Quantum computing stocks have been rising sharply for much of the past year, driven by a series of technological advances that have caught the attention of investors. One of the biggest occurred in December 2024, when Alphabet revealed that its Willow chip performed a complex calculation in minutes, an operation that the company said would have taken a supercomputer 10 seven billion years.

Elevate your investment strategy:

- Enjoy TipRanks Premium at 50% off! Benefit from powerful investing tools, advanced data, and insights from expert analysts to help you invest with confidence.

More recently, investor optimism was boosted when JP Morgan announced plans to allocate $1.5 trillion to sectors deemed vital to US national security, including quantum computing.

While the journey hasn’t been linear, the trend has certainly been positive for investors in companies leading the quantum charge. Indeed, many see this technology as a real turning point, drawing comparisons to the torrid AI revolution.

Investments in quantum are not without peril, however, as these companies remain firmly in the R&D stage and have yet to generate profits. Some technology leaders openly question whether quantum will actually have practical applications in the near term.

Still, the flashing dollar signs provide a strong incentive for many: a McKinsey report even predicted that the quantum computing industry could reach $72 billion in 2035.

Against this backdrop, one investor, known by the pseudonym Hunting Alpha, took a closer look at two of the most talked about names in the sector – IonQ (NYSE:IONQ) and Rigetti Informatique (NASDAQ:RGTI). The investor ultimately decided that one of the stocks offered enough promise to warrant a position, while the other was passed over. Let’s take a closer look.

IonQ

IONQ and its trapped ion technology have attracted sustained attention over the past year, propelled by a steady cadence of breakthroughs and strategic developments that demonstrate accelerating progress across the company’s roadmap.

Earlier this week, the company announced that its fifth-generation quantum system, IonQ Temp, had reached its AQ #64 benchmark three months ahead of schedule, and according to IONQ, the system now achieves a computational space 36 quadrillion times larger than that of IBM’s publicly available quantum computers.

The company also completed the acquisition of Vector Atomic earlier this month, adding sophisticated quantum sensing expertise in positioning, navigation and timing systems, a move that further expands its technological lead.

At the same time, the company has progressed some high-profile partnerships, including a recent memorandum of understanding with the U.S. Department of Energy, aimed at advancing quantum solutions for space innovation and cybersecurity.

Investors have certainly noticed, as IONQ’s stock price has soared 403% over the past 12 months.

Hunting Alpha, which previously had a bearish stance, now admits it has changed its mind. “I succumbed to FOMO and bought a small position in IONQ,” the investor said.

The investor believes the company’s growth is fueled by acquisitions, including Vector Atomic, which are “reasonably priced.” The investor notes that annual revenues from recent acquisitions are north of $100 million, while the median EV/revenue multiple of 45.1x compares well to the EV/revenue multiple of niche quantum stocks.

Additionally, the appointment of Chief Financial Officer Inder Singh, who brings strong M&A experience from his tenure at Cisco, reinforces confidence in IONQ’s ability to execute strategically sound transactions.

As high M&A costs lead to mounting EBITDA losses, Hunting Alpha also notes that a $1 billion capital raise in July gives IONQ plenty of free cash.

The investor is also encouraged to see a strong roster of customers and partners, including Nvidia, Google Cloud, and Microsoft Azure. “Many major brands are customers and partners of the company,” underlines Hunting Alpha.

While not quite ready to go all-in, Hunting Alpha believes the company is “worth a cautious FOMO bet” and therefore gives IONQ a Buy rating. (To see the Hunting Alpha list, click here)

The Street’s position on IONQ presents an interesting contradiction. On the one hand, the stock enjoys a Moderate Buy consensus rating, supported by 6 Buy recommendations and 3 Holds. On the other hand, the 12-month average price target sits at $61.63, implying a slight downside of around 2% from current levels – suggesting that the recent rise has pushed the stock further than most analysts expected. (See IONQ Stock Forecast)

Computers Rigetti

Rigetti Computing has arguably been one of the biggest beneficiaries of the rising quantum wave, and its stock price has soared by a seemingly absurd rate of 4,777% over the past twelve months.

RGTI has benefited from a series of tangible growth catalysts in recent months, including the sale of two 9-qubit quantum computing systems for $5.7 million, with deliveries planned for the first half of the coming year. Additionally, the company recently secured a three-year contract worth $5.8 million from the Air Force Research Laboratory (AFRL) to advance superconducting quantum networks in collaboration with Dutch startup QphoX.

At the same time, the company has sustained its market dynamics through technological progress. It recently announced that its 36-qubit modular system achieved a median two-qubit gate fidelity of 99.5%, representing a two-fold reduction in error rate compared to its previous 84-qubit Ankaa-3 system. This system is built by grouping together four 9-qubit “chiplets,” leveraging the company’s proprietary modular chip technology, and is scheduled to launch on August 15, 2025.

Importantly, the company remains on track to evolve this architecture to a system based on 100+ qubit chipsets by the end of 2025, while maintaining the same high fidelity target of 99.5%.

So with all this momentum, is it still worth jumping into RGTI now? Hunting Alpha admits that the performance is hard to ignore, but despite the tempting gains, the investor is not yet ready to become a “happy bull.”

“I can’t bring myself to act on this impulse, because my rational mind struggles to see a single good reason for a bullish fundamental growth outlook,” explains the investor.

Their skepticism begins with the numbers. Despite high-profile partnerships and system sales, Rigetti has yet to demonstrate “significant” revenue growth. Even CEO Subodh Kulkarni warned that it was still too early for the company to talk seriously about “sales and sales growth”, which hardly inspires confidence in near-term profitability.

And while recent system sales are encouraging, Hunting Alpha is concerned that these are isolated orders rather than the start of recurring demand. The investor also raises concerns about future dilution, arguing that the current valuation implies a future equity value of $3.553 billion, well above current levels of $553 million.

“I infer that for current valuations to make sense, the market is pricing in another ~6x multiplier growth on RGTI’s equity balance, likely via future equity injections,” Hunting Alpha summarizes.

Hunting Alpha is therefore prepared to opt out, giving RGTI stock a Hold (i.e. neutral) rating.

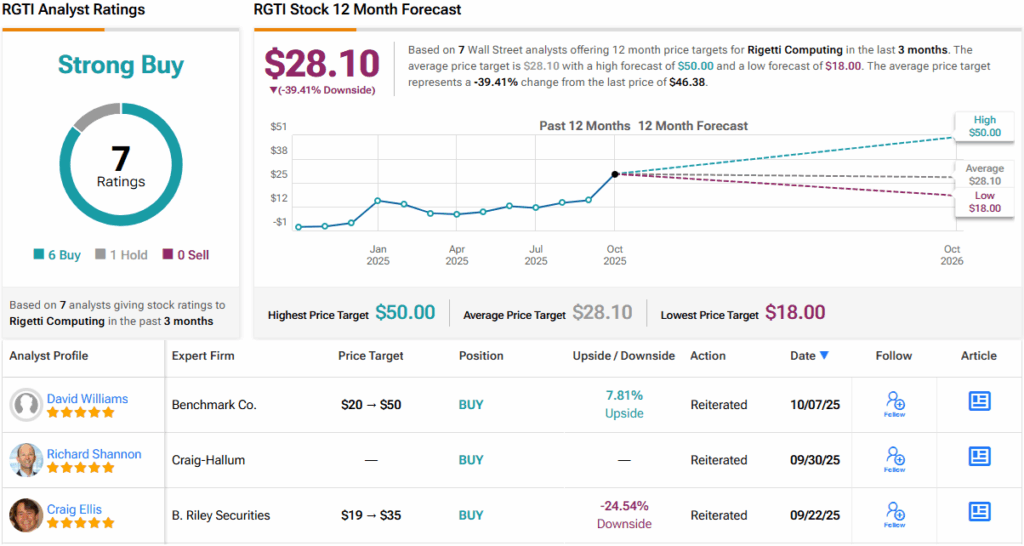

Wall Street’s position is also contradictory. On the surface, analysts are optimistic: 6 RGTI stocks are rated as Buy and one as Hold, resulting in a strong Buy consensus. Yet these same analysts set an average price target of just $28.10, implying a 39% downside from current levels. It will be interesting to see if these targets will be revised or if the stock will fall back to meet them. (See RGTI Stock Forecast)

With the facts laid out, it is clear that the investor has chosen IONQ as a top quantum computing stock to buy right now.

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the investor featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Disclaimer & DisclosureReport a Problem