- Bitcoin’s recent return sparked a cautious rebound, inviting shorts to increase their bets.

- Could this break be a strategic configuration?

Bitcoin (BTC) brought back in its classic mode “wait and see”.

After a retrace of the manual at the psychological level of $ 100,000, you expect the bulls to invoice with conviction. But instead, the rebound was disappointing. No explosive follow -up, no parabolic recovery.

This hesitation? It is given to short opportunistic films an opening, and they intervened. BTC / USDT of Binance perpetual Now show short biases of almost 60%, referring to what many traders look into the disadvantages.

However, what happens if this moderate break is not a sign of weakness, but a deliberate strategic consolidation? A calculated configuration, throwing the basics of a high volatility rupture?

Shorts develop strategies to take advantage of the hesitation of bulls

Currently, 96.6% of the Bitcoin offer is in unpaid profits. Add to that the fact that the short -term holder (STH) provide fell to the levels of November 2024.

Meanwhile, the retail trade remains on the sidelines, and with the construction of macro-trempe before the FOMC, the capital has turned into shares, leaving the momentum of the BTC in the balance.

In this context, the short -up bias does not seem reckless; It seems rather calculated, because short -term sellers are what looks like a clean reversion configuration.

But what adds fuel to their conviction is the lack of directional momentum.

In other words, with bulls showing hesitations and no escape in sight, no one really controls right now. This lack of direction Claire leaves the door wide open for withdrawal, and the shorts know.

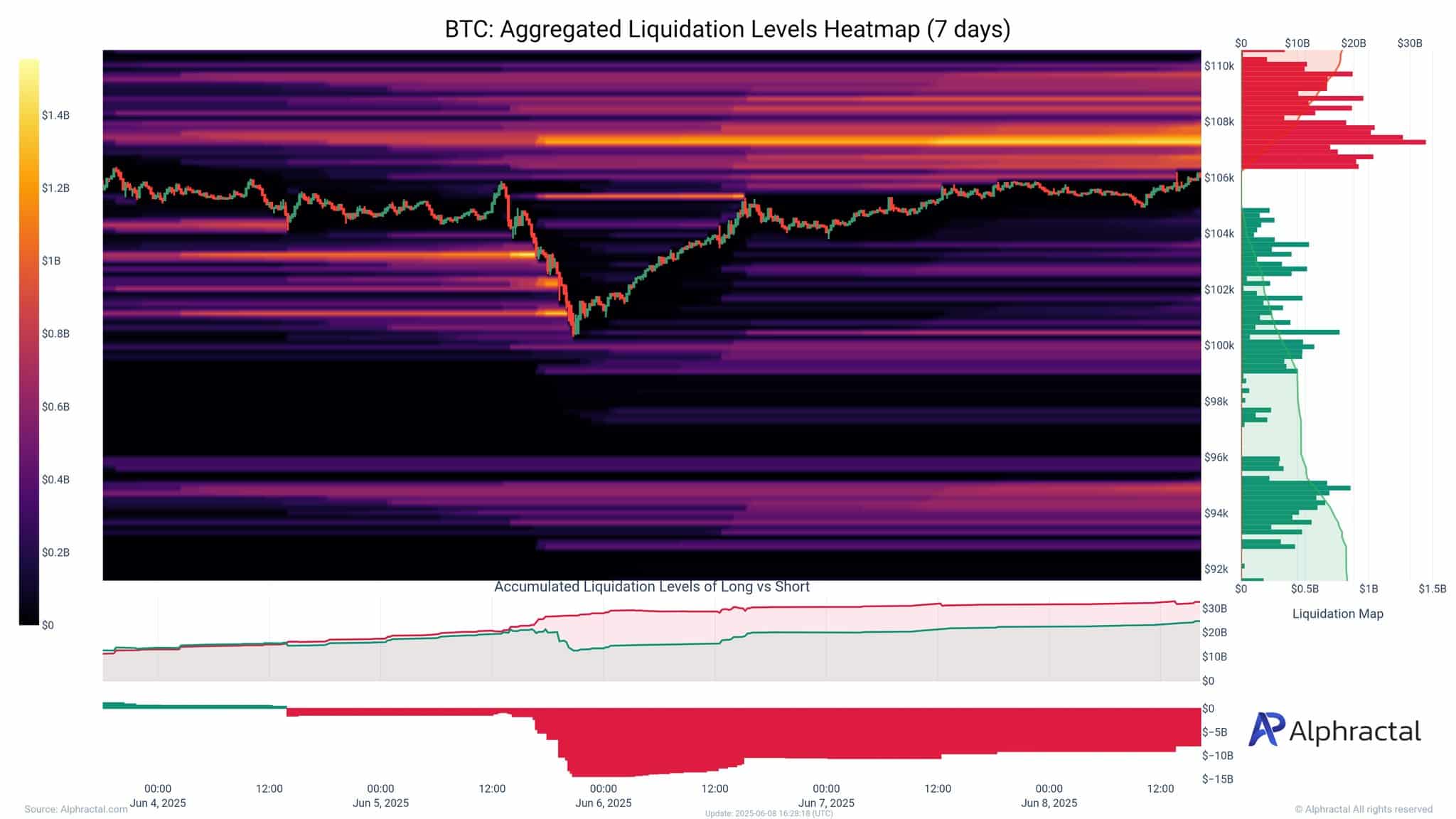

As illustrated in the graph above, the Bitcoin’s global global liquidation delta has a clear red domination, indicating that long positions are aggressively liquidated.

Consequently, this dynamic feeds a speculative bubble. Whenever BTC withdraws, forced liquidations wipe out Paris traders on a Haussier rally. Because Financing rates promote longLiquidations quickly in cascade in larger sales.

It is not a surprise that Binance see a big short bias. As mentioned above, the open sellers capitalize on the hesitation of the bulls, which makes it a primordial strategy for excessive yields.

Market tensions culminates while bitcoin looks at a large short cluster

Bitcoin has now spent more than a week to consolidate below $ 106,000 at $ 107,000, strengthening it as a key resistance ceiling.

Consequently, longs continue to let off steam and without large institutional money By backing up, shorts become more confident than a correction is on deck.

But here is the thing – whenever someone adds to a short bet, he also prepares the ground for compression. Therefore, the more the BTC consolidates without decomposing, the more explosive the break.

And with more than a billion dollars in shorts stacked just above $ 107,000, this level could act as a launch if the bulls decide to pass.

Interesting, Michael Saylor seems to position exactly for that, double While the reserves between exchanges continue to shrink while investors opt for cold storage.

Strong Tass behavior, confirmed by Channel metricsalso underlines the compression account of the offer.

Put all of this together, and the current consolidation of BTC does not look like indecision. Instead, it looks like a current trap. The one who could attract more shorts before releaseing pressure and unlocking higher targets.

At this point, Hodling may well be the most intelligent decision in the table.