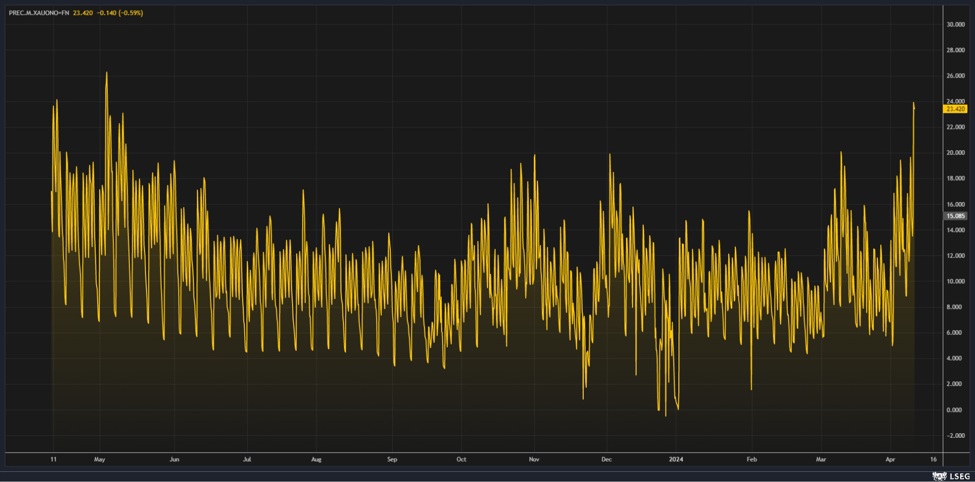

Options market expects impactful moves for gold

Gold’s overnight volatility soared to 23%, the highest since May 2023.

Given gold’s recent rally, it should come as no surprise that markets are getting a little uncertain as the CPI approaches.

Overnight gold thefts

We also talked about this yesterday, but it’s worth emphasizing once again that the options market is becoming a little cautious with the recent rise.

Below we can see that even though spot (blue) continued to rise, risk reversals (red) declined significantly (showing greater selling activity).

Gold Risk Reversals

Therefore, a rise in CPI today could offer short-term traders the best bang for their buck.

However, much of the recent rally in commodities has been attributed to inflationary risks. So while a rise in the U.S. CPI could lead to near-term pressure, it could also lead to increased hedging activity.

The key is to approach this one with caution.

cnbctv18-forexlive