In recent years, Nvidia (NVDA -4.10%)) Benefiting enormously from increased investment in chips for artificial intelligence (AI), but the news of China means that investors wonder if the high value of the action is worth it before potential risks for investments Massifs that large technological companies have devoted to the infrastructure of the data center.

We will examine the potential traps for Nvidia during the new year, before considering why Advanced micro-apparents (AMD 2.79%)) could be a better purchase right now.

Growth begins to slow down

When Openai published Chatgpt in 2022, companies began to spend billions of GPU to train AI models. Nvidia led the graphics processing units (GPU) market, it was the right company at the right time to provide monster yields to investors.

In 2023, the income and the course of NVIDIA’s action has skyrocketed. In two years, he has become a very large company with a turnover of $ 113 billion. This will naturally become more difficult to continue to grow at high rates with such large income figures.

Analysts always expect income to increase by 52% in the calendar 2025, according to Yahoo! Finance – About half of the rate it has provided in the past year. A risk that could ensure that the company does not respect these estimates is the constraints of supply chain limiting the production of its new Blackwell IT platform, which is starting to ship this quarter.

Nvidia has declared a solid request for its H200, which could take over until Blackwell returned to the game. But investors must be aware that Nvidia needs operators of data centers to continue to spend more Money every year to sell more tokens, and there are questions about how these expenses will be sustainable in the coming years.

Could China Deepseek be the catalyst for less expenses?

Deepseek in China claims that its AI model can occur equally with the best models of Aimle IA companies, including the OpenAi Chatppt, but the taking is that it costs less than $ 6 million to develop, this which is incredibly cheap in the world of AI research. Although there are analysts who raise doubts about the claims of the start-up, investors fear that large technological companies can start to look for ways to do more with less, as Deepseek has claimed. Since NVIDIA is the main GPU supplier for data centers, lower expenses would have a direct impact on Nvidia’s growth.

The data centers market has previously experienced growth cycles that harm Nvidia activities and have sent the stock a few times over the past 10 years. Large technological companies have spent billions in data centers in recent years, and there has been too much investment risk leading to an excess computer capacity. This boom could lead to a corresponding slowdown in expenditure in the data center, which would harm the Nvidia background line.

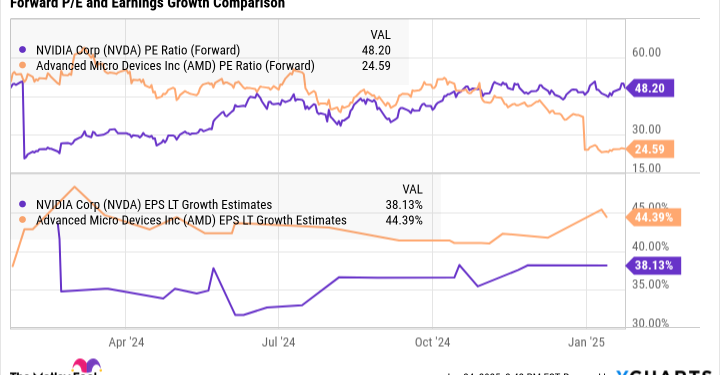

Everything said, everything must go to the right to justify the evaluation of the action, which, even after the recent drop in the new Deepseek, always costs a multiple term price (p / e) of 42. However , investors do not do so must take this risk when the competitor of the NVIDIA GPU is negotiated with a much lower assessment.

More growth for half the price

AMD Stock has returned almost 5,000% in the past 10 years and has more than doubled in the last five. The stock is negotiated at a lower P / E than Nvidia but offers a comparable growth potential based on analyst estimates. It faces the same risk that NVIDIA, but AMD revenues of the GPUs of the data center should total only 20% of its total income this year. In addition, the lower valuation of the stock offers better risk / reward ratio.

Ycharts data; PE = price for the benefit, BPA = profit per share.

There is an advantage for AMD which could give it an advantage on Nvidia, and it is the emphasis put by the company on the design of its GPU for the IA inference. AI training helps models to digest data mountains; Inference is the process that allows AI models to process new information and make decisions in real time, which is essential for autonomous cars and AI agents.

AMD’s Mi300X chip was used by Microsoft For his Cloud Azure company, but the flea manufacturer claims that his new MI325X version offers up to 20% higher performance for IA inference than Nvidia H200.

AMD could be in a solid position to see enormous growth for its data center GPUs in the coming years, and investors can buy the action at only 24 times the estimate of this year’s profits. This represents almost half of the profits that several investors pay for NVIDIA shares, but analysts expect AMD profits to increase by more than 44% per year in the coming years – more than 38% , they expect Nvidia’s benefits to increase per year.

Given the high expectations integrated during NVIDIA’s action before short -term risks that could send the stock declining, AMD shares seem a better bet. If the data centers continue their rapid investment rate in AI equipment, AMD could surpass its first rival. But if the expenditure of the GPU data center slows down, the Multiple P / E Lower AMD will soften the blow, while the company could always see strong growth in other chip products, including the units of Central treatment (CPU) for PCs.

John Ballard has positions in advanced micro-apparently and Nvidia. The Motley Fool has positions and recommends micro advanced devices, Microsoft and Nvidia. The Motley Fool recommends the following options: Long January 2026 Calls $ 395 on Microsoft and Court January 2026 405 $ calls Microsoft. The Motley Fool has a policy of disclosure.