I’m buying this dip, IMHO, on TSLA stock ahead of its earnings tomorrow. Here’s how.

I’m Watching Tesla Stock Ahead of Tomorrow’s Earnings Report and Starting Buying Now

As stock traders, we are always looking for opportunities that promise good returns relative to measured risk. Tesla Inc. (TSLA), the innovative electric vehicle and clean energy company, presents such an opportunity. Before the earnings release tomorrow, after the stock market closes, let’s take a look at why Tesla stock could be gearing up for a favorable entry point.

Tesla’s stock performance has been a roller coaster of ups and downs. Since its all-time high – where the company’s value soared more than 100% – the price has corrected significantly, hovering around 52% below that zenith. This correction has attracted the attention of traders looking for discounted entries into high-potential stocks.

The technical view of TSLA stock, see my video

From a technical analysis perspective, an interesting pattern is forming. Tesla’s price action is approaching the lower band of a Pitchfork model, coinciding with a gap formed after the January 23 earnings announcement. These technical indicators often attract traders who are looking for historical patterns to repeat themselves.

A network of predefined and ready purchase orders, with the Levitan Method

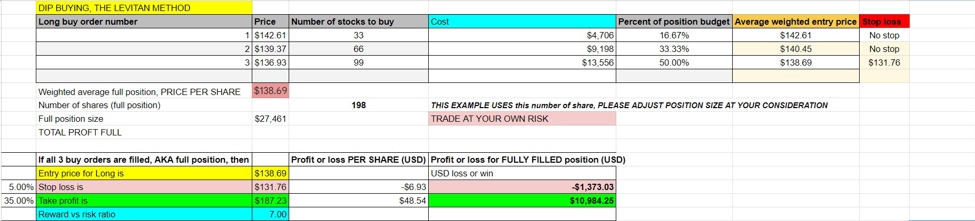

Most traders aren’t familiar with the Levitan method for buying on the dip, so here goes… While they may view this as a good time to consider an entry while a downtrend is in play, it’s clear . As the video shows a range in which we are targeting our purchases, one might consider initiating a position at $142.61, closely aligned with the current pre-market price. The plan involves move into position – buy more shares at calculated lower points – and using a disciplined stop-loss and take-profit strategy to manage risk.

A contrarian bet with calculated risk

One could argue that much of the negative news surrounding Tesla could already be priced in. If true, this contrarian approach could well pay off handsomely, especially for those willing to endure short-term volatility for long-term gains. With a stop loss set at 5% below the entry point and a take-profit target at 35% above, the risk-reward ratio stands at an attractive 7:1.

Long-term optimism but rigorous risk management

Although traders might decide to take partial profits along the way, it might make sense to hold onto some Tesla stock for the long term. If Tesla were to return to its all-time high – a prospect that is not out of the question – the upside could be substantial.

You can enlarge the image below to see the details of the purchase method and trading plan or TSLA action.

Dip by Buying TSLA Stock with the Levitan Method

Buy this dip, IMHO, on TSLA stock

Business plan for TSLA using the Levitan method

-

Identify potential decline points: Analyze the TSLA stock chart to identify potential dip points below the current market price where demand may increase, using technical analysis indicators and historical price levels.

-

Determine purchase levels and actions: Plan to enter three separate buy orders at these trough points, with the number of shares based on a Fibonacci series. For example:

- First buy order: 33 shares (33 x 1)

- Second buy order: 66 shares (33 x 2)

- Third buy order: 99 shares (33 x 3)

-

Calculate the weighted average entry price: If all three buy orders are executed, calculate the weighted average price of the shares purchased. This price will serve as a reference point for setting stop loss and take profit levels.

-

Define Stop Loss and Take Profit: Set a stop loss 5% below the weighted average entry price to limit potential losses. Set a profit level at 35% above the average entry price to lock in profits, aiming for a reward-to-risk ratio of 7:1.

-

Adjustments and partial benefits: Traders can choose to take partial profits with a 2:1 reward-to-risk ratio if the price achieves a 20% gain. Additionally, consider leaving a portion of the position (e.g., 20%) to potentially benefit from the long-term growth of TSLA stock.

-

Risk management: Allocate a specific portion of the trading budget to this strategy and do not exceed it to effectively manage risks.

-

Monitor the trade: Keep a close eye on TSLA price action, news and general market sentiment, ready to adjust the trading plan if necessary.

-

Document and review: Record details of all transactions and review them regularly to refine the strategy over time.

Investing in Tesla right now is a classic contrarian bet, rooted in technical analysis and confidence in the company’s position in the market. As with any trading, there is inherent risk, and it is crucial to trade based on your own research and risk tolerance. For those with an appetite for risk and an eye for potential, Tesla’s decline could be a launching pad for significant returns. Stay tuned to ForexLive.com for further analysis and updates on this developing story.

Remember that you trade at your own risk. This article is not financial advice but rather an outlook on market opportunities based on current conditions. Always do thorough research or consult a financial advisor before embarking on any stock trading.

cnbctv18-forexlive