“It’s still a great buy point,” says one investor of Nvidia stock

“Buy low, sell high” is the famous mantra of investors. Judging by this logic, Nvidia (NASDAQ:NVDA), which has seen good growth this year, should not be a very attractive investment at the moment.

Driven by the explosive growth of the AI sector, NVDA’s stock price has increased by 138% in value in 2024 alone.

Given this rapid growth, is it time for investors to sell NVDA? According to investor On the Pulse, the answer is a resounding no.

“Nvidia’s valuation is actually not excessive at all,” the investor maintains.

While acknowledging the meteoric growth, the investor remains optimistic about the future prospects of NVDA and its data center business in particular.

“I think investors are still underestimating Nvidia’s sales potential, particularly around the expanding data center market and the scaling opportunity for AI clusters,” On the Pulse writes.

NVDA’s position as the clear leader in the AI processor market offers an opportunity for continued long-term gains, says the investor, who believes that “Nvidia’s AI growth curve is just beginning.”

Looking at the broader machine learning sector, On the Pulse notes that this promising field is “poised for explosive growth through the end of the decade,” with NVDA leading the way.

Regarding valuation, On the Pulse compares NVDA to its closest competitor, AMD, which is valued at 33x forward earnings, close to NVDA’s 35x multiple. This comparison suggests that NVDA’s valuation is reasonable and not excessively high.

“With a nearly identical earnings multiple, I would pick Nvidia any day of the week given its dominant market share in the GPU market,” writes On the Pulse, which concludes that “the 35x earnings multiple along with the potential to substantially beat sales estimates in the data center segment going forward make Nvidia a solid growth investment.”

Therefore, On the Pulse confidently rates Nvidia stock as a Buy. (To see On the Pulse’s track record, click here)

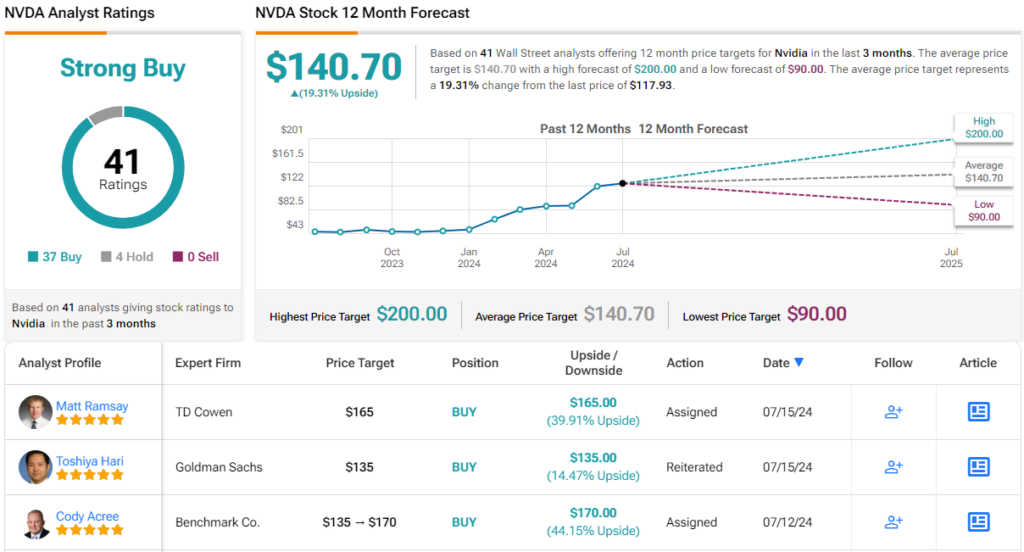

On Wall Street, analysts tend to agree with investors. The much-hyped stock has garnered 41 analyst ratings in the past three months, which break down into 37 Buy ratings and 4 Hold ratings. That naturally results in a Strong Buy consensus rating. At the same time, the average 12-month price target of $140.70 implies an upside of about 19% over the next 12 months. (See NVDA Stock Forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, the world’s leading equity news hub.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.