NVIDIA (NASDAQ:NVDA) has repeatedly proven wrong those who doubted its continued growth in recent years.

However, concerns such as a possible trade conflict between the United States and China, challenges with the deployment of its Blackwell chips and a slowdown in AI capital spending by megascalers have contributed to the sideways movement of the title over the past two months.

Given these concerns, investors can be forgiven for wondering how much longer the AI giant can maintain its solid year-over-year revenue and margin growth.

Lead investor Yiannis Zourmpanos isn’t ready to end Nvidia’s windfall. In fact, Zourmpanos expects big things in the coming month when Nvidia shares its fourth-quarter fiscal 2025 report.

“Nvidia could be on track to post astonishing growth of more than 70% year-over-year, fueled by unparalleled dominance in AI and strategic expansion into high-growth verticals such as healthcare,” says the 5-star investor, ranked in the top 1.% of TipRanks stock pros.

Zourmpanos is particularly optimistic about Nvidia’s ability to enter the $300 billion healthcare market by capitalizing on the growing need for AI-based medical imaging, genomics and drug discovery.

The company’s efforts in this area are already paying off, the investor adds, citing partnerships with leading companies such as IQVIA, aimed at transforming clinical trials, and Illumina, focused on expanding use of genomic data in multiple applications.

Beyond the healthcare opportunity, the investor also highlights Nvidia’s continued technology leadership in the data center segment. Zourmpanos cites Blackwell’s 30x improvement in inference performance, as well as the architecture’s ability to provide flexibility for working with many configurations and networking options.

These and other positives combine to create a promising prognosis, and the investor highlights the company’s projections of $37.5 billion in revenue for the fourth quarter of 2025 This would represent 70% year-over-year growth. Still, Zourmpanos cautions against underestimating Nvidia’s history of exceeding expectations.

“Nvidia has demonstrated a consistent pattern of beating major estimates, supporting stock value growth. Over the last 8 quarters, the company has recorded positive surprises, with an average surprise percentage of 8.64%,” the investor said.

Unsurprisingly, Zourmpanos continues to have confidence in NVDA, rating the stock a Strong Buy. (To see Zourmpanos’s track record, click here)

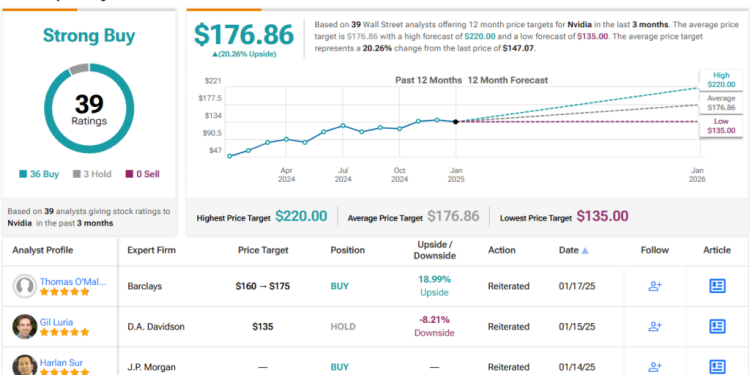

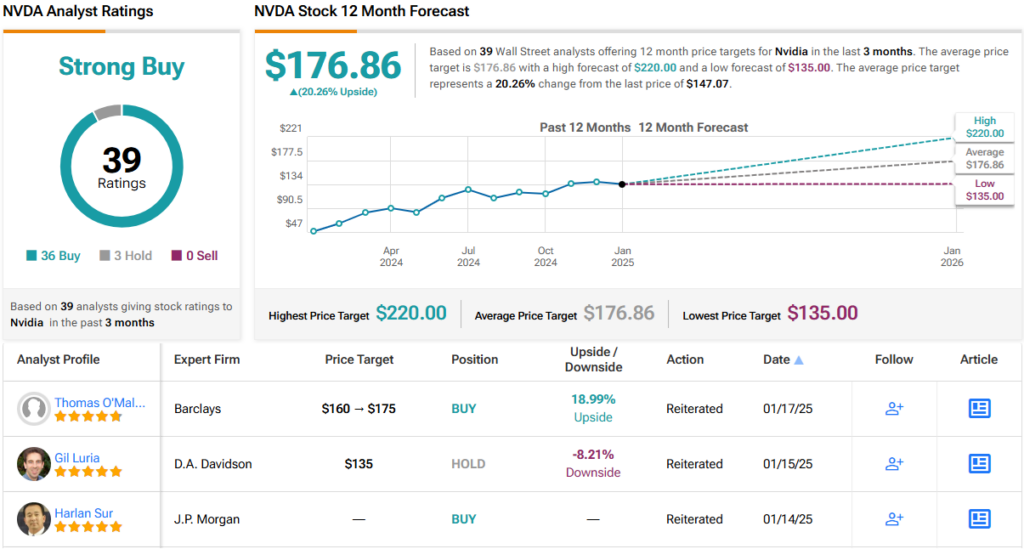

Wall Street is also showing no signs of losing confidence in NVDA. With 36 Buy ratings and 3 Hold ratings, NVDA holds a Strong Buy consensus rating. Its 12-month average price target of $176.86 implies further upside potential of more than 20%. (See NVDA Stock Forecast)

To find good ideas for trading AI stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the investor featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.