Startups Weekly: Let’s see what those Y Combinator kids have been up to this time

Welcome to Startups Weekly — your weekly recap of everything you can’t miss from the startup world. Sign up here to receive the Startups Weekly newsletter in your inboxes.

It’s the most wonderful time of the year… That’s right, we’re back with all the can’t-miss companies from the current crop of Y Combinator startups. AI was, unsurprisingly, the biggest theme, with 86 out of 247 companies calling themselves AI startups, but we’re reaching bubble territory given that 187 of them mention AI in their presentations . We’ve got some recaps for you, including the 18 most interesting and TechCrunch staff’s favorites.

Meanwhile, I wrote an in-depth interview with the founder of Ember, the flagship company, about (among other things) how he split his company in two so he could woo medtech and science investors of life.

Most interesting startup stories of the week

Image credits: PM Images (Opens in a new window) /Getty Images

Startups losing money is nothing new, but this week, Devin summarizes why Trump’s Social Truth is different in several key ways. In a nutshell, this whole thing plays out like a bad reality TV show, where the plot revolves around hemorrhaging money and the suspense is whether she’ll run out of money before viewers change the channel . Debuting on the Nasdaq as $DJT, thanks to a merger with the desperate darling of the financial world, the lifting of the financial veil of a SPAC, Trump Media & Technology Group (TMTG), reveals a loss of 58 million dollars on a meager turnover of 4 million dollars. . This isn’t the typical Silicon Valley “burn money now, profit later” saga; it’s more of a “burn the money now, and that’s it” kind of story. Unlike startups that thrive on vital venture capital support while disrupting industries, TMTG’s lifelines are fraying, with no explosive user growth, no venture capital sugar daddies, and little stance. enviable to be publicly accountable while trying to juggle a business model that seems to repel advertisers as it does. made of antimatter. As stock prices collapse, reality sets in: TMTG’s story may be less about pioneering digital media and more about losing friends and alienating advertisers, while the credits roll on what might be the most expensive episode of “The Apprentice.” never produced.

- IPOs are getting bigger…maybe?: Cybersecurity darling Rubrik, who has been gorging on venture capital like it’s going out of style, has decided it’s time to brave the public markets and file for an IPO. With a history of bleeding money, Rubrik’s story is one of modest revenue growth, staggering losses, and a pivot to subscription models as revolutionary as the decision to sell software as service in the world of technology.

- Accel rethinks India: Accel, the venture capital firm that collects Indian unicorns as if they were going out of fashion, is going through a bit of an existential crisis with its Atoms accelerator program, realizing that in the eyes of the founders, all the capital’s money- risk finally starts to look bad. the same thing – just a pile of money with strings attached.

- Is crypto back?:If the 2023 crypto business landscape was a pot of ice water, the first quarter of 2024 is the part where the bubbles start to form just before the water boils, said Tom Schmidt, partner at Dragonfly Capital , at TechCrunch in Jacquelyn’s preview. of the VC investment space for crypto.

Chaos in the land of automotive startups

Tesla’s cybertruck now exists. That’s about the best thing your friendly correspondent can say about this design monstrosity. Image credits: Darrell Etherington/Getty

Stormy weather continues to be the theme for those in the startup world: transportation.

Canoo’s 2023 results report reads like a tragicomedy. The star of the show? CEO Tony Aquila’s private jet, which cost the company double its total revenue for the year. In a year when Canoo managed to raise a paltry $890,000 by delivering just 22 vehicles, it simultaneously shelled out $1.7 million to ensure Aquila could fly in style. I guess in the fast-paced world of electric vehicles, nothing says “fiscal responsibility” like a private jet tab that eclipses your sales, even if the company chooses to clean the bones of its failing competitors.

Meanwhile, back in Fisker land, the company momentarily lost millions in customer payments amid a frenzied rush to restructure its business model. This financial game of hide and seek, which diverted crucial resources from sales to research, highlights the company’s rather casual approach to tracking transactions, including, in some cases, vehicle surrenders according to the honor system. Fisker’s attempt to catch up on paperwork not only strained its relationship with PwC during the preparation of the annual report, but also left the company with no idea of its actual revenues, while being at on the verge of bankruptcy. So if you’ve ever felt bad about losing your car keys, at least take comfort in knowing that you didn’t misplace an entire SUV’s worth of dollar bills, or throw you in an investigation into why the doors of the cars you make won’t open.

- Autonomous driving…into the abyss: Ghost Autonomy, a startup that once dreamed of making highways safer with its self-driving software, has ghosted the auto world, shutting down operations despite a nearly $220 million session with investors.

- Captivating reading from Rivian: Rivian’s latest bulletin sounds more like a cry for help than a victory lap. The electric vehicle underdog kicked off 2024 by building fewer cars and delivering even fewer. With every electric vehicle sold last quarter costing them the equivalent in losses of a luxury sedan, Rivian’s path to profitability seems… interesting.

- Tesla takes a dive: Tesla’s latest delivery figures are poor, as the company blames everything from arsonists in a vendetta against German factories to maritime chaos caused by Houthi rebels for its first year-over-year sales decline in three years. As if the transition to the new Model 3 wasn’t enough of a speed bump, Tesla is also juggling producing the Cybertruck and a mysterious lower-cost electric vehicle while trying to invent a revolutionary manufacturing process on the fly .

The most interesting fundraisers this week

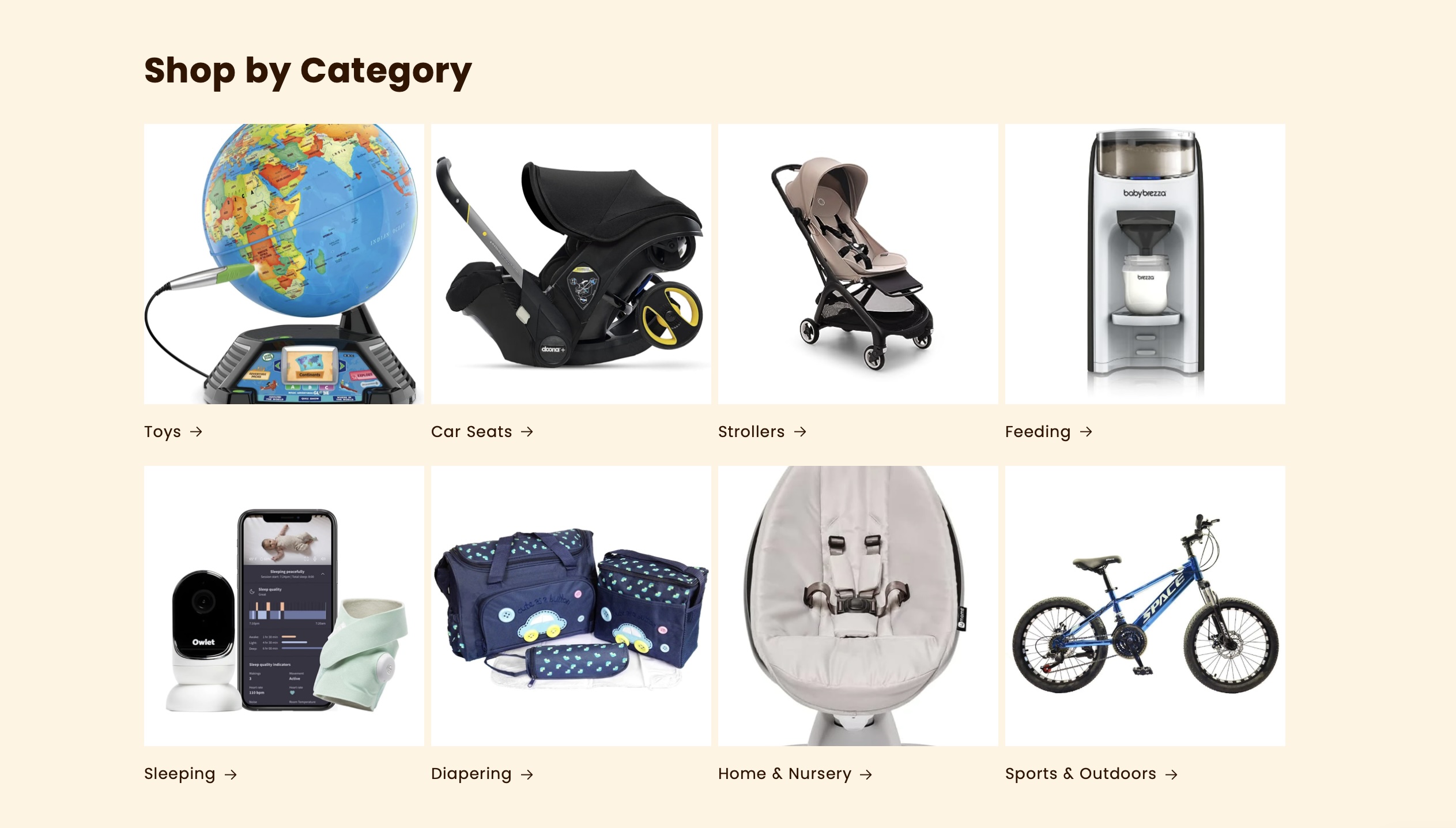

Kidsy’s catalog has attracted the interest of investors. Image credits: Childish

Kidsy is the latest idea from the startup incubator. The company is essentially the TJ Maxx of baby gear, stepping in to save parents from the financial black hole of raising their children by offering discounted, overstocked and gently used items that were once destined for the landfill. Founded by a former business journalist and a software engineer, Kidsy quickly became the circular economy superhero for baby products, managing to charm investors into an “oversubscribed” pre-seed funding round faster than ‘a young child cannot throw a tantrum.

- A sticky startup indeed: Stripe, the payments giant, faded to a four-person startup named Supaglue, formerly known as Supergrain, in a classic story of buy-and-rent romance. Supaglue somehow caught Stripe’s attention – perhaps through the technological equivalent of a love potion mixed with mutual acquaintances and chance encounters.

- Google grants $20 million to nonprofits: Google.org is investing $20 million in nonprofits to act as the fairy godmother of their AI dreams. Twenty-one lucky nonprofits become guinea pigs for a six-month tech boot camp, complete with AI coaches and Google employees, all with the aim of making the world a better place – an automated task at a time.

- Blah blah blah something something cars: From its humble beginnings as an online hitchhiking platform to becoming a unicorn with a penchant for accumulating millions and splashing around on buses, BlaBlaCar has had quite a journey. Now armed with a $108 million line of credit and a new taste for profitability, she embarks on a small business shopping spree.

Other must-read TechCrunch stories…

Every week there are always a few stories I want to share with you that somehow don’t fit into the above categories. It would be a shame if you missed them, so here’s a bag of random goodies for you:

- No account required: OpenAI, in a move that screams “data is the new gold”, now allows anyone to chat with ChatGPT without an account, ensuring that even your grandmother’s queries about knitting patterns can help train its AI, while vaguely alluding to “more restrictive knitting patterns”. content policies” that are as clear as mud.

- I’m just doing stupid things: Bumble, once the belle of the IPO ball, now finds itself grappling with the modern dating dilemma: being ghosted by users for TikTok love stories. New CEO Lidiane Jones is on a mission to rekindle the flame by rethinking the mantra of the first women’s movement and flirting with AI, while trying to make dating fun again without actually changing the swipe-right culture.

- Hey, that’s a good impression of me: OpenAI is basically saying “Hold my beer” by diving headfirst into the ethical quagmire of voice cloning with its new voice engine. The company insists this is responsible innovation while opening Pandora’s box to see how it can be used and abused. We can’t think of a single downside.…

- B cancels the AI: Beyoncé’s “Cowboy Carter” was only released a few days ago. But midway through the press release for “Cowboy Carter,” the singer made an unexpected statement against the growing presence of AI in music.

techcrunch

/cdn.vox-cdn.com/uploads/chorus_asset/file/24390407/STK149_AI_02.jpg?w=390&resize=390,220&ssl=1)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24401980/STK071_ACastro_apple_0003.jpg?w=390&resize=390,220&ssl=1)