In 2024, African stock markets have demonstrated their resilience and attractiveness for international investors. Ghana, in particular, emerged as leader, followed by Ivory Coast and Nigeria. A look back at these performances and the outlook for 2025.

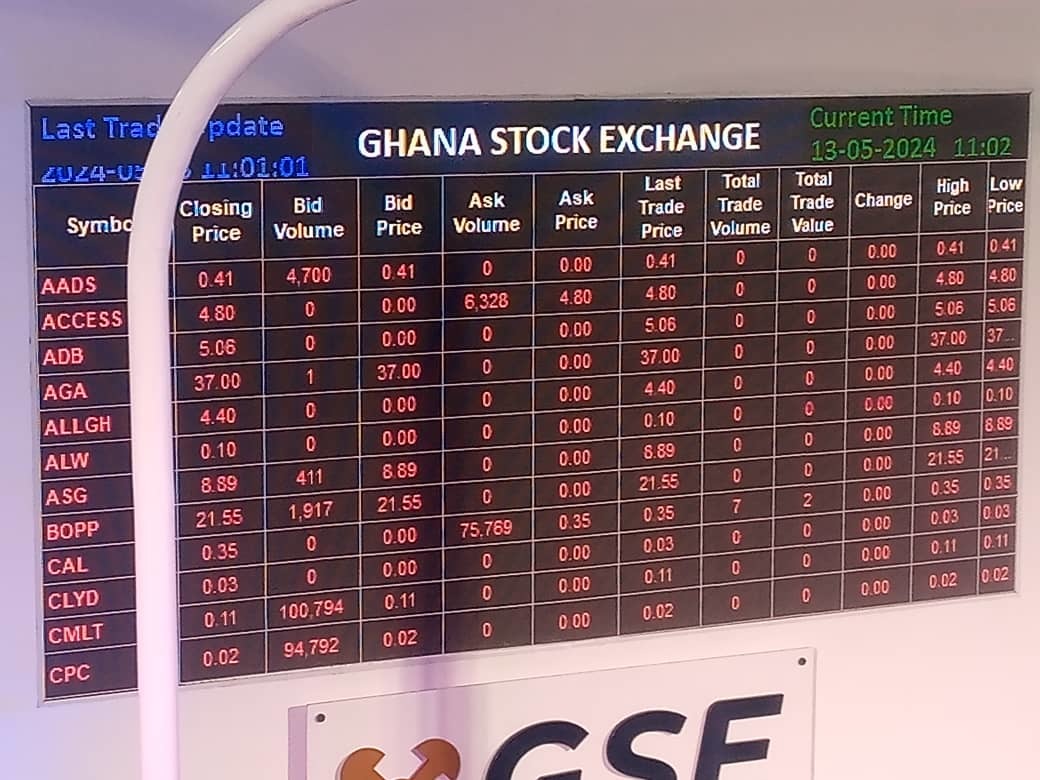

According to an article from Bloomberg of January 2, 2025, the composite index of the Ghana Stock Exchange recorded an increase of 56% in local currency in 2024, the best performance since 2013. This jump is largely the result of a support plan of 3 billion dollars of the International Monetary Fund (IMF), aimed at strengthening the Ghanaian economy.

“The worst is behind us,” said Alex Boahen, head of research at the Accra-based Databank Group. He clarified to Bloomberg that the Ghanaian index could further grow by 45% in 2025, driven by renewed investor confidence and a tangible economic recovery. Between January and September 2024, Ghana’s gross domestic product (GDP) grew by 6.3%, compared to only 2.6% over the same period in 2023.

President John Mahama, elected last December, has promised to restore economic stability and reposition Ghana as the region’s second largest economy. The cedi (Ghana’s local currency) also recorded gains of 7.6% last quarter, which could help reduce imported inflation, added Nana Kofi Agyeman Gyamfi of Bora Capital Advisors as quoted by Bloomberg.

Ivory Coast: a dynamic neighbor

In Ivory Coast, the BRVM Composite index, which brings together companies from the eight member countries of the West African Economic and Monetary Union (UEMOA), increased by 29% in 2024. According to Bloombergthis increase is the largest in the last three years. It coincides with a $3.5 billion loan granted in April 2024 by the IMF to support the Ivorian economy, the world’s leading cocoa producer.

The IMF forecasts economic growth of 6.4% for Ivory Coast in 2025, driven by high cocoa prices and new oil and mining projects, notably those launched by Eni SpA and Montage Gold Corp. Banks have also started lending again in Ivory Coast, signaling an economic recovery, according to Famara Ndiaye, fund manager at Abco Bourse, cited by Bloomberg.

Nigeria: a power in full transformation

Nigeria also had an exceptional year, with a 38% increase in its benchmark stock index, thanks to President Bola Tinubu’s ambitious economic reforms. These reforms include the end of fuel subsidies, the liberalization of the naira (Nigerian local currency) and the lifting of state controls on electricity tariffs, as reported Business Insider Africa in his article of January 3, 2025.

Nigerian companies like Oando Plc and Seplat Energy Plc have also taken advantage of these reforms to increase their value. The first saw its value increase sixfold, while the second recorded a spectacular increase of 147%, after strategic acquisitions in the oil and gas sector. However, Nigeria remains facing challenges, including soaring inflation that has reached record levels in 2024, triggering social unrest, according to Bloomberg.

African stock markets continue to attract investors, becoming a key driver for the continent’s economic growth. As nations like Ghana, Ivory Coast and Nigeria take the lead, economic policies and political stability will play a key role in consolidating this progress.

RT All Fr Trans