Managers of the Federal Reserve said during their last meeting that they may meet “difficult compromises” in the coming months, with an increase in inflation occurring in parallel with increasing unemployment. This prospect was supported by projections of the Fed staff who highlighted the increased risks of a recession, as revealed by the recently published minutes of the session from May 6 to 7.

In addition, the Central Bank decision -makers face a dilemma concerning the increase in inflation and unemployment. They must choose between implementing a stricter monetary policy to combat inflation or reduce interest rates to promote growth and employment.

Key quotes

- Participants in the meeting from May 6 to 7 of the Fed agreed that they were well placed to wait more clarity on the prospects.

- Participants agreed that the risks of higher inflation and higher unemployment had increased.

- Participants agreed that uncertainty about the prospects had increased and it was appropriate to adopt a cautious approach to monetary policy.

- Almost all participants commented on the risk that inflation can be more persistent than expected.

- The participants noted that they could face “difficult compromises” if inflation has proven more persistent while the growth and employment prospects were weakening.

- Participants considered uncertainty about their economic prospects as unusually high.

- The projection of staff for the growth of GDP 2025 and 2026 was lower than their estimate at the March meeting.

- The staff cited pricing policies as involving a greater trail of activity than the policies they had assumed in their previous forecasts.

- The committee voted to renew the exchange lines of dollars and foreign currencies.

- These participants noted that a lasting change in such correlations or a decrease in the perceived status of American assets for American assets could have lasting implications for the economy.

- Some participants commented on the changes in typical correlations between asset prices in the first half.

Market reaction

The green back maintains its upward position following the FOMC minutes, with the US dollar index (DXY) hovering just below the psychological obstacle of the 100.00 in the middle of a small rebound in American, yields through the curve.

This section below was published in preview of the FOMC minutes of the meeting from May 6 to 7 at 1:15 p.m. GMT.

- The minutes of the Rally of May 6 to 7 of the Fed should be directed on Wednesday.

- The federal reserve has kept the pending benchmark interest rate, as planned.

- The US dollar is likely to unravel its 2025 level among the concerns related to prices.

The Federal Open Market Committee (FOMC) will publish the minutes of its meeting on Wednesday from May 6 to 7. At the time, political decision -makers decided to maintain the target range of federal funds (FFTR) unchanged at 4.25% at 4.50%, as best planned by market players.

The Federal Reserve (Fed) adopted a more Bellician position at the beginning of the year, in the midst of concerns concerning UNITED STATES (United States) The potential impact of President Donald Trump on economic progress and inflation.

Not only did the civil servants decided to keep the pending benchmark interest rate, but they also gave no clue to future rate drops, maintaining the waiting position adopted in March.

The Fed is concerned about the risks that are in advance

Nourished The officials noted: “Uncertainty around the economy prospects increased. The committee is paying attention to the risks on both sides of its double mandate, “said the press release published in parallel with the decision.

Later in the press conference, President Jerome Powell said: “We are comfortable with our political position”. “We think that at the moment, the appropriate thing to do is to wait and see how things evolve. There is so much uncertainty,” he added.

In addition, the Fed has slowed down the pace of the drop in its titles. The Central Bank has allowed up to maturity up to $ 25 billion in cash and reduced the roll-off to only $ 5 billion from April. Reduction of balance sheet is another tool that Fed uses to control inflationary pressures.

President Trump’s massive rates were the main reason for the Fed’s last bellicist position. Despite his usual prudence, President Powell finally recognized that the prices are “a good part” of their increased expectations for higher inflation. He added that it would be “very difficult” to assess the amount of inflation from prices.

“For the future, the new administration is implementing important policy changes in four separate areas: trade, immigration, fiscal policy and regulations. This is the net effect of these policy changes that will import for the economy and for the means of monetary policy,” said Powell.

When will the FOMC minutes be released and how could it affect the US dollar?

The FOMC should publish the minutes of its political meeting from May 6 to 7 at 6:00 p.m. GMT on Wednesday, and market players hope that the document will highlight the future of monetary policy.

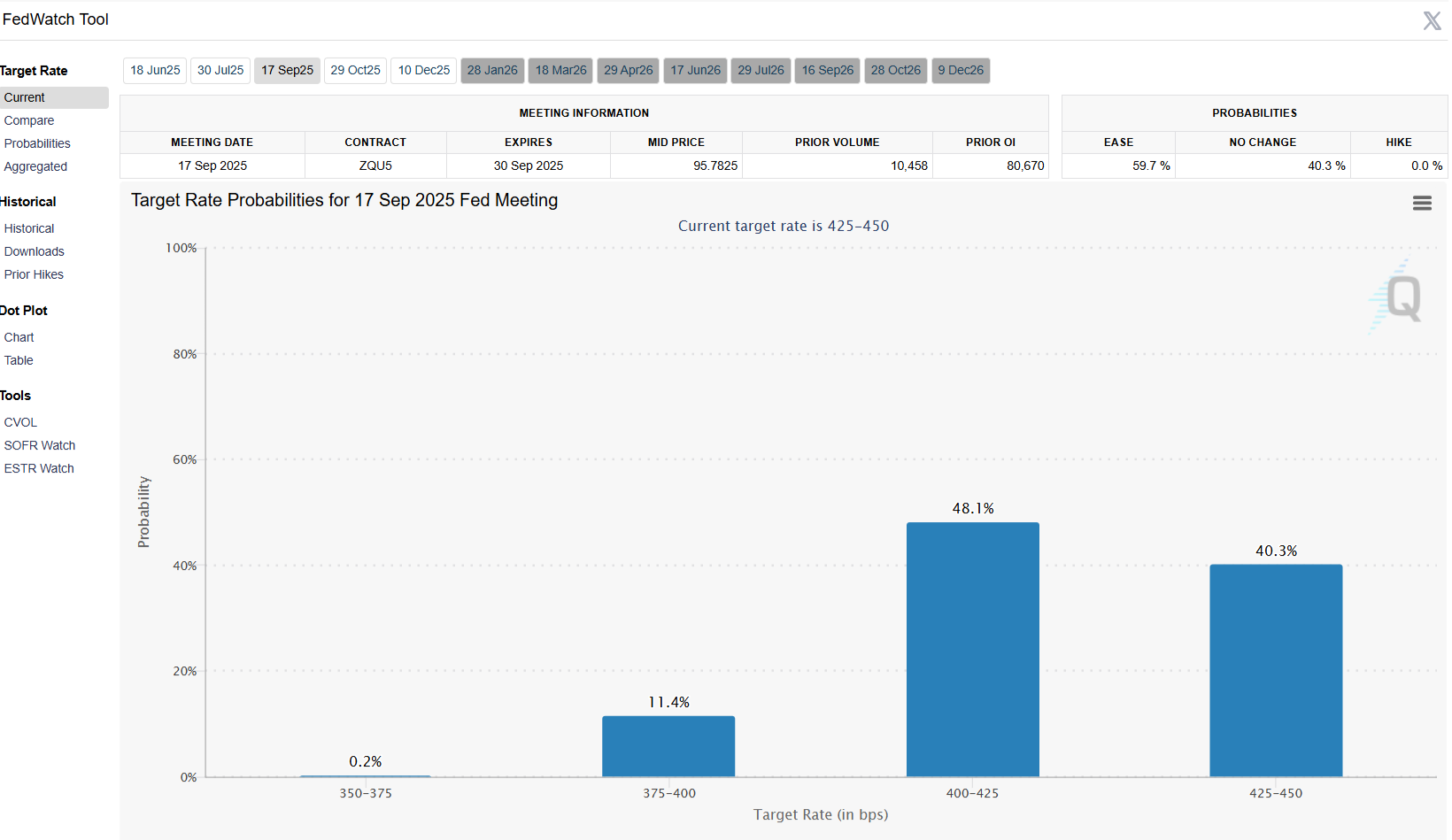

Before the press release, the CME Fedwatch tool shows that speculative interest does not expect interest rate reductions in June or July, with a reduction of 25 basic points (BPS) at around 48% in September.

The US dollar is under pressure from pressure before the event, with the US dollar index (Dxy) comfortably below the brand at 100.00. The Fed should not adopt a dominant position, which means that most of what they could reveal is aligned with what the market already knows. THE FOMC minutes should then have a limited impact on the DXY.

Valeria Bednarik, chief analyst at FxstreetDeclares: “The Doxy exchanges no longer above the bottom of several months displayed in April at 97.91, and the risk is downwards, according to technical readings in the daily graph. The index develops below all its mobile averages, with a simple mobile average (SMA), offering resistance to around 100.20. Gains beyond the image, it seems that the 101. Out of the image, given the limited purchase interest. indicators Within the period mentioned, it has advanced, but remains well below their intermediate lines, not supporting a regular lead. »»

Bednarik adds: “On the other hand, the relevant support is available at 98.70, monthly May.

US dollar FAQ

The US dollar (USD) is the official currency of the United States of America and the “de facto” currency of a large number of other countries where it is in circulation alongside local tickets. It is the most negotiated currency in the world, representing more than 88% of all global turnover, an average of 6.6 billions of dollars of transactions per day, according to data from 2022. After the Second World War, the USD took over from the British book as a global reserve currency. For most of its history, the US dollar was supported by gold, until the Bretton Woods agreement in 1971 when the Order stallion left.

The single most important factor on the value of the US dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to reach price stability (controlling inflation) and promoting full employment. Its main tool to achieve these two objectives is to adjust interest rates. When prices are increasing too quickly and inflation is greater than the 2% target of the Fed, the Fed will increase rates, which helps the USD value. When inflation falls below 2% or the unemployment rate is too high, the Fed can reduce interest rates, which weighs on the greenback.

In extreme situations, the federal reserve can also print more dollars and promulgate a quantitative relaxation (QE). QE is the process by which the Fed considerably increases the credit flow in a blocked financial system. This is a non -standard political measure used when credit has dried up because the banks will not lend themselves (by default of the fear of the counterpart). This is a last appeal when the simple drop in interest rates is unlikely to achieve the necessary result. It was Fed’s weapon of choice to combat the credit crisis that occurred during the great financial crisis in 2008. It implies the Fed Print more dollars and use them to buy US state bonds mainly from financial institutions. QE usually leads to a lower US dollar.

The quantitative tightening (QT) is the opposite process by which the federal reserve ceases to buy obligations from financial institutions and does not reinvest the principal of the obligations it holds in new purchases. It is generally positive for the US dollar.