarter, analysts were expecting about 457,000 deliveries for the period, according to the average of 11 analyst estimates compiled by FactSet. This would represent an increase of 8% from the 422,875 recorded a year earlier. Estimates for the quarter ranged from 414,000 to 511,000 deliveries.

Analysts who updated their figures in March were the most pessimistic, with estimates ranging from 414,000 to 469,000. Independent auto industry researcher “Troy Teslike” expects deliveries of the company are lower than even the lowest estimate collected by FactSet.

Deliveries are the closest approximation of Tesla’s reported sales, but are not precisely defined in the company’s shareholder communications.

Here are four major reasons for Tesla’s decline in the first quarter.

Relentless competition in China

In China, there is competition from a wave of fully electric vehicles, including new models that cost less than Tesla’s popular Model Y SUV and Model 3 sedan.

Chinese smartphone company Xiaomi is getting into the game with its first vehicle, an all-electric SUV that costs significantly less than Tesla’s entry-level Model 3 sedan. Xiaomi CEO Lei Jun said the standard version of the SU7 would sell for the equivalent of $30,408 in China, a price he said would mean the company would lose money on every sale. Tesla’s Model 3 costs about $4,000 more than that.

In response, Tesla reduced prices, but sales remained slow.

According to data from the China Passenger Car Association, Tesla sold 71,447 of its China-made cars in January, with 39,881 sold domestically, down from December. The numbers fell further in February to 60,365 Teslas manufactured in China, including exports.

As sales declined, Tesla reduced production at its Shanghai factory, reducing staff from six and a half days to five days a week, Bloomberg first reported.

Tesla didn’t give a forecast for 2024 during its January earnings call, but analysts see Tesla’s struggles in China as a harbinger of a tough quarter, if not a full year.

Deutsche Bank analyst Emmanuel Rosner lowered his price target on Tesla this week, citing weaker-than-expected sales in China and the company’s recent plan to cut production in the region. Rosner now expects Tesla to report deliveries of 414,000 for the first three months of 2024, and forecasts only single-digit growth for Tesla’s year.

Red Sea attacks and militant clashes in Europe

There were also tragedies in Europe.

Tesla and other manufacturers like Volvo suspended part of their production on the continent in January due to a shortage of components following attacks on shippers in the Red Sea. Attacks by Iran-backed Houthi militias continued to disrupt one of the world’s busiest roads.

Elon Musk, CEO of Tesla Inc., arrives at the Tesla factory in Gruenheide, Germany, March 13, 2024.

Krisztien Bocsi | Bloomberg | Getty Images

Then, in March, there was a dramatic protest by environmentalists in Germany. Opposing Tesla’s plans to expand the footprint of its car and battery factory in Brandenburg, outside Berlin, protesters set fire to electrical infrastructure near the Tesla factory. Although the fire did not spread to the factory, it left the facility without sufficient electricity to operate, forcing a temporary suspension of production.

CEO Elon Musk visited the German factory after the attack to reassure employees. He also called the protest “extremely stupid.” Tesla policy chief Rohan Patel wrote on a culture of doing the right thing in our community. “.

Meanwhile, in the Nordic countries, Tesla service technicians and other workers went on strike in support of the Swedish union IF Metall. The union group has been pressuring Tesla since October 2023 to negotiate and sign a collective agreement with its workers.

The IF Metall website states that nine out of ten workers are unionized in Sweden. Yet Tesla resisted unions, as it regularly does in the United States, and rebuffed IF Metall’s bargaining efforts.

Aging range, debut for Cybertruck

Even though electric vehicle sales continue to gain popularity around the world, their growth rate has slowed. And as Tesla is no longer the dominant player, each new product becomes more crucial. There’s not much in the hopper.

The Cybertruck is still in its infancy and is aimed at a niche audience. The company began delivering the angular, unpainted steel model of the truck in December at a promotional event in Austin, Texas.

Musk previously said during an earnings conference call that Tesla “dug its own grave,” with the sci-fi-inspired Cybertruck. In an interview with Tesla fan and auto critic Sandy Munro in late 2023, Musk warned that the “Cybertruck is not something that will have a big impact on Tesla’s finances” in 2024, and “probably will in 2025”.

A Tesla Cybertruck at a Tesla store in San Jose, California on November 28, 2023.

Bloomberg | Bloomberg | Getty Images

Tesla is preparing production of its refreshed Model 3, known as the Highland, in Fremont, California. Larry Magid of Forbes wrote: “Visually, the exterior changes are subtle. » He also didn’t like Tesla’s controversial decision to omit the “stalks” on the sides of the steering wheel. Highland drivers use buttons and on-screen controls to shift from drive to reverse and park or to signal a turn or lane change.

Tesla has an all-new platform in the works, a more affordable electric vehicle that fans are calling the “Model 2.” But it won’t be delivered to customers for years.

Musk control and controversy

Musk has continued to bet that Tesla’s customers and shareholders will remain loyal to the company, despite his increasingly inflammatory rhetoric about X and beyond.

Earlier this month, Musk met with the former president Donald Trump in Florida. He called for a “red wave” during the upcoming US elections, and he shared, liked or promoted far-right accounts and content on X, where he now has 178.8 million followers. from Haiti are cannibals.

Musk’s political ideology is at odds with the groups of people most likely to buy his products. Supporters of electric vehicles tend to be ideologically left-leaning, according to a study by Pew Research and Gallup last year.

Musk also bet that Tesla shareholders and its board of directors would follow his lead. In February, Musk said he would seek a shareholder vote to move Tesla’s Texas incorporation site from Delaware, after a Delaware judge overturned the $56 billion pay package he had been given. granted in 2019 on the grounds that the board of directors had failed to prove “the compensation plan was fair.

Before the decision, Musk began lobbying Tesla shareholders and board of directors to give him more control over the electric vehicle maker.

“I am not comfortable making Tesla a leader in AI and robotics without having approximately 25% voting control,” Musk wrote in a post in January.

Investor Ross Gerber, a longtime Tesla bull, called the request the equivalent of “blackmail” in an interview with CNBC.

Bears clean up

All of this represents a market capitalization loss of more than $230 billion for Tesla and its shareholders from the start of the calendar through 2024. This made for a very lucrative quarter for short sellers, who were expecting such a slow-down.

According to data from S3 Partners, Tesla shorts are up more than $5.77 billion in 2024, making it the most profitable name in the United States. Short interest at the end of trading Thursday was about 3.76% of the float, representing $18.71 billion in notional value.

Brad Gerstner of Altimeter Capital is buy the dip. Gerstner told CNBC this week that the company is now making “massive progress at an accelerating pace” in its self-driving technology efforts.

Musk has been making such statements for years. In 2015, he told shareholders that by 2018, Tesla cars would achieve “full autonomy” and be able to drive themselves. In 2016, he said Tesla would be able to send one of its cars on a cross-country trip without requiring any human intervention by the end of the following year.

Tesla has yet to deliver a robo-taxi, autonomous vehicle, or technology capable of transforming its cars into “Level 3” automated vehicles. However, Tesla offers advanced driver assistance systems (ADAS), including a standard Autopilot option or a premium Full Self-Driving “FSD” option, the latter of which costs $199 per month for subscribers in the United States. United or $12,000 up front.

In an effort to secure end-of-quarter sales, Musk recently required all sales and service personnel to install and demonstrate FSD for customers before handing over their cars. He wrote in an email to employees: “Almost no one realizes how well (supervised) FSD actually works. I know this will slow down the delivery process, but it is a strict requirement nonetheless.

Despite its name, Tesla’s premium option requires a human driver behind the wheel, ready to steer or brake at a moment’s notice.

WATCH: Tesla is going through a “code red situation”

cnbc