Some people buy a house. Others, apparently, buy a Jeep Wrangler with a loan of seven years and sufficient interest in making an accountant run by shouting for the hills.

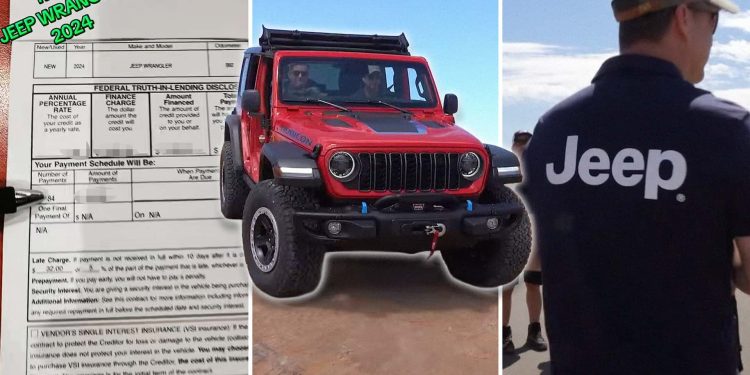

A Tiktok clip of the creator named description I’m just a finance Guy (@imtheautofinanceGuy) shows how scandalous financing offers can get these days, especially for those who have bad credit scores. The video, which has been watched more than 290,000 times, zooms in on the paperwork of a truth in the disclosure of loan for a Jeep Wrangler 2024 which could well be the most expensive basic model of recent memory.

The funding terms are more like an edifying story than a dealer victory:

- Loan amount: $ 74,599

- Financing costs (interest): $ 56,931.5

- APR: 17.69%

- Term: 84 months (it’s 7 years)

- Monthly payment: $ 1,565.84

- Reading of the kilometric counter: 860 miles

The documents show a total reimbursement of $ 131,530.56, or the cost of a house in a small town in Ohio, all for a Jeep with less than 1,000 miles on the clock.

If it is not horrible enough, let’s decompose it further: $ 1,565.84 × 84 months = $ 131,530.56.

This represents more than $ 56,000 in interest paid on the duration of the loan. At 17.69% APR, the buyer ends up lowering almost double the price of the Jeep sticker when he is paid. You can make the same payments on a mortgage of 15 years in certain parts of the country. According to Zillow, the median price of houses in Toledo, Ohio is Just under $ 130,000.

Although it is tempting to treat this loan as an aberrant value, it is more a warning panel. In 2025, the Average apr For a new car loan in the United States is between 7 and 9%, depending on the borrower’s credit rating. A rate of 17.69% suggests a borrower in a deep subprime category or someone who obtained funding through a dealership “Buy here, pay here” known for predatory conditions.

And then there is the question of the amount of the loan itself. A JEEP WRANGLER from the BASE 2024 model usually starts around $ 35,000. Higher versions like Rubicon can go to the $ 55,000 range with options.

There are some possibilities. The concessionaire may have loaded the vehicle with expensive additional modules such as extensive guarantees, all-terrain packages or levels of appearance that seem beautiful on paper and benefit margins of PAD. It is also possible that the buyer exchanged a previous vehicle with negative equity, wrapping the unpaid balance in the new loan. And in many cases, high interest loans like this are presented to buyers who are informed that it is their “only option”, a preferred tactic of high-risk financing outfits.

Anyway, it’s a difficult look. Seven years is a long time to reimburse a car, especially that which can see a serious depreciation before it is halfway the length of the loan.

According to the CFPB, the Americans now wear more than $ 1.6 billion In car loan debt, and loan conditions from 72 to 84 months are more and more common, even if they often leave “submarine” buyers on their loans during most of the reimbursement period.

Financial advisers generally recommend: Keep loan conditions in the 60 months, avoid APRs from more than 6 to 7%, unless necessary, and never finance the additional modules or prolonged guarantees, unless you have calculated the long -term cost. There is no indication on the term sheet of whom the concessionaire or the financier was for the proposed loan, but the commentators on the clip were ready to grasp their forks and their torches in indignation.

“It should be illegal. Someone label the repo man! ” One of them wrote.

Another offered that the agreement proposed is another example of the prey of buyers: “In case someone wondered why we need a consumer protection agency. These loans should be criminals. “

And another did not feel well at the idea of making a mortgage payment for an asset of depreciation on wheels, by writing: “I do not pay $ 131,000 for nothing, except a house and I would do it extremely reluctantly.”

Motor1 Has handed the creator by direct message and Jeep / Stellantis by e-mail. If we hear, we will be sure to update this article.