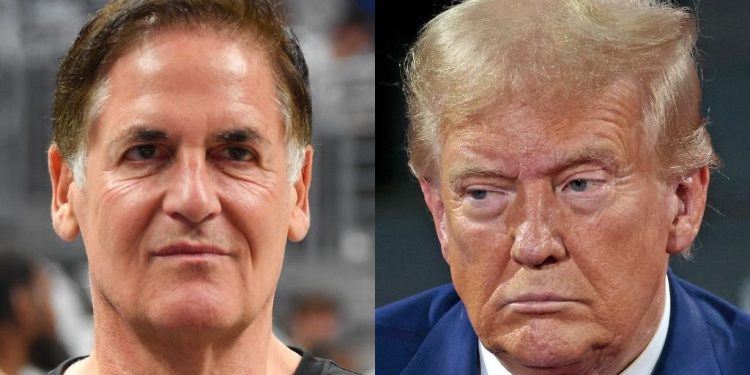

Although President Donald Trump has recognized that his aggressive tariff plan could lead to the short -term “little pain”, some business figures, such as the Billionaire “Shark Tank” Mark Cuban, see a higher risk of long -term economic damage.

In a series of Bluesky messages on Saturday, Cuban developed his previous criticisms of Trump’s trade policies. The co-founder of Drugs Cost Plus suggested that the extensive prices announced by the Trump administration on Wednesday, combined with federal workforce, led by the White House Doge office, could lead to a worst financial crisis than the great recession of 2008.

“If the new prices remain in place for several years and are applied and inflationist, and Doge continues to cut and shoot, we will be in a very worse than 2008 situation,” wrote Cuban in response to the question of another user on the economic impacts of the Trump pricing plan.

The minority owner of the Dallas Mavericks did not develop why he sees the radical reductions of the federal workforce led by the Doge Office linked to the economic health of the country. However, the reductions have targeted the financial protection office of consumers and the taxation of the application of the escape of the Internal Revenue Service, among other agencies.

Cuban and representatives of the Trump administration did not immediately respond to requests for comments from Business Insider.

During the 2008 financial crisis and its immediate consequences, the country’s GDP has decreased by more than 4%, the unemployment rate reached 10% and the housing market crashed into what economists have recognized as the deepest recession since the Second World War.

The president, in comments on the press on his trade policy, recognized: “We can have, in the short term, a little pain, and people understand it”, but in an article on Saturday on Truth Social said: “Only the weak will fail!”

Economic uncertainty resulting from Trump’s pricing plan brought the stock market down and prompted consumers to store essential elements while reducing luxury products. Economists and supply chain experts previously told Business Insider that the increase in import costs caused by prices should lead to higher price for everything Gardening staples such as coffee and more important coffee and purchases such as cars and household appliances.

Cuban is not the only one to worry about the lasting economic impacts of the president’s policies. Many commentators in the financial field have questioned prices and highlighted their potential consequences.

The World JPMorgan World economist, in a research note to customers published Thursday, entitled “There will be blood,” warned that the risk that the global economy fell into a recession has increased from 40% to 60% in response to the price announcement on Wednesday.

businessinsider