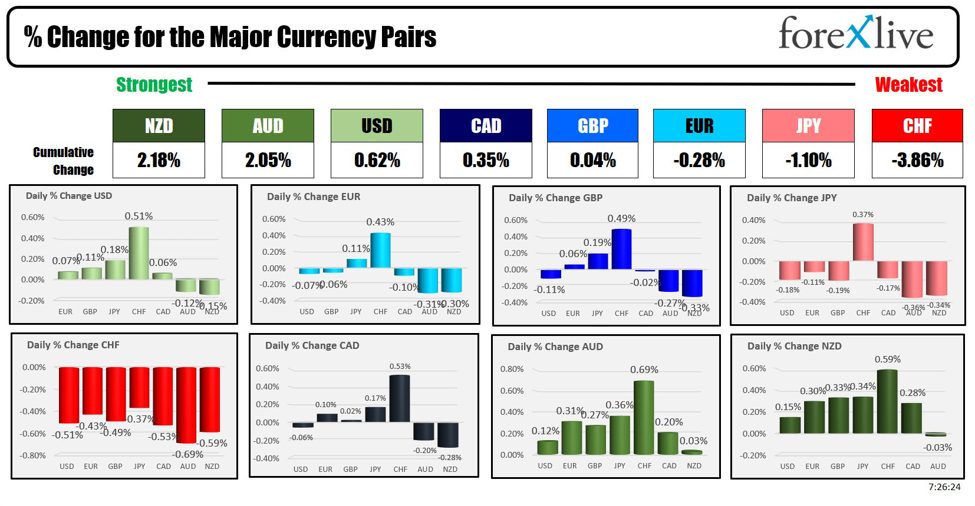

NZD is strongest and CHF is weakest at the start of the NA session.

NZD is strongest and CHF is weakest

At the start of the NA session, the NZD is the strongest and the CHF the weakest. The USD is mixed, even higher to start the North American session.

The US jobs report on Friday showed stronger job creation (NFP up +303 with higher revisions in previous months). The unemployment rate fell to 3.8% from 3.9% last month. On Friday, the DXY index rose 0.079%. However, over the trading week, the DXY fell -0.249%

This week will mark the start of the new earnings season (yes already!), with the release of results from big banks like JPMorgan Chase, Citigroup and Wells Fargo on Friday. Other notable companies such as Delta Air Lines and BlackRock will also announce their quarterly results. The S&P 500 is up 9.11% year to date, driven by its best first quarter performance since 2019. The Nasdaq is up 8.24%. Stocks are trading higher and lower unchanged in early trading.

Crude oil is down in pre-market trading, with hopes for a ceasefire in Israel the latest. Bitcoin is higher and nearing the all-time high at $73,794. Today’s high price has reached $72,756 so far.

A look at other markets at the start of the North American session currently shows:

- Crude oil is trading down $0.59 or -0.69% at $86.30. At this time on Friday, the price was $86.63.

- Gold is trading up $7.69 or 0.33% at $2,337.23. At this time on Friday, the price was $2,291.13.

- Silver is trading up $0.16 or 0.56% at $27.61. At this time Friday, the price was $26.69

- Bitcoin is currently trading at $72,348. At this time on Friday, the price was trading at $66,498.

In pre-market, the main indices are trading above and below unchanged:

- Dow Industrial Average futures imply a gain of 15.96 points. On Friday, the index rose 307.06 points or 0.80% to 38904.05

- S&P futures imply a slight gain of 0.66 points. On Friday, the index rose 57.15 points or 1.11% to 5204.35

- Nasdaq futures imply a decline of -2.21 points. On Friday, the index rose 199.44 points or 1.24% to 16,248.52

The European indices are mostly higher:

- German DAX, +0.27%

- CAC France, +0.23%

- British FTSE 100, -0.26%

- Spanish ibex, +0.41%

- Italian FTSE MIB, +0.54%

Stocks in Asia-Pacific markets were down:

- Japan’s Nikkei 225 was up 0.91%

- Chinese Shanghai Composite Index, -0.72%

- Hong Kong’s Hang Seng Index was 0.05%

- Australian S&P/ASX index, +0.20%

On the US debt market, yields are almost unchanged:

- 2-year yield 4.790%, +5.9 basis points. At this time Friday, the yield was at 4.662%

- 5-year yield 4.450%, +8.2 basis points. At this time Friday, the yield was at 4.313%

- 10-year yield 4.458%, +8.0 basis points at this time Friday, the yield was at 4.330%

- Yield at 30 years 4.597%, +6.5 basis points. At this time Friday, the yield was at 4.491%

Looking at Treasury yield curve spreads:

- The 2-10 year gap stands at -32.9 basis points. At this time Friday, the spread was -33.2 basis points.

- The 2-30 year gap stands at -19.2 basis points. As of this time Friday, the spread was -17.1 basis points.

European benchmark yields are mostly lower:

cnbctv18-forexlive