TD: The most important data print of the year

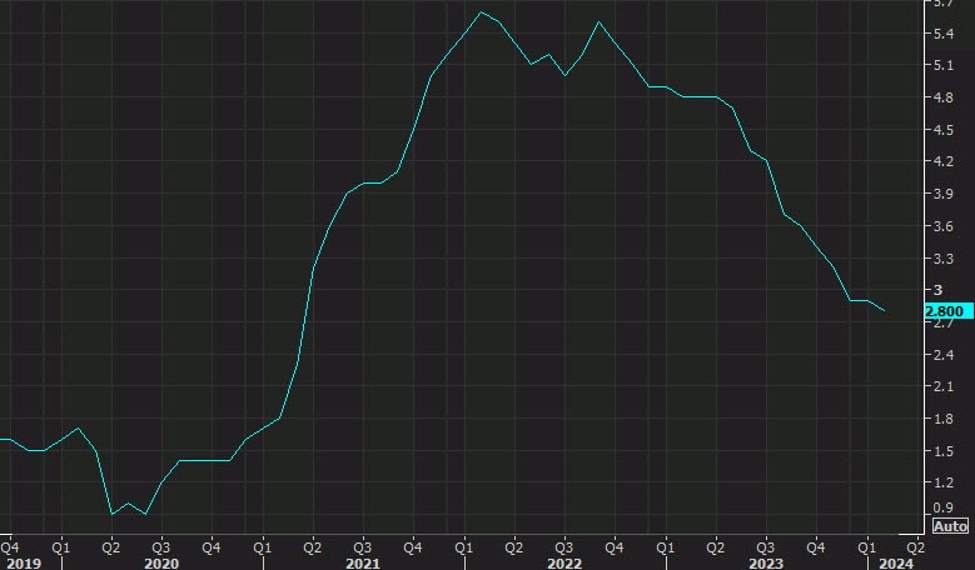

Basic PCE in the United States aa

TD Securities highlights the importance of Friday’s core PCE data, considering it key in shaping market expectations and movements in 2024. Amid fluctuating market sentiments and various economic indicators, this release is expected to be a determinant crucial to future monetary policy and currency valuations.

Key points:

-

Importance of basic PCE data: TD Securities says this week’s headline PCE reading could be one of the most crucial data releases of the year, potentially setting the stage for monetary policy direction and market movements for the rest of the year.

-

Uncertainty and market sentiment: Recent discussions with clients across Europe reveal a general lack of conviction about current market directions, although there is consensus that a significant pivot point could be near. This sentiment is reflected in the market’s mixed reactions to various economic indicators such as growth divergences, risk correlations and central bank policies.

-

Influence on USD and risk assets: Core PCE data is particularly crucial because it directly influences inflation perceptions and, therefore, the Fed’s rate decisions. A result in line with expectations of slowing inflation could support a moderate reversal in dollar strength in the third quarter, benefiting risky assets and potentially realigning the Fed’s rate expectations with those of other G10 central banks.

-

Implications of unexpectedly high inflation: Conversely, a higher-than-expected inflation reading could diminish the Fed’s rate cut prospects this year, likely leading to further dollar appreciation and negative impacts on risk assets. This scenario would strengthen the dollar’s strength due to persistent inflation and divergent central bank policies.

Conclusion:

The next core PCE figure is crucial in determining short- and medium-term market dynamics and central bank actions. Investors and traders should prepare for potential volatility following this release, as it could significantly influence market sentiment and strategic positioning. The outcome could either confirm a trajectory toward easing monetary conditions or signal the continuation of restrictive policies driven by persistent inflationary pressures.

For banking transaction ideas, check out eFX Plus. For a limited time, get a 7-day free trial, basic at $79 per month and premium at $109 per month. Get it here.

cnbctv18-forexlive