Mark Zuckerberg, CEO of Meta Platforms, in July 2021.

Kevin Dietsch | Getty Images News | Getty Images

Meta will report its first quarter results after the bell on Wednesday.

Here’s what analysts expect.

- Earnings per share: $4.32, according to LSEG.

- Income: $36.16 billion, according to LSEG.

- Daily Active Users (DAU): 2.12 billion, according to StreetAccount

- Monthly active users (MAU): 3.09 billion, according to StreetAccount

- Average revenue per user (ARPU): $11.75 according to StreetAccount

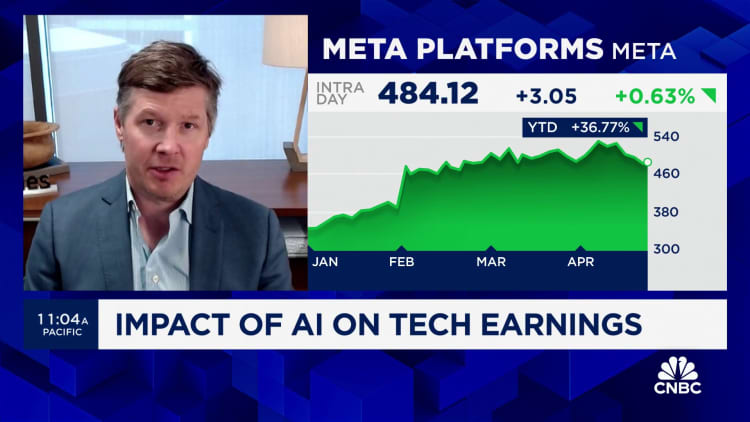

Meta has been a favorite on Wall Street since early 2023, when CEO Mark Zuckerberg told investors it would be “the year of efficiency.” The stock nearly tripled last year, trailing only Nvidia among members of the S&P 500, and is up another 40% in 2024.

Facebook’s parent company has clawed back digital advertising market share after a dismal 2022. At that time, the company was in shock. Apples iOS privacy update and macroeconomic concerns have led many brands to limit spending.

Zuckerberg has spearheaded an initiative to rebuild the advertising industry with a focus on artificial intelligence. During the company’s most recent earnings conference call in February, CFO Susan Li said Meta had invested in AI models that can accurately predict which ads are relevant to users, as well as tools that automate the ad creation process.

Analysts expect Meta to report a 26% increase in revenue from $28.65 billion a year earlier. This would be the fastest growth rate since the third quarter of 2021, which was before Apple’s privacy changes began showing up on other companies’ balance sheets.

Meta is benefiting from a stabilized economy and increased spending by Chinese discount retailers like Temu and Shein, which have pumped money into company-owned Facebook and Instagram in a bid to reach a wider range of users. Baird analysts said in a note Monday that slowing spending by China-based advertisers could be a cause for concern for first-quarter results.

Still, Baird analysts see continued momentum in Meta and say they have “reasonably high” expectations for the company due to its improving advertising tools and success in monetizing ads. short videos.

Investors will remain focused on Meta costs, which have played a central role in the stock market rally. Early last year, Zuckerberg said the company would be better able to eliminate unnecessary projects and combat bloat, which would help Meta become “a stronger, more agile organization.”

The company cut about 21,000 jobs in the first half of 2023, and Zuckerberg said in February of this year that hiring would be “relatively minimal compared to what we would have done historically.”

As of Dec. 31, Meta had 67,317 employees worldwide, up from a peak of more than 87,000 employees in 2022, according to Securities and Exchange Commission filings.

Analysts at Jefferies wrote in a report last week that it was “hard to argue with excellence.” Analysts expect Meta to outperform its first-quarter results and provide better-than-expected guidance for the second quarter. Currently, the average analyst estimate is for revenue growth of 20% in the second quarter, to $38.29 billion, according to LSEG.

“We continue to be encouraged by META’s ability to sustain double-digit growth, given the combination of higher engagement from AI investments and increased advertiser ROI and effectiveness “, wrote Jefferies analysts.

Meta’s Reality Labs unit, which houses the company’s hardware and software for development of the nascent Metaverse, continues to bleed cash. Analysts expect the division to post an operating loss of $4.31 billion for the quarter, on top of the $42 billion lost since the end of 2020. The unit’s revenue is expected to reach $512.5 million dollars, an increase of 51% from $339 million per year. earlier.

Executives will discuss the company’s results on a call with analysts at 5 p.m. ET.

cnbc