Stock prices of major microchip companies, including Nvidia (NVDA), Arm (ARM) and Micron (MU), are down Thursday after SK Hynix, an Nvidia supplier, said it was uncertain about demand of semiconductors in 2025. Chief Financial Officer Woo-Hyun Kim pointed to inventory adjustments and geopolitical risks as reasons for the unclear outlook. This follows yesterday’s rally in chip stocks, driven by the announcement of a massive AI infrastructure project called Stargate. Funded by OpenAI, SoftBank (SFTBY), Oracle (ORCL) and UAE-based MGX, the project aims to accelerate the adoption of AI.

Interestingly, however, Kim’s comments demonstrate how semiconductors used in consumer products operate differently from those used in data centers for artificial intelligence. Indeed, in a report to investors earlier this year, Needham analysts explained that 2024 was a mixed year for semiconductor companies. Those that relied on sales to the PC, smartphone and automotive sectors struggled due to weak demand and too much inventory. However, companies that have focused on artificial intelligence have seen high demand due to the growing need for AI infrastructure.

Despite the uncertainty, SK Hynix expects demand for memory chips used in AI data centers to continue to grow due to investments made by large technology companies. However, analysts warn that AI revenue growth could slow in 2025, which could narrow the gap between non-AI and AI chip stocks.

Which stock is the best buy?

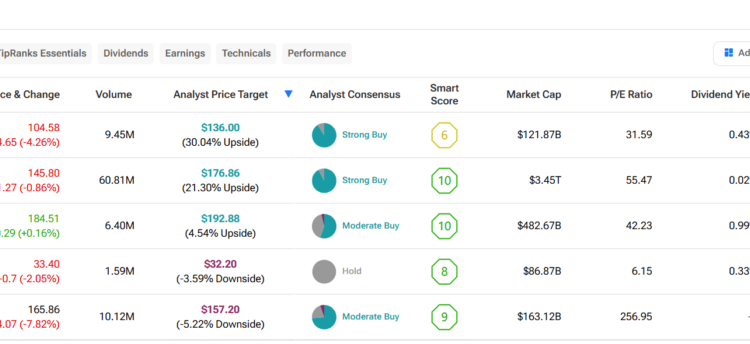

When it comes to Wall Street, among the stocks mentioned above, analysts believe MU stock has the most room to run. In fact, MU’s average price target of $136 per share implies more than 30% upside potential. On the other hand, analysts expect the least from ARM stock, as its average price target of $157.20 equates to a downside risk of 5.2%.

See more MU analyst notes