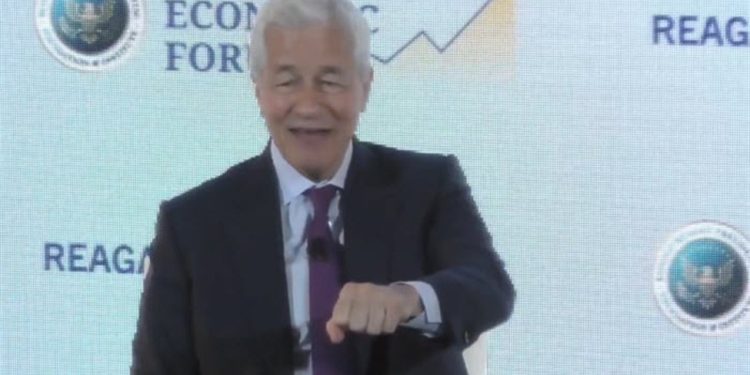

Jamie Dimon’s comments on May 30 deserve to be reassessed.

He underlined the “crack” on the COVID bond market and the additional 10 billions of the American public debt issued since then, more huge amounts elsewhere.

“You will see a crack in the bond markets. It will happen. I tell you that it will happen, and you will panic. I will not panic, we will be fine. We will probably win more money.”

He continued to say that certain rules and regulations must be modified so that he can talk about his book.

He also did not put chronology cramp and said he did not know if it was going to be in six months or six years.

I think no one learned anything from what happened at the start of Covid, when the yields turned higher Before the Fed launched into an unlimited QE. We also had a taste of this after the release day when the yields jumped 70 base points before setting up.

For me, the game book at the moment in any crisis is to sell The links first and I worry at this stage that when it becomes conventional knowledge, this will add to the pressure on the links in any “crack”.

Later this year,

Forexlive.com

evolves in

Investinglive.comA new destination for smart market updates and more intelligent decision -making for investors and merchants.