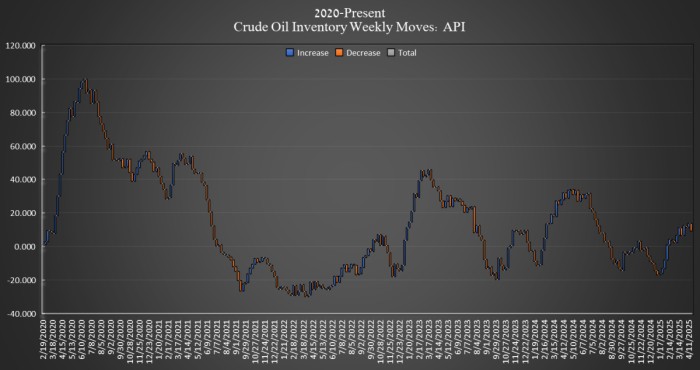

The American Petroleum Institute (API) estimated that raw oil stocks in the United States fell 4.565 million barrels over the week ending on April 18. The API estimated a construction of 2.4 million barrels in the previous week.

So far this year, crude oil inventories are still up more than 19 million barrels, according to the Oilprice Calculations of API data.

Earlier this week, the Ministry of Energy (DOE) said that crude oil inventories in the Strategic Oil Reserve (SPR) had climbed 500,000 barrels to 397.5 million barrels during the week ending on April 18. The levels of inventory in the SPR have taken hundreds of millions of level levels in the inventory before the withdrawal of the SPR which took place under the administration of Biden.

At 3:07 p.m., Brent Brude was exchanging $ 1.00 (+ 1.51%) on the day, leaving the international index to $ 67.26. Down during the day, this is a rebound of $ 3 last week, and a rebound of almost $ 6 from low after the announcement of the rates of the Liberation Day.

WTI also traded during the day, from $ 1.12 (+ 1.48%) to $ 64.20, an increase of $ 3 per barrel compared to last week.

Fuel stocks also dropped the week ending on April 18, with 2.180 million barrels, after falling 3 million barrels the previous week. Last week, petrol stocks are now 1% below the five -year average for this period of the year, according to the latest EIA data.

Distillat stocks were also down this week, 1.640 million barrels in the last week. During the previous week, distillate stocks dropped 3.2 million barrels. Distillat stocks were already about 11% lower than the five -year average from the week ending on April 11, according to the latest EIA data.

Inventories of Cushing – The reference crude reference stored and exchanged at the key delivery point against American term contracts in Cushing, Oklahoma – take place of 354,000 barrels, showed API data, more than offset last week 349,000 barrel barrels.

By Julianne Geiger for Oilprice.com

More top readings of OilPrice.com