Invite brief

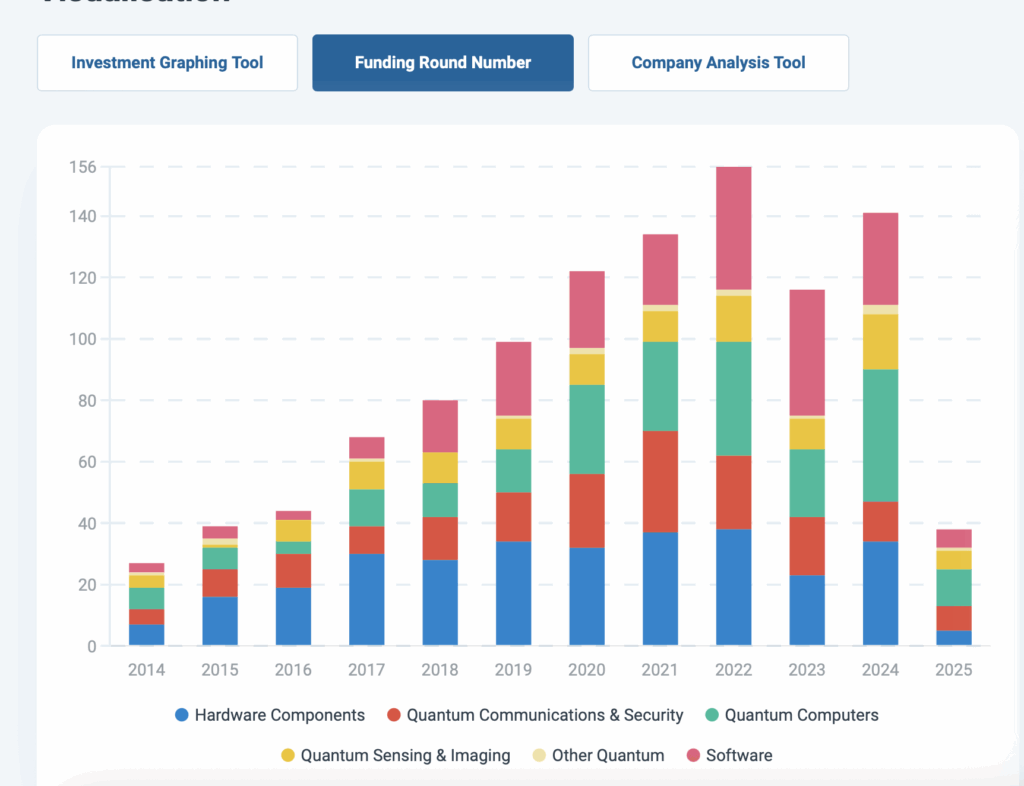

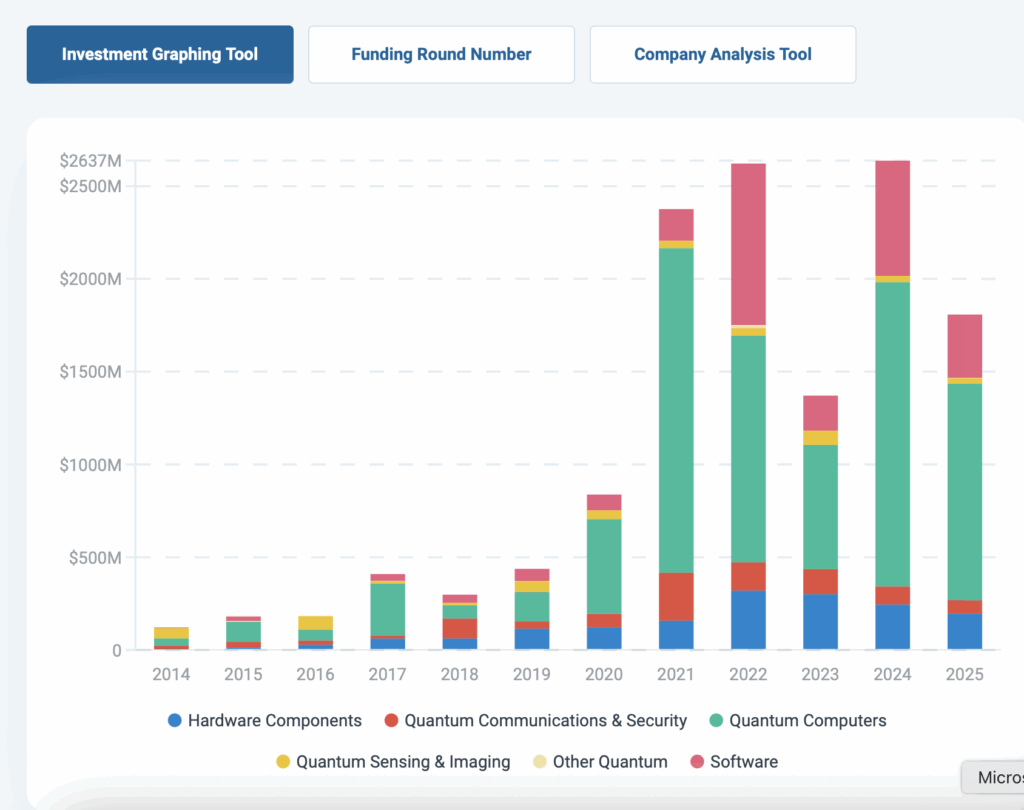

- Quantum technological investment in the first five months of 2025 has already reached almost three -quarters of the total of 2024, indicating an evolution towards less important but much larger and more strategic financing cycles.

- Commercial orders for quantum computers totaled $ 854 million in 2024 – up 70% compared to 2023 – suppliers selling more units at lower average prices, reflecting wider adoption between sectors and geographies.

- The growing prevalence of multi -year contracts, sales of complete systems and buyers preferences indicate that industry increases from experimental deployments to commercial -scale commitments.

An increase in high -value, growing sales and equity prices have marked a good start for 2025 for the quantum technology industry, perhaps suggesting that industry – and the market – enter a new phase of commercial maturity.

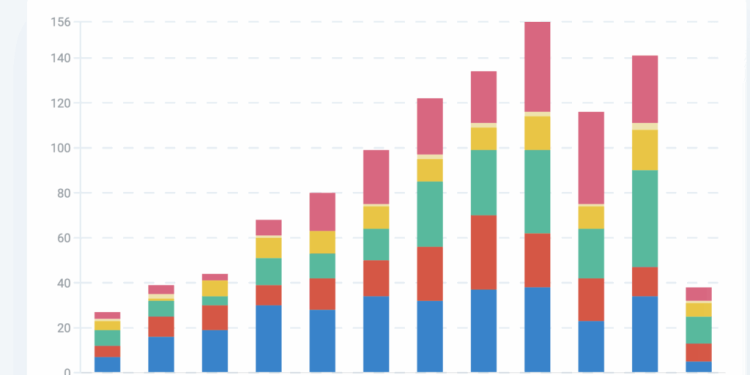

According to the new data of Quantum Insider’s intelligence platformQuantum funding in the first five months of 2025 has already reached 70% of the total of 2024, despite the number of financing series at only around a quarter of last year. The involvement is that the transactions that are concluded are larger, targeted and potentially more strategic.

This increase in the size of the agreement echoes wider signs of optimism in the sector. A distinct analysis of quantum computers compiled by Resonance and published in March shows a sustained momentum of 2024 entering the new year, with 2024 definition records for the volume of commands and the overall value.

Less rounds, bigger bets

To decompose it, the graph on the financing of round figures shows a strong increase in the average size of the agreement for 2025. Although the round volume has dropped considerably compared to its peak of 2022, the total raised capital remains robust. The composition of this year’s activity is distorted to funding at a stage or at the growth stage, a sign that investors can concentrate capital on companies considered as closer to the delivery of products or income.

Chiefs of the sector, such as Flower And Quera Computinghave recently attracted significant cycles, while companies operating to allow hardware, photonic and software layers also benefit from deep pocket investors who make selective and confidence bets.

Quantum Insider data show that quantum computers – once the field of speculative research – is now attracting dollars with a clearer commercial logic. Investors seem to support companies positioned to meet growing institutional demand.

2024 was a record year for sales – and 2025 follows strong

In a review of commercial orders published in March, Resonance reported that 2024 had seen 37 quantum computer orders totaling approximately $ 854 million. This represented an increase of 70% compared to the value of the order compared to 2023 and almost double the number of orders recorded two years earlier.

This growth, however, came with a change in market dynamics: although more units were sold, the average value of the order has decreased, falling to $ 19 million in 2024, against a peak of $ 48 million in 2021. This trend suggests that suppliers sell lower or demonstration systems and that buyers can distribute risks to smaller risks.

According to the recent report by the supplier of Quantum Insider, Available for platform subscribersThe first months of 2025 continue to reflect a strong activity. The pace of the investment suggests that suppliers convert capital to contracts, pushing towards evolutionary deployments in industries such as aerospace, pharmaceutical products and national defense.

Larger customers, longer commitments

A tendency that is worth keeping an eye on: multi -year contracts and sales of complete systems are increasingly common. These include quantum processors (QPU), but also the care of infrastructure, software, advice and training. Sellers such as IBM and Quannum are known to sign extensive service agreements, which sometimes brings together quantum access, hardware upgrades and cloud -based services.

As the Quantum Insider reports, many of these contracts are not disclosed in real time, but rather filtered in the public view of the quarters. Their internal database, updated regularly with supplier data and expert information, suggests that almost 55% of all quantum computer orders since 2012 have occurred in the past two years, a sign of the development of commercial demand.

The mixture of modality shows the preferences of the expansion buyer

While superconductive systems still dominate in terms of income – according to around 60% of the order value – they represent only 40% of the order volume, which indicates that more customers explored alternative methods. Resonance data shows an increasing activity in the original trapped systems, neutral atom, photonics and NV diamond.

Part of this is motivated by emerging markets and new entrants. Companies like IQM and XEEDQ have delivered low qubit systems to institutions from countries that had previously seen little quantum activity, such as Colombia and Turkey. These “start -up systems” can report a change in demand models, while the institutions concerned about the budget are starting to experiment with smaller scale.

Equity prices reflect the increase in confidence

Public quantum companies also experienced upward movements in 2025. Although the wider technology market has fluctuated, many actions linked to the quantum have outlined expectations. This includes both quantum pure game companies, such as Ionq And Wave Dand companies with great capitalization with quantum divisions, such as Honeywell (which has a majority participation in As to) And IBM.

Recent activities – such as acquisitions, new roadmaps, user -use partnerships and research progress – show that public enterprises are focusing on marketing their technology.

The growing interest of investors suggests growing confidence that Quantum will soon offer a commercial value. In other words, their investment times and their quantum roadmaps are starting to converge. Suppliers also position themselves more and more not only as equipment sellers, but as suppliers of integrated solutions capable of solving specific problems in the logistics, simulation, discovery of materials and secure communication. Quantum companies are also starting to show that aspects of their technology – such as the combination of quantum computers with conventional super computers and quantum -supported artificial intelligence methods – have the potential to claim the most lucrative demands available today.

Finally, it is not lost for certain investors that quantum technology – which includes detection, communications and calculations – are important for national defense and national security. Since a robust commercial quantum ecosystem is at the heart of the American strategy to remain a leader in quantum technologies, it is not lost for investors that the government will continue to support quantum and private companies during this transition from research and development to marketing with subsidies and contracts.

What motivates acceleration?

To summarize, analysts highlight a combination of factors behind the momentum:

- Strategic capital allowance. The concentration of capital in less of larger tricks suggests that the reasonable diligence of investors in maturation and the emphasis on the marketing potential on scientific novelty.

- Preparation for the offer. The sellers have exceeded the prototypes in production, with dozens of systems now in commercial use or engaged through signed contracts.

- Diversification of demand. Governments, societies and research institutions no longer explore Quantum – they deploy it. With more than 100 quantum systems sold or engaged since 2012, customers are developing in all geographies and sectors.

- Policy-Tailwind. Continuous government funding, in particular through national quantum strategies in the United States, Europe and Asia, deactivated early adoption and encourages the participation of the private sector.

Perspectives: less Paris, greater impact?

If current trends are maintained, 2025 can exceed 2024 in total investment with much fewer transactions, what experts suggest is a signal that the market promotes consolidation and maturity in relation to experimentation. While more and more business buyers are looking for quantum solutions, suppliers of proven systems and support models are likely to attract the share of lion financing.

However, important questions remain: will the prices per qubit will continue to drop? Can suppliers effectively run multi-system orders? And how will customer satisfaction shape repeated sales?

According to the intelligence platform of Quantum Insider, the industry is approaching a new step – less focused on the prouvance of quantum works and more concerned with showing how it offers.

Key numbers (in May 2025):

- 70% of the total investment of 2024 is already reached, with only 25% of the finished laps.

- $ 854 million in orders recorded for 2024, compared to $ 494 million in 2023.

- 41 Quantum computers sold in 2024, more than double the count in 2021.

- The average size of orders increased from $ 48 million (2021) to $ 19 million (2024), suggesting market diversification.

Sources: The quantum intelligence platform of initiateCommercial resonance Orders database, March 2025 Report.