Yesterday we heard about how Intel chip stock (INTC) is facing major issues losing market share, as its competitors emerge with more powerful products than Intel currently offers, and diversify also in areas where Intel doesn’t seem to be doing the same. Now, Intel is making its own comeback with some very powerful new chips, and investors are responding. Shares of Intel rose nearly 2% Tuesday afternoon.

Stay ahead of the market:

Intel rolled out a few of them at the Consumer Electronic Show (CES) event currently taking place in Las Vegas. Both the Core Ultra 200H and Core Ultra 200HX were presented, representatives of the Arrow Lake family of chips. Now these will make their way to laptops and offer significant new power that should help Intel keep its day-to-day operations where they should be.

The new chips feature up to 24 cores, which may not seem like much, but considering the previous generation of Lunar Lake chips had eight cores, it’s a very welcome sign. Additionally, according to reports, the new Arrow Lake chip line is expected to deliver this power on a more power-efficient basis than even the Raptor Lake chipsets. This means better battery life for laptops and reduced power consumption for more stationary desktops.

18A Not Dead Yet

Although we have heard little good news regarding the 18A process at Intel, a new report from Tom’s material also offers some hope. Intel is currently beginning to test the new Panther Lake range with its customers. Additionally, the new 18A chips are expected to be ready for full launch in the second half of this year.

Intel is already shipping completed samples and plans to begin mass production later this year. This is part of a larger plan, says a company statement, which will “…continue to strengthen its PC AI product portfolio in 2025 and beyond as we test our core Intel 18A product with customers ahead of the volume production in the second half of 2025.” Much depends on the success of the 18A process, although early reports suggest it may not be all it claims to be. At least, currently.

Is Intel a Buy, Hold or Sell?

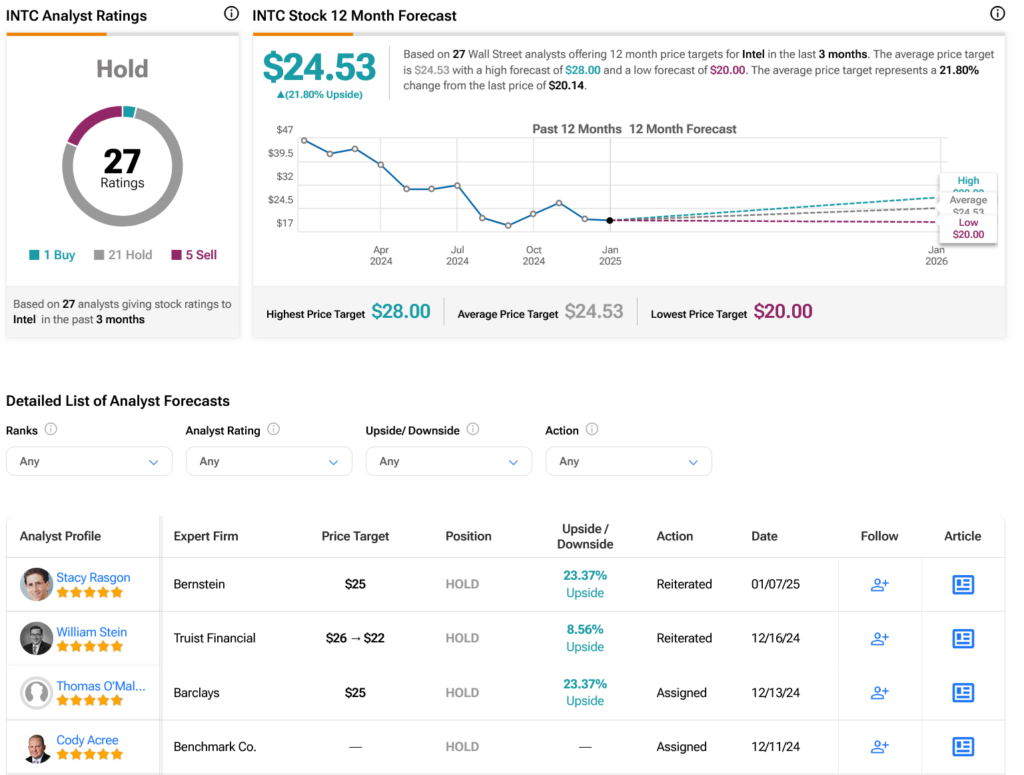

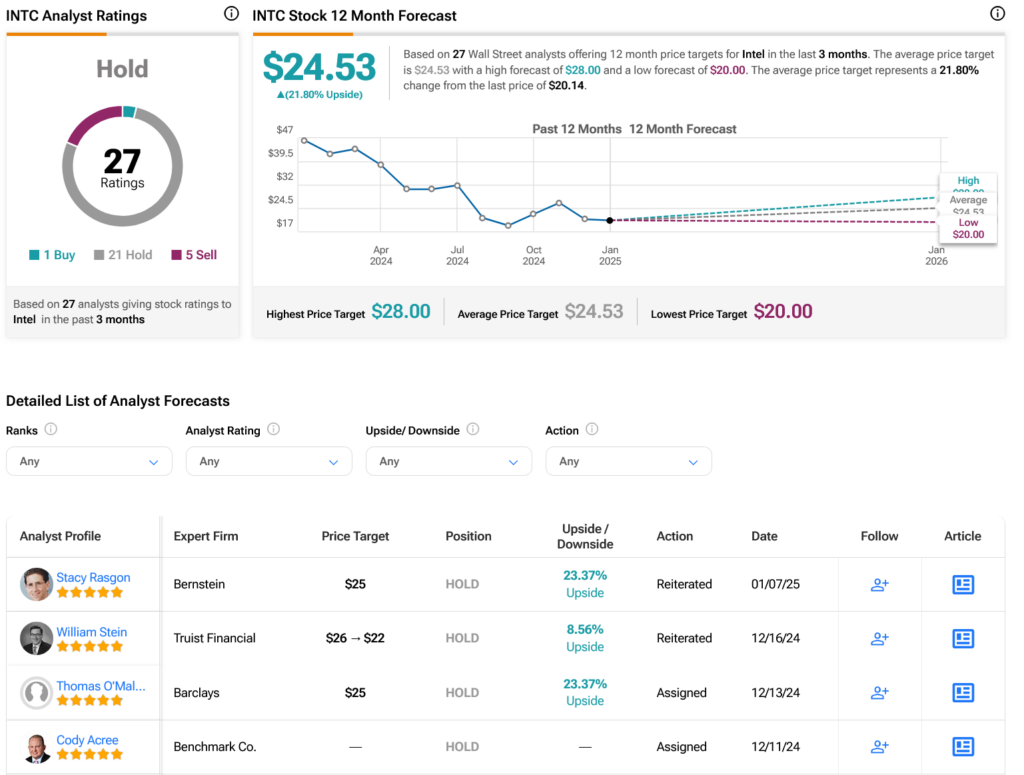

As for Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 21 Holds, and five Sells assigned over the past three months, as shown in the chart below. After a 57.61% loss in its stock price over the past year, INTC’s average price target of $24.53 per share implies 21.8% upside potential.

See more INTC analyst notes

Disclosure